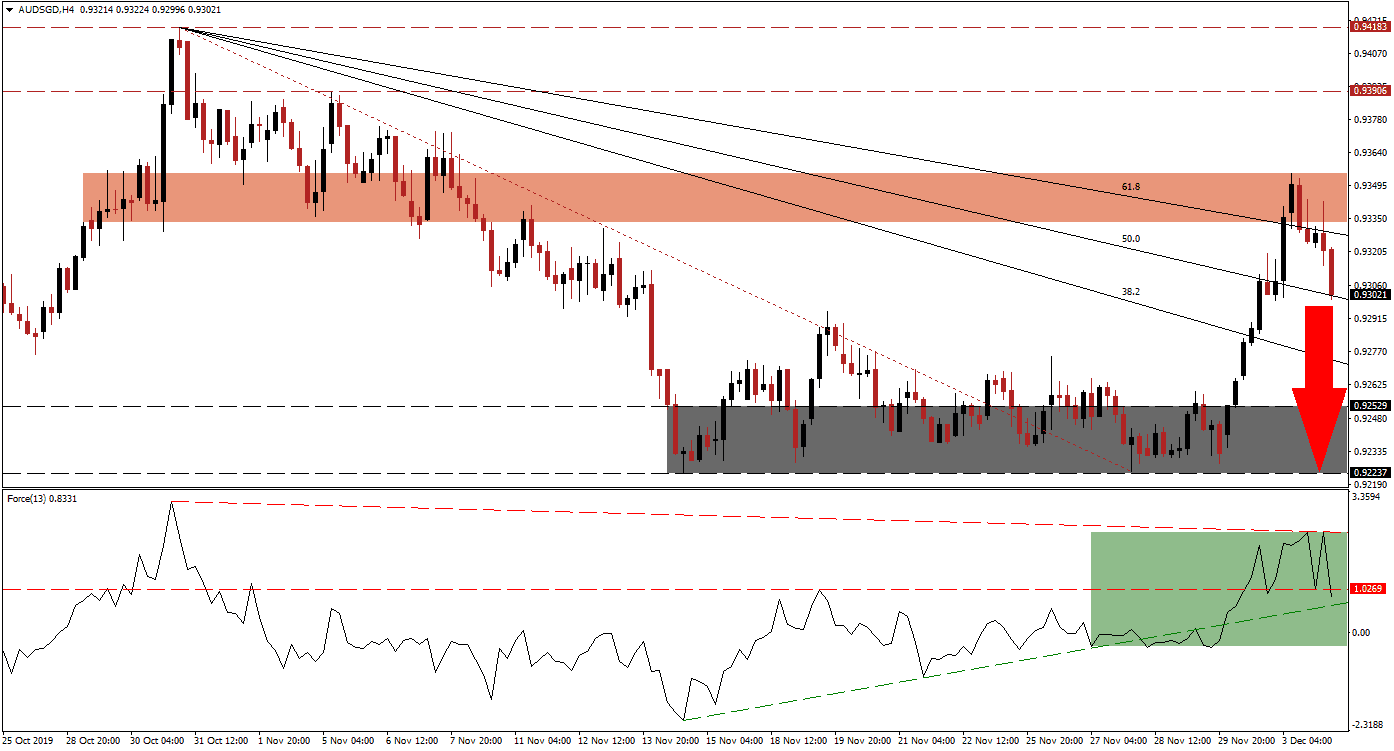

After the release of Australian economic data that showed the service sector continues to cool down and third-quarter GDP clocked in lower than what economists were looking for, the Australian Dollar came under selling pressure. Within the GDP report, capital expenditures contracted and consumption data were weak, pushing the AUD/SGD below its short-term resistance zone. This was followed a breakdown through its descending 61.8 Fibonacci Retracement Fan Support Level, converting it into resistance, and bearish momentum is expanding. You can learn more about a breakdown here.

The Force Index, a next-generation technical indicator, points towards the increase in bearish momentum as this currency pair initiated its breakdown sequence. More downside is anticipated after the Force Index reversed and moved below its horizontal support level, turning it into resistance as marked by the green rectangle. A descending resistance level formed and this technical indicator is on track to move into negative territory and place bears in charge of the AUD/SGD; this is expected to lead to a breakdown below its ascending support level and clear the path for more downside in price action.

This currency pair is now faced with its 50.0Fibonacci Retracement Fan Support Level after being rejected by its resistance zone located between 0.93331 and 0.93547 as marked by the red rectangle. Forex traders are advised to monitor the intra-day high of 0.92945, the peak of a previous breakout in the AUD/SGD above its support zone which was reversed. A push below this mark is expected to attract a fresh wave of sell orders and the Fibonacci Retracement Fan is likely to guide this currency pair lower. You can learn more about the Fibonacci Retracement Fan here.

China showed a surprise increase in its services sector and this followed a similar surprise in its manufacturing data published earlier this week. Despite the ongoing US-China trade war, the Chinese economy is printing solid data all facts considered. The Australian Dollar is the top Chinese Yuan proxy currency but failed to benefit from the data. Price action is expected to extend its breakdown until it will reach its support zone located between 0.92237 and 0.92529 as marked by the grey rectangle. More downside in the AUD/SGD would require a fresh fundamental catalyst.

AUD/SGD Technical Trading Set-Up - Breakdown Extension Scenario

Short Entry @ 0.93000

Take Profit @ 0.92250

Stop Loss @ 0.93250

Downside Potential: 75 pips

Upside Risk: 25 pips

Risk/Reward Ratio: 3.00

In the event of a breakout in the Force Index above its horizontal resistance level, followed by a push above its descending resistance level, the AUD/SGD may attempt a breakout above its short-term resistance zone. The upside potential in this currency pair remains limited to its next long-term resistance zone located between 0.93906 and 0.94183, with the long-term outlook bearish.

AUD/SGD Technical Trading Set-Up - Breakout Scenario

Long Entry @ 0.93600

Take Profit @ 0.94150

Stop Loss @ 0.93350

Upside Potential: 55 pips

Downside Risk: 25 pips

Risk/Reward Ratio: 2.20