The Australian dollar has initially tried to rally during the trading session on Friday but gave back the gains as the US job number came out much more resilient than anticipated. By blowing the jobs number apart, the Americans have shown just how stronger they are than the rest of the world. Except people buying the US dollar of course, as the market will continue to see a lot of faith in the greenback. The Federal Reserve is on the sidelines, and at this point it’s obvious that they don’t need to do anything as far as quantitative easing is concerned. Because of this, the greenback will get a bit of a surge of bullishness, because there are so many central banks around the world that are looking to cut interest rates or to do more quantitative easing.

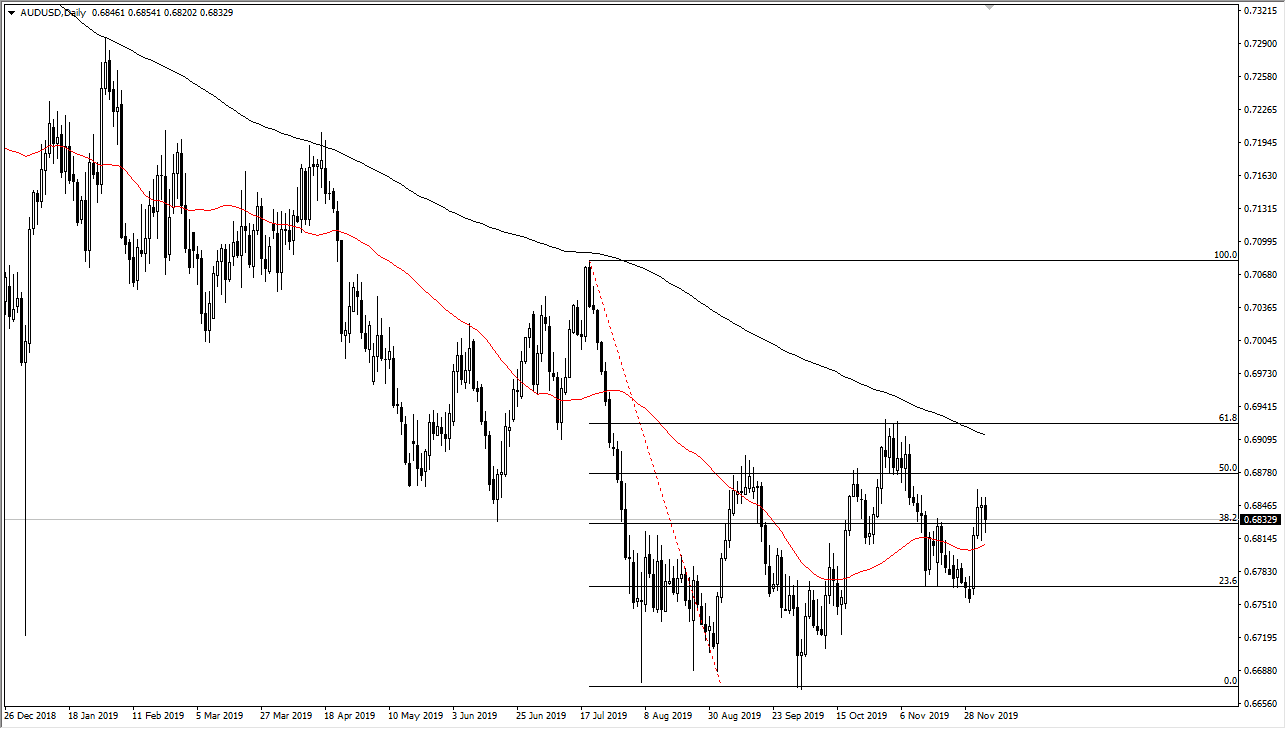

Looking at this chart, it’s obvious that we see a lot of noise in this general vicinity, with the 50 day EMA sitting just below offering support. At this point in time it’s obvious that the market is trying to build itself out, because we have recently seen such a huge surge higher. At this point, the market is showing a lot of resistance at the 0.6875 handle, an area that has been important more than once. We have the 200 day EMA above that will continue to cause a bit of resistance as well, so keep that in mind. If we were to break above the 200 day EMA it’s likely that the market could then go to the 61.8% Fibonacci retracement level and then the 0.70 level.

Pullbacks at this point time should have plenty of support based upon the 50 day EMA and of course the 0.6750 level. That is an area that has so far formed a “higher low”, after the “double bottom” that had formed at the 0.67 handle. Ultimately, this is a market that continues to see a bit of optimism due to the fact that the US/China trade situation looks likely to be moving forward, so at this point it’s likely that the Australian dollar will move with the headlines as per usual. Remember, Australia is extraordinarily sensitive to China, and as the Chinese have suggested that things are going forward, that is a good sign for the Australian dollar. However, if we break down below the recent low, then the market is going to attack the 0.67 level again.