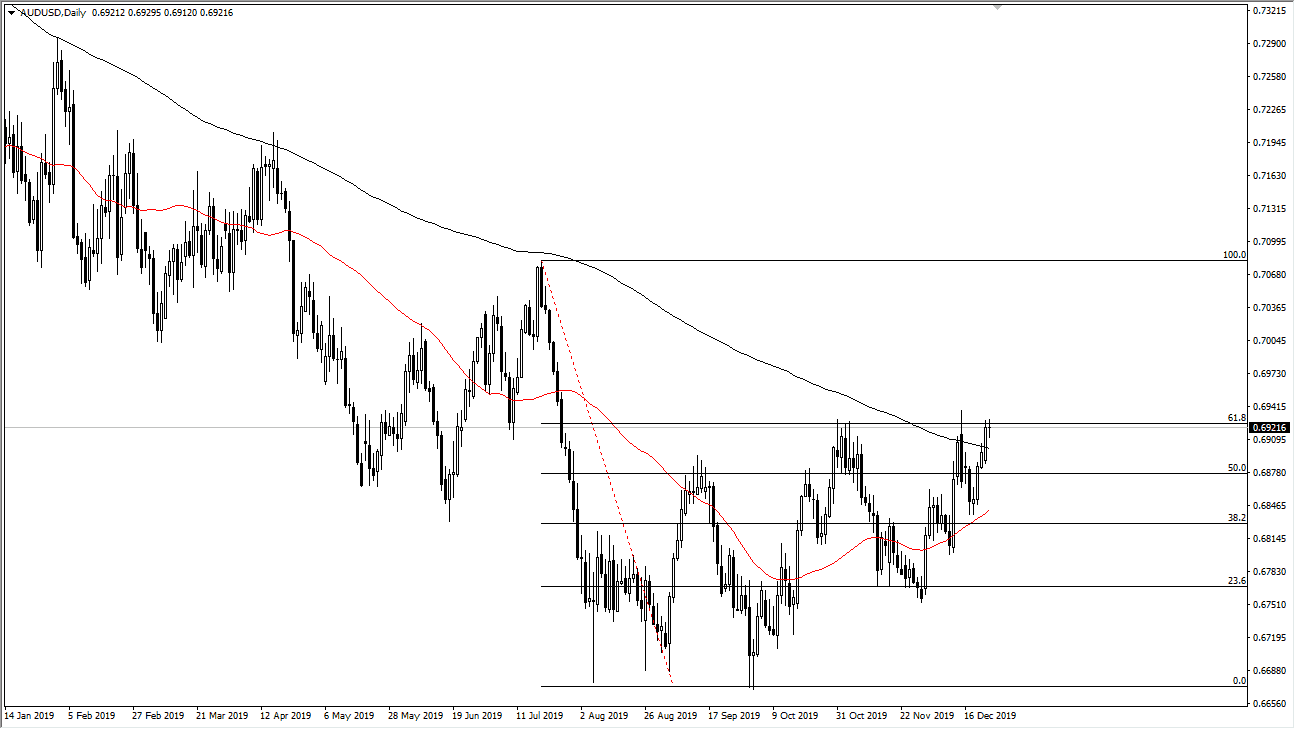

The Australian dollar has done very little during the trading session on Tuesday, but that in and of itself might be an important signal as well. After all, the market is at the highs, and even though it is Christmas eve, markets tend to be much like a person, they need to be comfortable in their environment. It’s obvious that the Australian dollar is a very comfortable in this general vicinity, as we press the recent highs yet again.

That being said, we are also above the 200 day EMA so that in and of itself is bullish. The 61.8% Fibonacci retracement level is right here as well, and that is probably the last vestige of resistance for the Aussie to get above. If we can break the highs from the previous week, it’s very likely at that point the Australian dollar will then go looking towards the 100% Fibonacci retracement level based upon my experience. In general, once the 61.8% Fibonacci retracement level gets broken through, it has the entire move wiped out. The Aussie looks very likely to do that, especially if we get any type of “risk on” type of news.

That being said, I believe that the liquidity coming back will probably send this market to the upside. Overall, short-term pullback should end up being buying opportunities, especially near the 200 day EMA and even as low as the 50 day EMA. Speaking of the 50 day EMA, it is sloping much higher and it looks as if it is going to go tracking the 200 day EMA in the so-called “golden cross”, something that is well known as being a longer-term “buy-and-hold” type of signal. In fact, this point I fully anticipate that the Australian dollar will be one of the best performers for 2020, and this will be especially true the US/China trade relations continue to get better. We recently seen a cooling of tensions, and with Australia being a major supplier of commodities to China, it makes quite a bit of sense that we could see it outperform many of the other currencies and economies around the world. Quite frankly, this looks like a market that is in the midst of changing the longer-term trend, which would make quite a bit of sense considering that we are at historically supportive and low levels in the Aussie dollar.