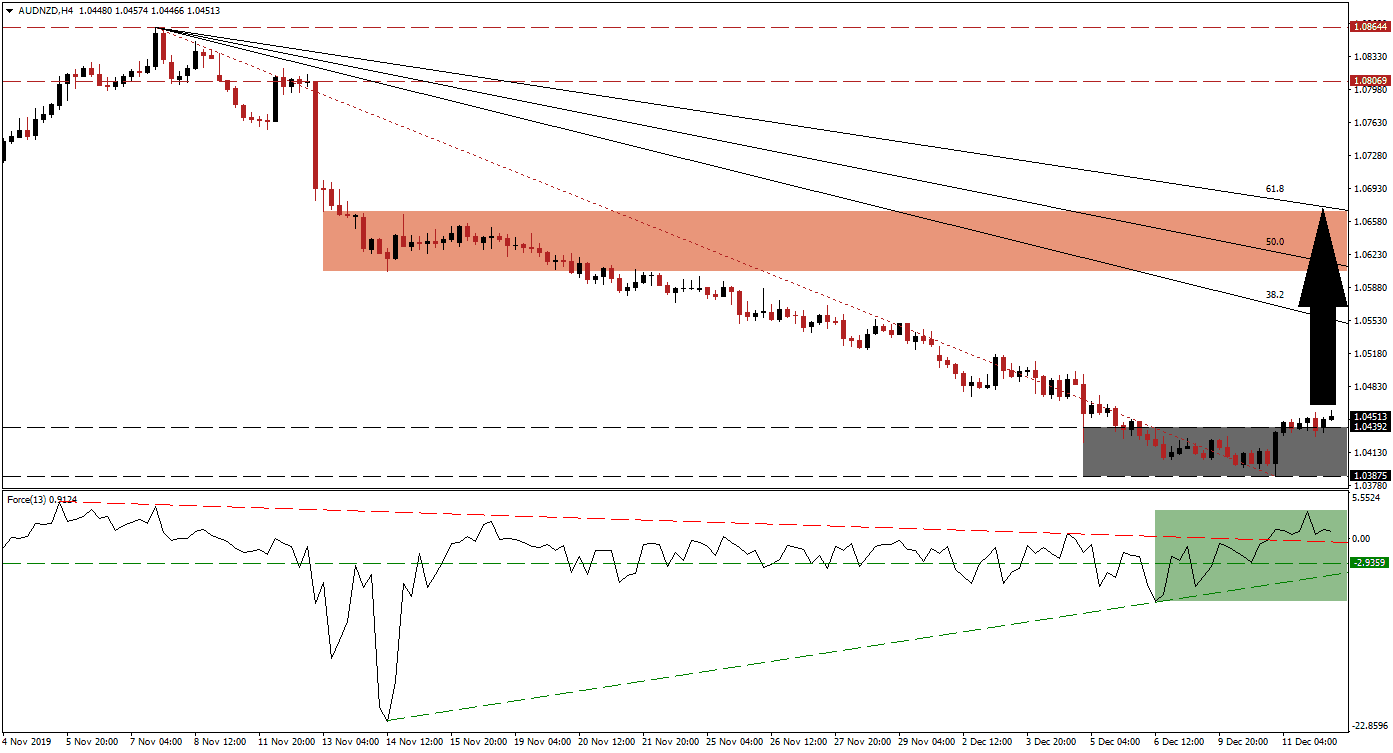

Australian consumer inflation expectations for December remained elevated and gave the Reserve Bank of Australia another reason to remain on the sidelines. This provided the required fundamental catalyst to push the AUD/NZD out of its support zone. Adding to bullish momentum in this currency pair was migration and visitors data out of New Zealand that pointed to a slowdown. More upside is expected following the breakout in price action, which will close the gap to its descending 38.2 Fibonacci Retracement Fan Resistance Level.

The Force Index, a next-generation technical indicator, confirmed the breakout in the AUD/NZD by converting its horizontal resistance level into support after creating a higher low. An ascending support level formed and assisted the Force Index in its advance; bullish momentum was sufficient to elevate it above its descending resistance level, as marked by the green rectangle. This technical indicator is now in positive territory, which placed bulls in charge of price action. You can learn more about the Force Index here.

After price action eclipsed its support zone located between 1.03875 and 1.04392, as marked by the grey rectangle, a short-covering rally is anticipated to materialize. Another bullish development emerged following the move in the AUD/NZD above the Fibonacci Retracement Fan trendline. This has cleared the path for this currency pair to ascend into its 38.2 Fibonacci Retracement Fan Resistance Level; a move above the intra-day high of 1.05169 will invalidate the existing downtrend and enable more upside.

With the December 15th deadline for a deal just days away, uncertainty remains elevated. Expectations call for fresh tariffs to be delayed, but the US announced more sanctions against Iran yesterday, in a possible reminder that tariffs are very much on the table. The AUD/NZD is anticipated to extend its advance until it will reach its next short-term resistance zone located between 1.06048 and 1.06690, as marked by the red rectangle. The 61.8 Fibonacci Retracement Fan Resistance Level has approached the top range of this zone; a further breakout into its long-term resistance zone, located between 1.08069 and 1.08644, is possible. You can learn more about a resistance zone here.

AUD/NZD Technical Trading Set-Up - Breakout Extension Scenario

Long Entry @ 1.04500

Take Profit @ 1.06600

Stop Loss @ 1.03800

Upside Potential: 210 pips

Downside Risk: 70 pips

Risk/Reward Ratio: 3.00

A breakdown in the Force Index below its ascending support level may pressure the AUD/NZD to the downside. The long-term fundamental outlook remains bullish, and the technical scenario supports more upside. Any potential correction from current levels should be considered an excellent buying opportunity. The next support zone awaits this currency pair between 1.02746 and 1.02975.

AUD/NZD Technical Trading Set-Up - Limited Breakdown Scenario

Short Entry @ 1.03700

Take Profit @ 1.02800

Stop Loss @ 1.04100

Downside Potential: 90 pips

Upside Risk: 40 pips

Risk/Reward Ratio: 2.25