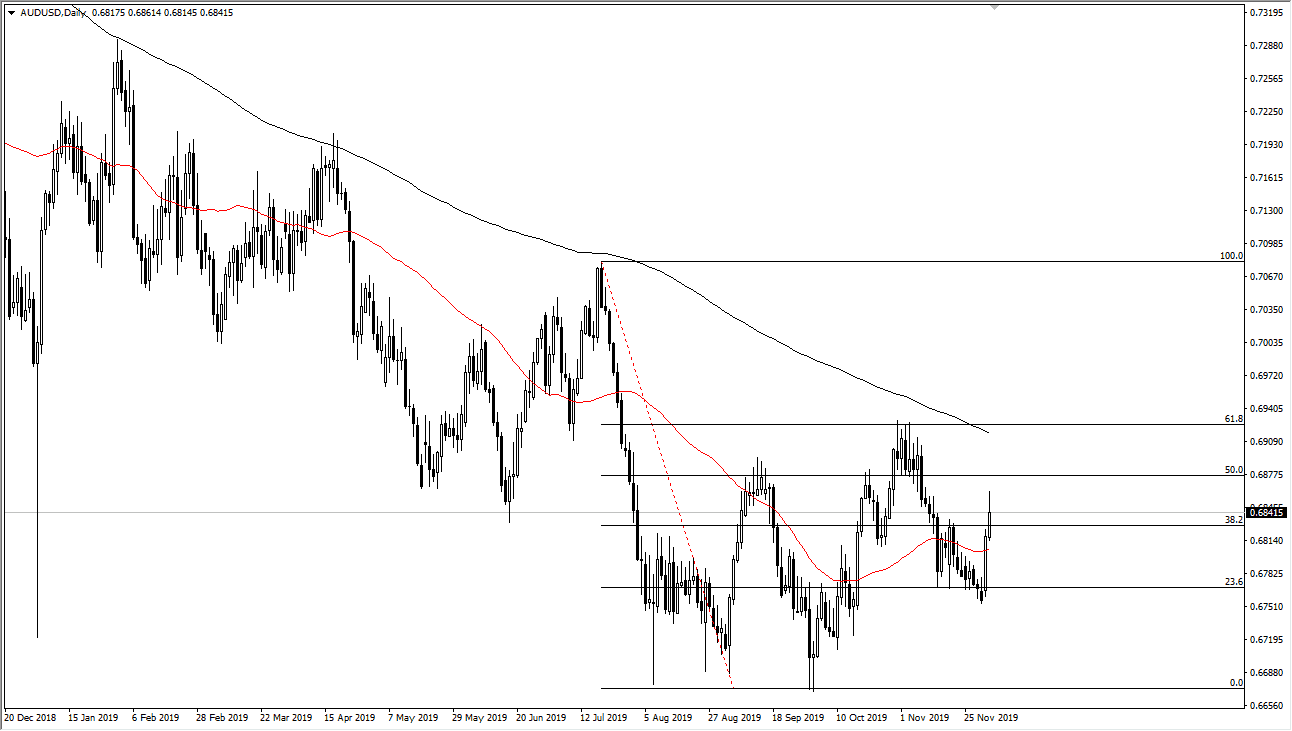

The Australian dollar has rallied a bit during the trading session on Tuesday but gave back quite a bit of the gains due to Donald Trump suggesting that the trade deal might be better served happening after the election. If that’s going to be the case, that has a lot of people concerned as there will be more tariffs levied on consumer goods coming into the United States and China. Granted, this is a bit of an overreaction as we have seen the stock markets get hammered, but ultimately this is a market that is far too highly levered to the Chinese situation to think that we are going to get an easy path higher.

That being said, even if we do pullback from here it looks as if we are most certainly trying to break to the upside. The Australian dollar has been beaten down significantly on a longer-term standpoint and it’s likely that we will continue to see buyers underneath trying to take advantage of this. I like the idea of buying this pair, but I also recognize that there’s no need to jump into it right away. Even if you were to wait a break above the 200 day EMA, I suspect that this might be a multi-year trade, so quite frankly 70 pips here or there doesn’t really matter.

It’s also worth noting that the 0.67 level underneath has offered a lot of support, and the most recent pullback has been a little bit shallower, forming a “higher low”, which of course is the very epitome of a potential trend change. If we do get that trend change, this is a market that is very likely to go to the upside and reach towards the 0.70 level, and then eventually the 0.71 level after that. With this, I think that if you are patient enough you can start to build up a larger core position, but it is going to take quite a bit of patience to make this thing turnaround from a longer-term standpoint. Once it does though, this could be a nice trade, or perhaps even something more along the lines of an investment as it could be held onto that long. With this, I am optimistic, but not quite yet bullish. Those are two different things, and that should be kept in the back of your mind.