After the release of third-quarter GDP data out of New Zealand, which surprised to the upside on a quarter-over-quarter comparison, the New Zealand Dollar briefly spiked. Exports, as well as imports for November, came in better than expected, resulting in a bigger trade deficit. This was countered by a strong employment report out of Australia, and the AUD/NZD started to recover. Bullish momentum is expanding and pushed this currency pair above its support zone, an extension of the breakout is likely to follow.

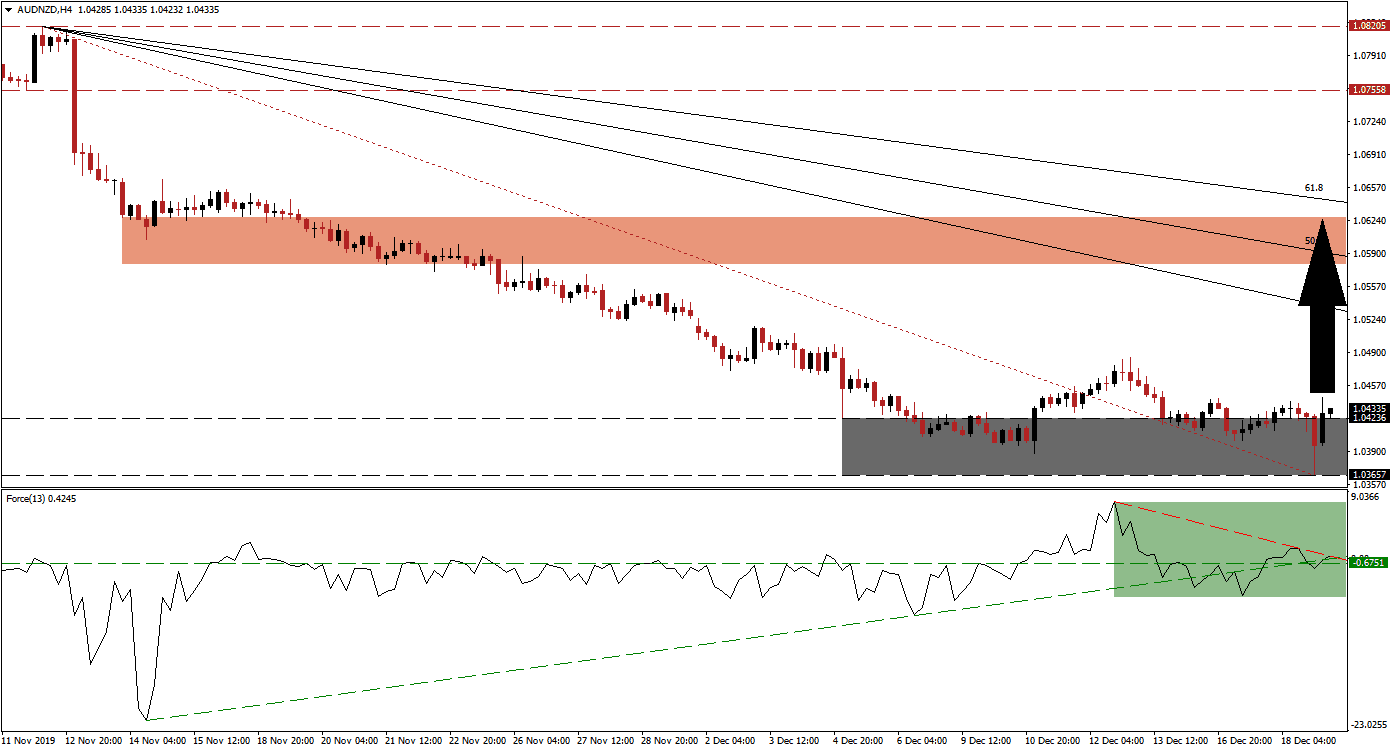

The Force Index, a next-generation technical indicator, stared to recover as this currency pair descended farther to the downside, and a positive divergence materialized. Before this bullish development, the Force Index briefly dipped below its horizontal and ascending support levels. The recovery has now elevated price action above both of them. This technical indicator is now faced with its descending resistance level, as marked by the green rectangle, and a breakout is favored to extend the AUD/NZD to the upside. The Force Index has additionally recovered into positive territory, and bulls are in charge of this currency pair.

Following the breakout in price action above its support zone located between 1.03657 and 1.04236, as marked by the grey rectangle, the AUD/NZD is expected to close to the gap to its descending 38.2 Fibonacci Retracement Fan Resistance Level. A move above its intra-day high of 1.04450, the peak of its initial push above its support zone, is additionally favored to result in a short-covering rally. The Australian and New Zealand Dollars are both commodity currencies, impacted by the global economic slowdown, and heavily dependent on China. You can learn more about a short-covering rally here.

Price action will face its first major resistance level posed by its 50.0 Fibonacci Retracement Fan Resistance Level, which is moving across its short-term resistance zone. This zone is located between 1.05790 and 1.06266, as marked by the red rectangle. More upside is possible, but a fresh fundamental catalyst would be required for a double breakout with the 61.8 Fibonacci Retracement Fan Resistance Level is approaching the top range of its short-term resistance zone. The next long-term resistance zone awaits price action between 1.07558 and 1.08205.

AUD/NZD Technical Trading Set-Up - Breakout Scenario

Long Entry @ 1.04300

Take Profit @ 1.06200

Stop Loss @ 1.03900

Upside Potential: 190 pips

Downside Risk: 40 pips

Risk/Reward Ratio: 4.75

In the event of a breakdown in the Force Index below its ascending support level, the AUD/NZD is likely to follow suit. A breakdown attempt may follow, but given the long-term fundamental outlook for this currency pair, the downside is expected to remain limited to its next support zone. This zone is located between 1.02746 and 1.02929, forex traders are advised to view it as an outstanding buying opportunity.

AUD/NZD Technical Trading Set-Up - Limited Breakdown Scenario

Short Entry @ 1.03500

Take Profit @ 1.02750

Stop Loss @ 1.03800

Downside Potential: 75 pips

Upside Risk: 30 pips

Risk/Reward Ratio: 2.50