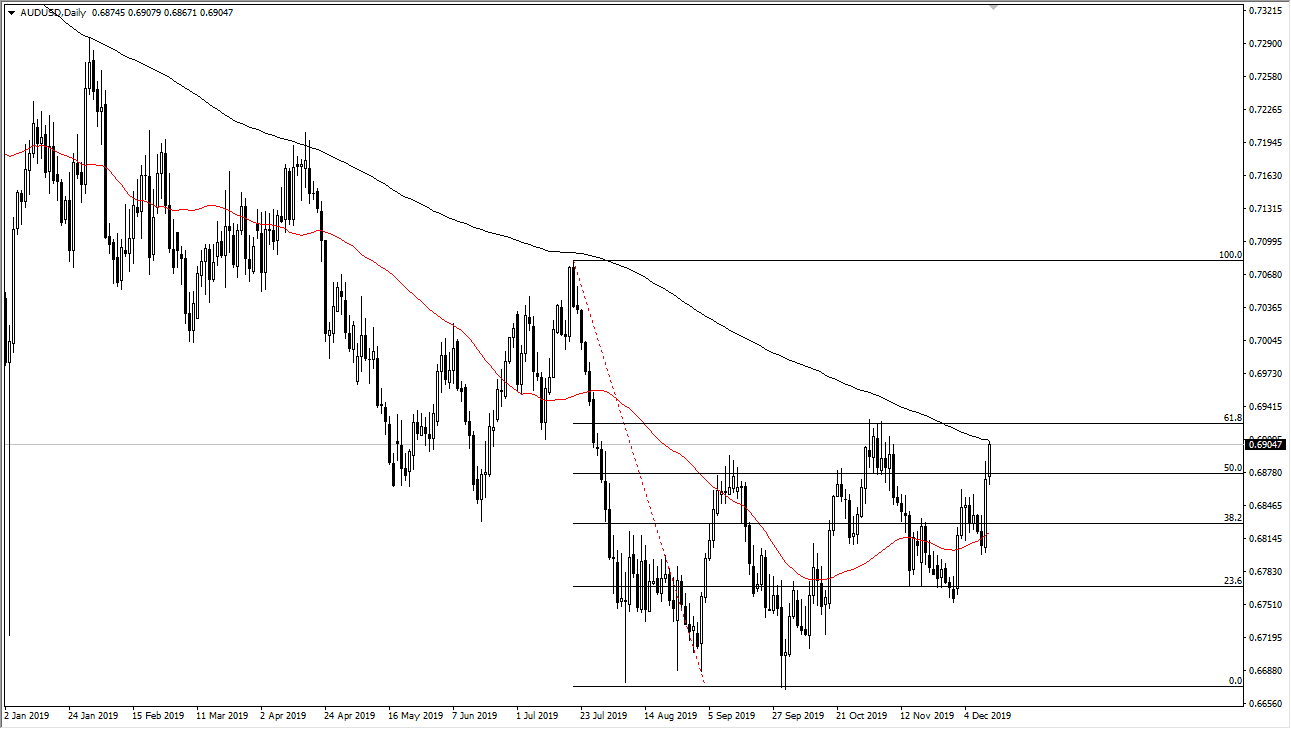

The Australian dollar has rallied significantly during the trading session on Thursday, reaching towards the 200 day EMA. This is a very significant technical indicator the people will be paying attention to, and as a result it’s likely that the trend could be determined rather quickly. Beyond that, the 61.8% Fibonacci retracement level is just above, and if we can break above that it would be a “double whammy” for the buyers.

If it weren’t for the trade tariffs on Sunday, then I might be more apt to put money right away. On a breakout, it’s very likely that we could go to the 0.70 level, possibly even higher than that. However, we have to wait to see what’s going to happen with the trade tariffs on Sunday before we can truly jump in feet first to the Australian dollar. Obviously, a lot of Wall Street pundits have suggested that the tariffs are likely to be delayed, and that is part of what we are seeing played out in the Aussie. However, the market is likely to continue to be moved rapidly by the next Tweet. Looking at the way it reacted to the Tweet on Thursday where Trump said that the trade negotiation was going better, it looks as if the market is truly hoping for some type of resolution.

A delay of tariffs should break the Aussie out. However, if the trade tariffs are in fact levied on Sunday, it’s very likely that the Australian dollar will get hammered on Monday. This makes the Aussie a very difficult currency pair to trade right now, because quite frankly looking at the chart it looks as if it is ready to go higher. However, it would take one flick of the pen by Donald Trump to send this market right back down. We have formed a double bottom at the 0.67 handle, and then a couple of “higher lows.” At this point, the market is likely to see a lot of volatility, so it’s very difficult to imagine that is going to be easy to trade in the short term. Longer-term, if we get a breakout based upon a delay the tariffs then it might be a longer-term “buy-and-hold” scenario. That being said though, if it does turn up being a trend change, we have thousands of pips ahead of us so there isn’t necessarily going to be a massive rush.