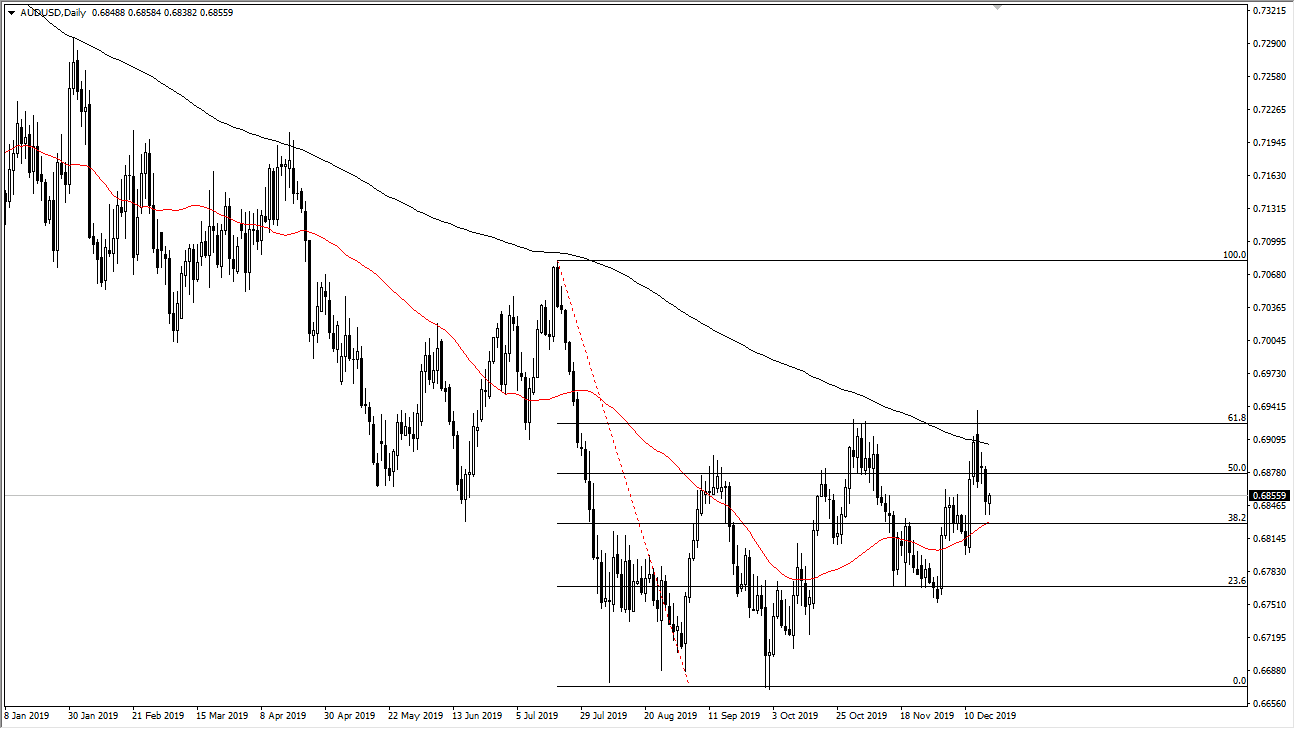

The Australian dollar has fallen a bit during the trading session on Tuesday but has seen buyers come back to push it higher again. Ultimately, this is a market that I think will continue to find quite a bit of a boost underneath, as it should be plenty of support near the 50 day EMA that is now starting to tilt higher. Having said that, the 200 day EMA is starting to come close and it is decidedly negative. Sooner or later we will need to make some type of decision when it comes to the Australian dollar, and I do think that risk appetite will be under the microscope as the US/China trade deal continues to drive where the Aussie goes. Yes, we have an agreement in theory, but we have yet to sign anything for all of the fanfare.

To the upside, the 0.69 level offers resistance and sodas the 0.6950 level. If we can break above the 0.6950 level, then it’s likely that the market will continue to see the Australian dollar rally from there and go looking towards the 0.70 level and perhaps even higher than that as it could be a major trend change. Ultimately, this is a market that has been historically cheap as of late, and I think that will continue to be the prism that people look at this market through. With that, I remain somewhat bullish but recognize that we will continue to see a lot of noise out there that will throw this market back and forth and fits and starts. Trading with all of the headlines caused by Donald Trump and the Chinese has been next to impossible over the last couple of months, as we never know when the next nonsense will occur. Algorithm traders continue to plague the markets with their overreactions, so keep in mind that at any moment your position can be blown right out of the water. That being said, we are historically cheap, and we have started to make “higher lows”, so that is a sign in and of itself that perhaps longer-term “buy-and-hold” traders are willing to step in and hold the Aussie. In the meantime, though, I think you have to keep your position size rather small and simply look at it from the prism of several months, not the next couple of days. Trading short-term charts has been a great way to lose money in this pair.