The Australian dollar rallied quite nicely during the trading session on Monday, reaching towards the most recent highs. That being said, the Australian dollar is highly sensitive to the Chinese economy and everything going on in China itself. The Australians provide the Chinese with a lot of raw materials, so therefore the idea is that as the Chinese do more construction and manufacturing, they will need the raw materials that Australia supplies.

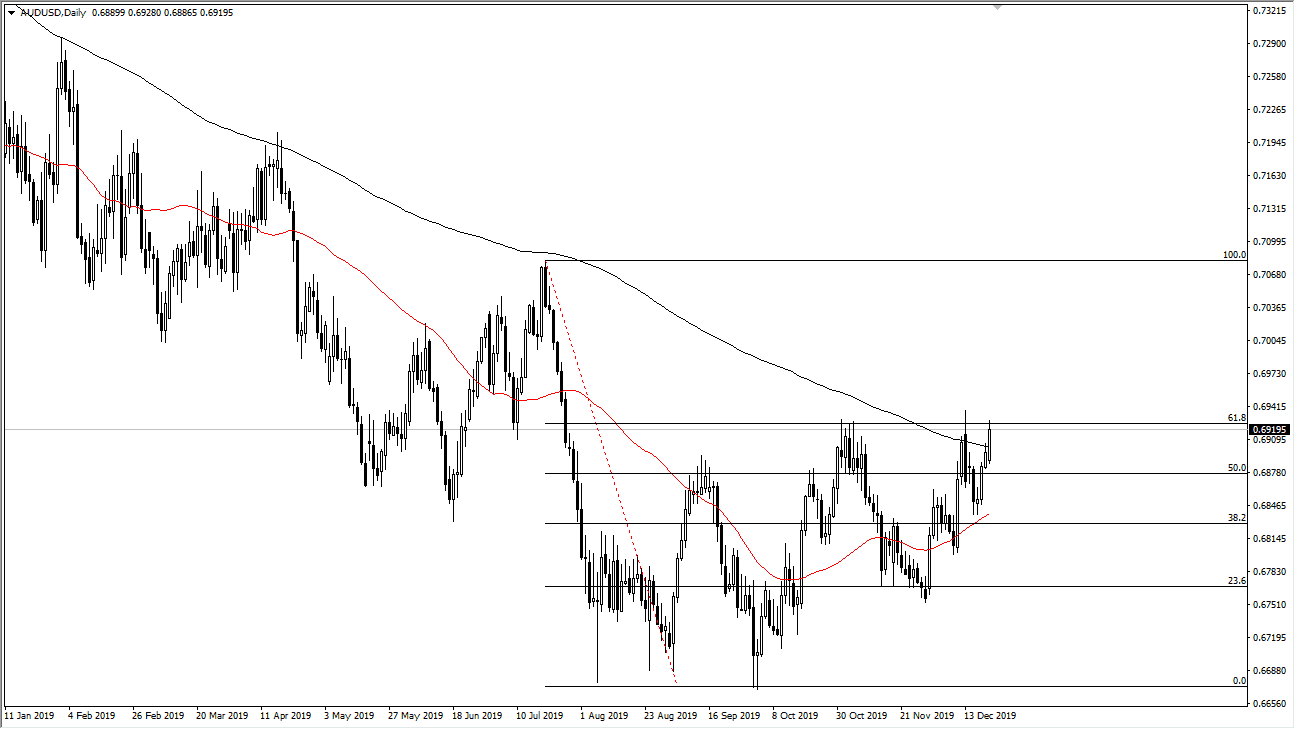

The market breaking above the 200 day EMA and looking very likely to stay above there is a strong sign for the Aussie dollar. I think at this point it’s very likely that the market will continue to see a lot of noise, but I think that pullbacks will continue to be bought as we continue to see “higher lows” over the last several weeks. I think that we have tried to form a bit of a base down at the 0.67 handle, where we had formed a nice double bottom. The short-term pullbacks continue to get bought into and I think it’s only a matter of time before we go higher based upon what we have seen of the last several weeks.

If the US/China trade situation continues to see more gains pushing the situation forward, it’s likely that this pair will continue to grind higher. Beyond that, we have recently had strong employment figures coming out of Australia which of course helps the situation as well. I think that it until we break down below the 50 day EMA which is painted in red, it’s difficult if not absolutely impossible to short the Australian dollar. I think it’s only a matter of time before we go looking towards the 0.70 level and then eventually the 0.71 handle.

However, if we were to break down below the 50 day EMA and then eventually take out the low at the 0.6850 level, it would change the overall attitude of the market and could send the Aussie lower. Breaking the 0.67 level would be extraordinarily negative, but I think at this point it’s going to take something rather negative to make that happen. I look at pullbacks as opportunities in the Aussie dollar and believe that we may have seen the bottom of the market longer-term, and that the Aussie is trying to turn things around for a longer-term move. As we close out the session on Monday, it certainly looks as if the buyers are lurking.