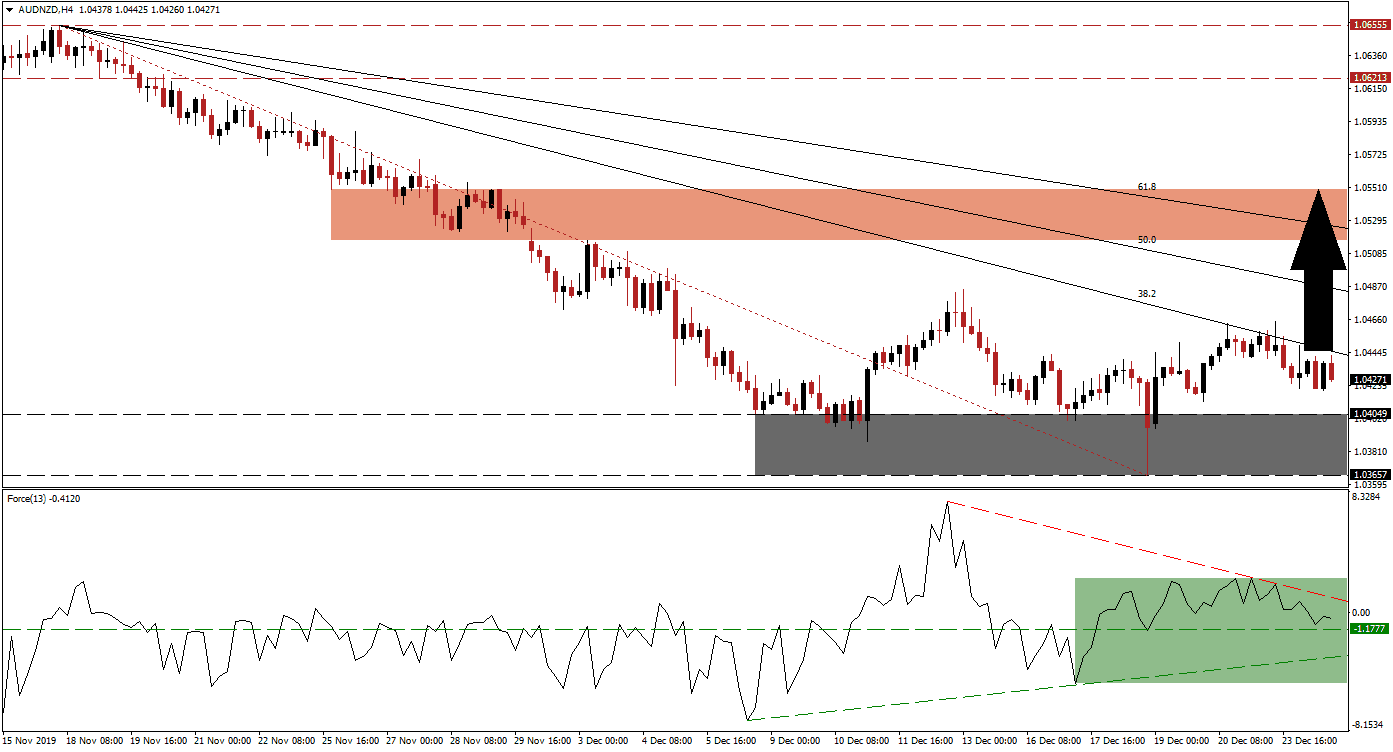

With the Fibonacci Retracement Fan closing the gap to the support zone, and the AUD/NZD caught in between, pressures for either a breakout or breakdown are on the rise. This currency pair pushed out of its support zone on the back of a recovery in bullish momentum. More upside is expected to follow the breakout, as the long-term fundamental outlook remains bullish. Volume is thin due to the holiday-shortened trading week. You can learn more about the Fibonacci Retracement Fan here.

The Force Index, a next-generation technical indicator, started to increase as this currency approached its support zone. A positive divergence formed, offering the first sign that a price action reversal may be imminent. The Force Index advanced above its horizontal resistance level, converting it back to support. After the AUD/NZD approached its descending 38.2 Fibonacci Retracement Fan Resistance Level, this technical indicator was pressured to the downside, as marked by the green rectangle, and a descending resistance level materialized. The ascending support level is anticipated to lead to more upside in the Force Index.

After this currency pair moved out of its support zone, located between 1.03657 and 1.04049, as marked by the grey rectangle, the long-term downtrend was broken. Most traders are focused on the announced trade truce between the US and China through the phase-one trade armistice, but the Regional Comprehensive Economic Partnership (RCEP) will fulfill a far more prominent role for Australia, New Zealand, and global trade. RCEP is on track to be signed in 2020 and provide a long-term catalyst for the AUD/NZD. You can learn more about a support zone here.

Price action is expected to eclipse its 38.2 Fibonacci Retracement Fan Resistance Level from where a short-covering rally may follow. This is likely to provide enough buying pressure to lift the AUD/NZD into its next short-term resistance zone located between 1.05169 and 1.05500, as marked by the red rectangle. The 61.8 Fibonacci Retracement Fan Resistance Level is passing through this zone, but a breakout may emerge and extend the favored advance in this currency pair. The next long-term resistance zone awaits between 1.06213 and 1.06555.

AUD/NZD Technical Trading Set-Up - Breakout Extension Scenario

Long Entry @ 1.04250

Take Profit @ 1.05500

Stop Loss @ 1.03950

Upside Potential: 125 pips

Downside Risk: 30 pips

Risk/Reward Ratio: 4.17

In case of a breakdown in the Force Index below its ascending support level, the AUD/NZD is expected to descend into its support zone. Given the long-term fundamental outlook, the downside remains limited. The next support zone is located between 1.02620 and 1.02975, forex traders should consider this an excellent buying opportunity. This currency pair remains fundamentally oversold, a condition likely to be corrected in 2020.

AUD/NZD Technical Trading Set-Up - Limited Breakdown Scenario

Short Entry @ 1.03550

Take Profit @ 1.02800

Stop Loss @ 1.03850

Downside Potential: 75 pips

Upside Risk: 30 pips

Risk/Reward Ratio: 2.50