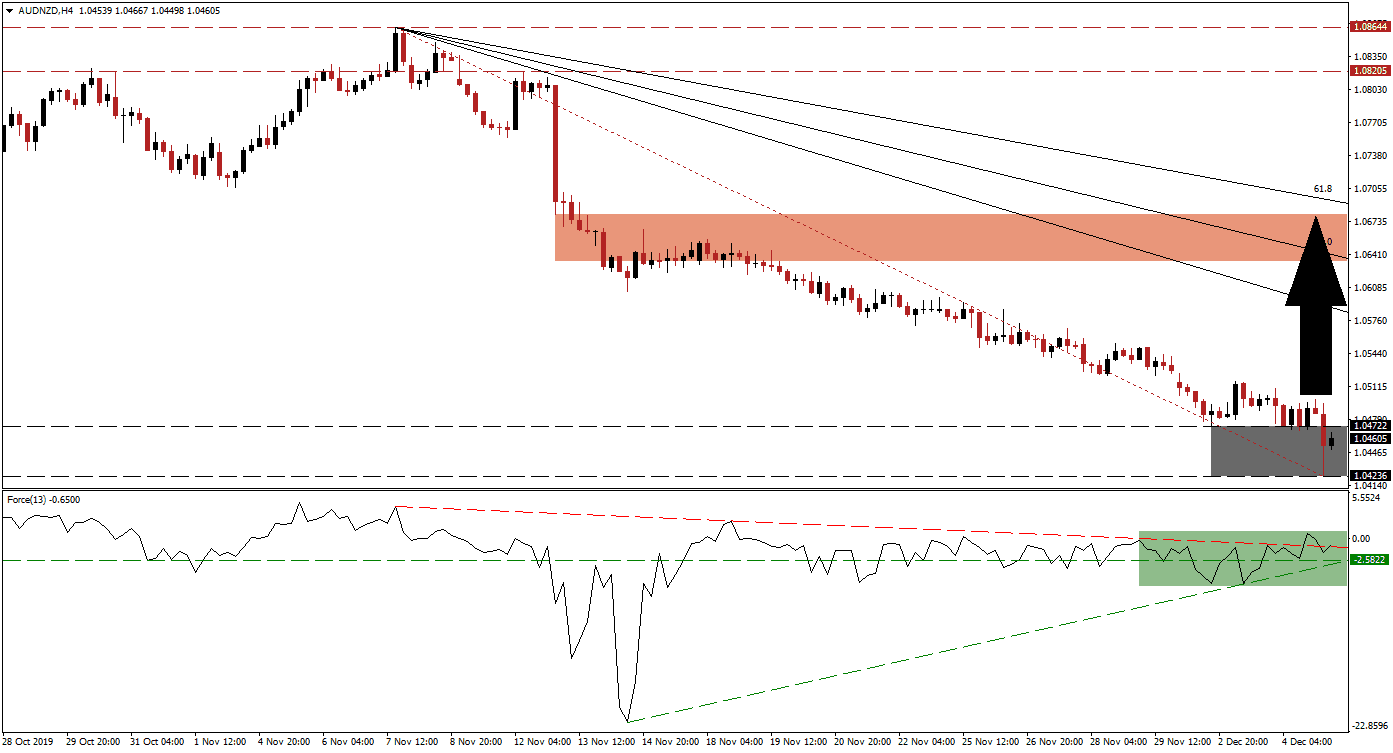

Australian retail sales for October disappointed and exports for October unexpectedly plunged, confirmed that global trade remains weaker than what markets have priced in. The AUD/NZD initially sold-off, but quickly recovered and stabilized inside its support zone. Despite the bearish fundamental data, bullish momentum is expanding and this currency pair is expected to attempt a breakout. A short-covering rally is likely to close the gap between price action and its descending 38.2 Fibonacci Retracement Fan Resistance Level. You can learn more about a breakout here.

The Force Index, a next-generation technical indicator, shows the rise in bullish momentum as price action slipped further and a positive divergence formed as a result. This bullish trading signal suggests that a price action reversal may be imminent. The Force Index advanced from its ascending support level and pushed through its horizontal resistance level, converting it into support. This technical indicator is now in the process of completing a breakout above its descending resistance level as marked by the green rectangle. A push higher will additionally place the Force Index in positive territory and bulls in charge of the AUD/NZD.

Confusing regarding US-China trade discussions remains after commentary out of the US agriculture department stating that US President Trump seeks an enforceable trade deal. The Australian Dollar remains heavily exposed to China as it remains the top Chinese Yuan proxy currency. With the expansion in bullish momentum, the AUD/NZD is positioned for a breakout above its support zone located between 1.04236 and 1.04722 as marked by the grey rectangle. You can learn more about a support zone here.

Forex traders are advised to monitor the Force Index as a move into positive conditions is likely to ignite a short-covering rally in this currency pair. This should clear the path for an advance in the AUD/NZD into its 38.2 Fibonacci Retracement Fan Resistance Level from where an extension into its short-term resistance zone is anticipated. The short-term resistance zone is located between 1.06346 and 1.06806 as marked by the red rectangle; the 50.0 Fibonacci Retracement Fan Resistance Level is currently passing through this zone. More upside is possible but would require a fresh fundamental catalyst.

AUD/NZD Technical Trading Set-Up - Breakout Scenario

- Long Entry @ 1.04650

- Take Profit @ 1.06800

- Stop Loss @ 1.04100

- Upside Potential: 215 pips

- Downside Risk: 55 pips

- Risk/Reward Ratio: 3.91

In case of a breakdown in the Force Index below its ascending support level, the AUD/NZD could attempt a breakdown below its support zone. Given the long-term fundamental outlook, supported by short-term technical developments, the downside in price action remains limited to its next support zone between 1.03206 and 1.03561. Forex traders should consider this an excellent buying opportunity in this currency pair.

AUD/NZD Technical Trading Set-Up - Limited Breakdown Scenario

- Short Entry @ 1.03850

- Take Profit @ 1.03250

- Stop Loss @ 1.04100

- Downside Potential: 60 pips

- Upside Risk: 25 pips

- Risk/Reward Ratio: 2.40