Commentary out of the US and China over the weekend attempted to strike a positive tone regarding the phase-one trade truce. Available details suggest that it won’t have the desired positive impact on the global economy, and risks for 2020 remain elevated. The AUD/SGD pushed into its resistance zone, and bullish momentum is fading. Private sector credit growth in Australia extended its slowdown, a potentially worrying sign for the consumer if the trend accelerates. A corrective phase in this currency pair is anticipated to follow. You can learn more about a resistance zone here.

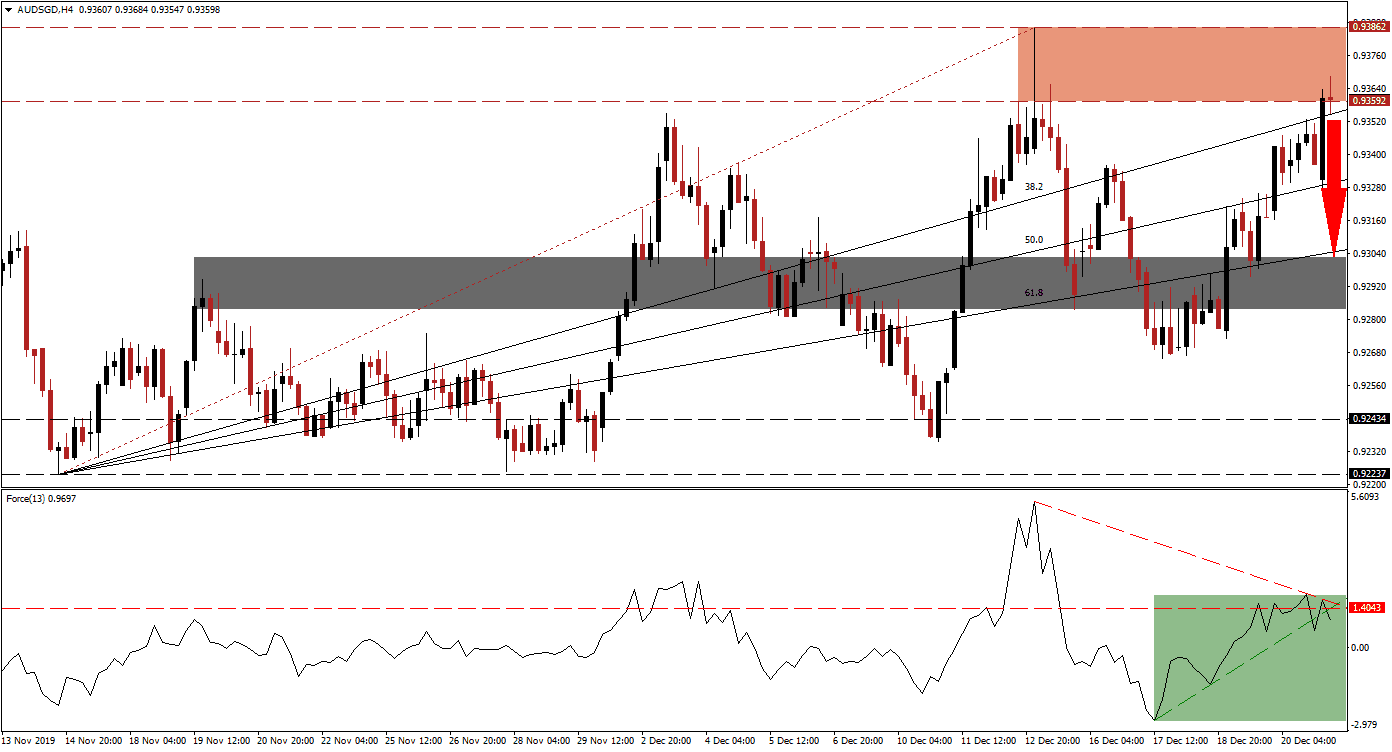

The Force Index, a next-generation technical indicator, advanced together with price action but started to struggle as it approached its resistance zone. A brief move above its horizontal support level was reversed, and a descending resistance level emerged. The Force Index has additionally contracted below its ascending support level, as marked by the green rectangle. While this technical indicator remains in positive conditions with bulls in charge of the AUD/SGD, the rise in bearish pressures is expected to take the Force Index below the 0 centerline. Price action is anticipated to follow through with a breakdown.

Volatility is likely to increase as the Australian Dollar remains the top Chinese Yuan proxy currency. Chinese economic data has shown signs of a rebound, but the Singapore Dollar continues to attract capital outflows from Hong Kong. The AUD/SGD is expected to be rejected by its resistance zone located between 0.93592 and 0.93862, as marked by the red rectangle. This will additionally take price action below its ascending 38.2 Fibonacci Retracement Fan Support Level from where a profit-taking sell-off may follow.

Any corrective phase is anticipated to keep the long-term uptrend in this currency pair intact. Price action may descend into its next short-term support located between 0.92834 and 0.93025, as marked by the grey rectangle. The 61.8 Fibonacci Retracement Fan Support Level just crossed above this zone, and an extension of the breakdown in the AUD/SGD will require a fresh fundamental catalyst. Trading volume is expected to slow down over the holiday week, which can magnify moves in either direction. You can learn more about the Fibonacci Retracement Fan here.

AUD/SGD Technical Trading Set-Up - Breakdown Scenario

Short Entry @ 0.93600

Take Profit @ 0.93000

Stop Loss @ 0.93800

Downside Potential: 60 pips

Upside Risk: 20 pips

Risk/Reward Ratio: 3.00

In the event of a renewed push to the upside in the Force Index, leading to a breakout above its descending resistance level, the AUD/SGD is expected to attempt a breakout above its resistance zone. While the long-term outlook for this currency pair remains bullish, the short-term technical scenario favors a corrective phase. The next resistance zone awaits price action between 0.94394 and 0.94798.

AUD/SGD Technical Trading Set-Up - Breakout Scenario

Long Entry @ 0.94100

Take Profit @ 0.94600

Stop Loss @ 0.93900

Upside Potential: 50 pips

Downside Risk: 20 pips

Risk/Reward Ratio: 2.50