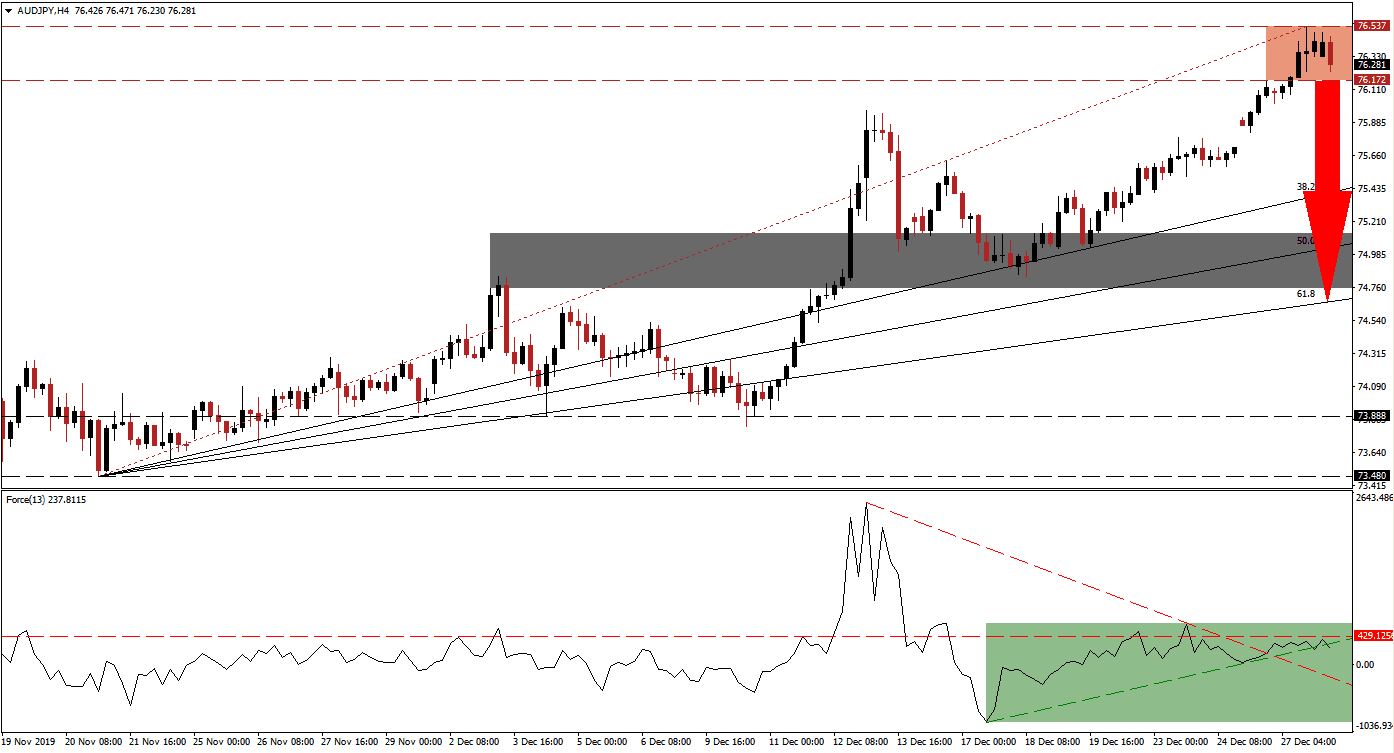

With two days remaining in 2019 and many traders on vacation until next week Monday. Most year-end portfolio adjustments are concluded, but volatility may be elevated due to the lack of trading volume. The AUD/JPY shows signs of exhaustion to the upside and with the beginning of an uncertain 2020, a risk-off session is favored to benefit the Japanese Yen. Bearish pressures are rising as this currency pair reached its resistance zone, and a breakdown is anticipated to initiate a profit-taking sell-off.

The Force Index, a next-generation technical indicator, supported the advance in this currency pair but started to reverse as the AUD/JPY extended to the upside. A negative divergence formed and provided an early warning signal that a reversal may be imminent. During push higher, the Force Index eclipsed its descending resistance level and turned it into temporary support. This technical indicator was rejected by its horizontal resistance level and contracted below its ascending support level, as marked by the green rectangle. While the Force Index remains in positive territory, a crossover below the 0 center-line is expected to lead price action into an extended corrective phase.

Downside pressure increased for the AUD/JPY after it failed to push through its resistance zone located between 76.172 and 76.537, as marked by the red rectangle. Traders grew overly optimistic about the announced phase-one trade armistice between the US and China, which lacks substance. As traders begin to adjust to the ongoing global economic slowdown, this currency pair is favored to accelerate to the downside. Forex traders are advised to monitor the intra-day low of 75.817, the low before price action recorded a fresh high. It additionally follows a price gap to the upside, and a breakdown is likely to result in new net short positions.

A corrective phase will close the gap between this currency pair and its ascending 38.2 Fibonacci Retracement Fan Support Level. This will take the AUD/JPY into its short-term support zone located between 74.759 and 75.133, as marked by the grey rectangle, and enforced by its 50.0 Fibonacci Retracement Fan Support Level. Adding to bearish developments was the move by this currency pair below its Fibonacci Retracement Fan trendline. A breakdown below its short-term support zone cannot be ruled out. The next long-term support zone awaits price action between 73.480 and 73.880. You can learn more about a breakdown here.

AUD/JPY Technical Trading Set-Up - Breakdown Scenario

Short Entry @ 76.250

Take Profit @ 74.750

Stop Loss @ 76.700

Downside Potential: 150 pips

Upside Risk: 45 pips

Risk/Reward Ratio: 3.33

In case of a breakout in the Force Index above its ascending support level, which acts as temporary resistance, the AUD/JPY may attempt a breakout above its resistance zone. With the long-term fundamental outlook uncertain and the technical picture suggesting a corrective phase, the upside remains limited. The next resistance zone is located between 77.538 and 78.031. This would close a previous gap to the downside and offer forex traders a good short-selling opportunity.

AUD/JPY Technical Trading Set-Up - Limited Breakout Scenario

Long Entry @ 76.900

Take Profit @ 77.900

Stop Loss @ 76.450

Upside Potential: 100 pips

Downside Risk: 45 pips

Risk/Reward Ratio: 2.22