Economic trade data out of Japan confirmed that the global economy continues to weaken, which ushered in the return of risk-off sentiment. Exports contracted in November at a slightly reduced pace over the previous month, while the plunge in imports intensified. The Japanese Yen strengthened as risk-averse traders rotated into safe-haven assets, and the AUD/JPY is expected to extend its breakdown sequence, after descending below its resistance zone; weak Australian data added to bearish momentum. You can learn more about a breakdown here.

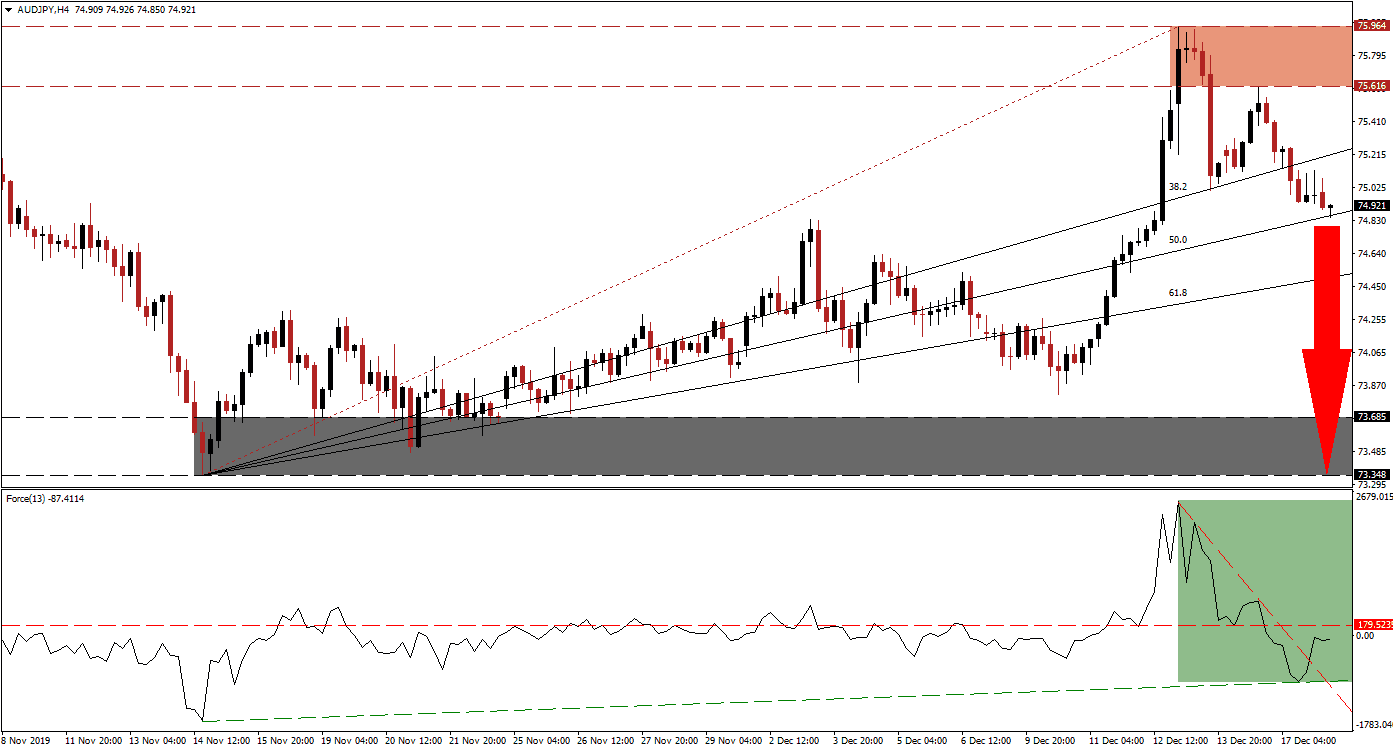

The Force Index, a next-generation technical indicator, shows the loss in bullish momentum after spiking to a fresh high together with this currency pair. The Force Index retreated after the AUD/JPY moved into its resistance zone, and converted its horizontal support zone into resistance. A steep descending resistance level formed and is adding downside pressures, but this technical indicator was able to temporarily recover above it, as marked by the green rectangle. An ascending support level formed, but the Force Index remains in negative territory with bears in control of price action; a renewed push to the downside is favored.

After price action completed a breakdown below its resistance zone located between 75.616 and 75.964, as marked by the red rectangle, bearish momentum expanded. This allowed the AUD/JPY to push through its ascending 38.2 Fibonacci Retracement Fan Support Level; a recovery resulted in a lower high before being reversed. The sell-off paused as this currency pair reached its 50.0 Fibonacci Retracement Fan Support Level, but more downside is expected with global economic worries on the rise. You can learn more about the Fibonacci Retracement Fan here.

Forex traders are advised to monitor the intra-day high of 74.836, the peak of a reversed advanced that led to a lower low; a move below this level is anticipated to result in the addition of new net short positions and refuel the correction. A breakdown in the AUD/JPY below its 61.8 Fibonacci Retracement Fan Support Level will clear the path for a wider sell-off into its support zone; this zone awaits this currency pair between 73.348 and 73.685, as marked by the grey rectangle.

AUD/JPY Technical Trading Set-Up - Breakdown Extension Scenario

Short Entry @ 74.950

Take Profit @ 73.350

Stop Loss @ 75.300

Downside Potential: 160 pips

Upside Risk: 35 pips

Risk/Reward Ratio: 4.57

In the event of a breakout in the Force Index above its horizontal resistance level, assisted by its ascending support level, the AUD/JPY is expected to reverse to the upside. Given the existing fundamental developments, any advance is anticipated to remain confined to its resistance zone. Forex traders should consider an advance in this currency pair as a solid short-selling opportunity.

AUD/JPY Technical Trading Set-Up - Limited Reversal Scenario

Long Entry @ 75.500

Take Profit @ 75.950

Stop Loss @ 75.300

Upside Potential: 45 pips

Downside Risk: 20 pips

Risk/Reward Ratio: 2.25