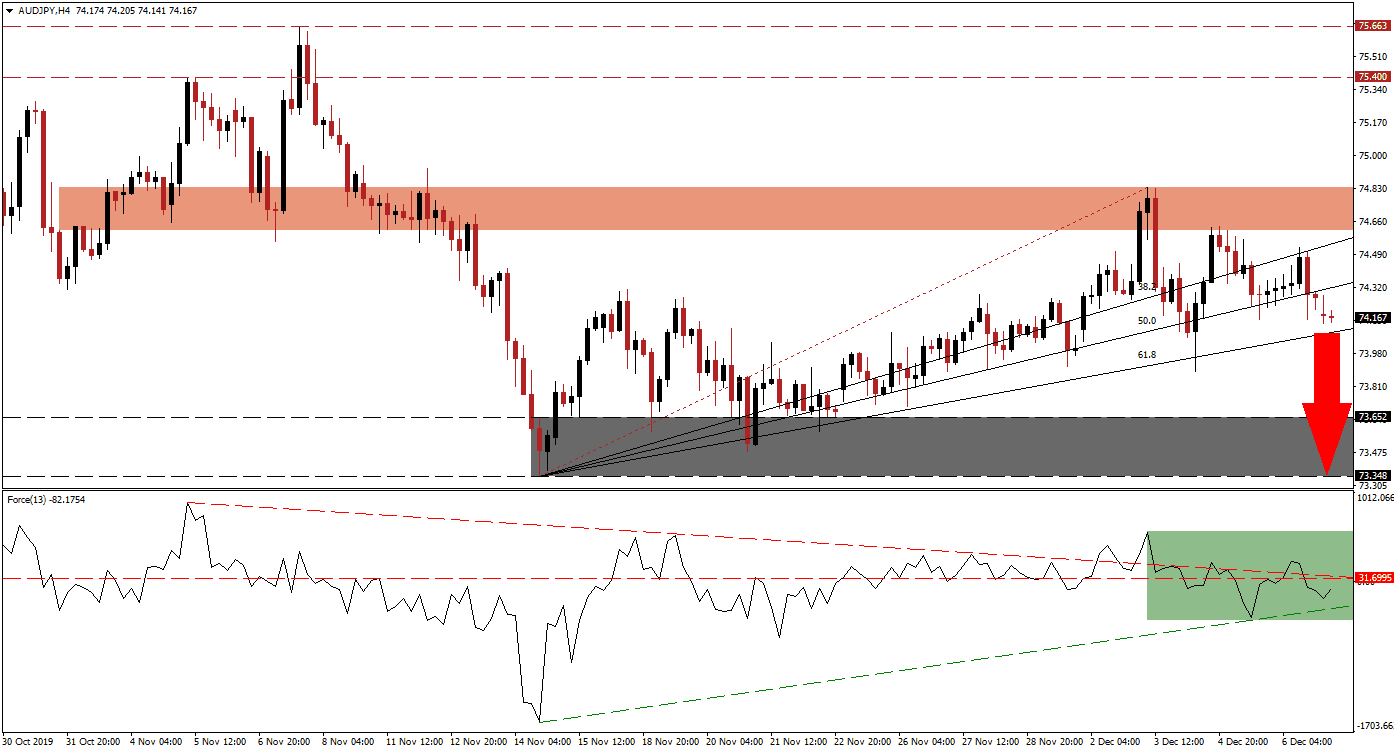

Economic data released out of China showed a contraction in exports, confirming the global economic slowdown is ongoing; the rise in imports suggests a stronger domestic economy. After the release of Chinese data, the AUD/JPY extended its breakdown sequence and is now approaching its ascending 61.8 Fibonacci Retracement Fan Support Level. An upward revision to third-quarter Japanese GDP added to the advance in the Japanese Yen and is anticipated to extend price action into its next support zone. You can learn more about the Fibonacci Retracement Fan here.

The Force Index, a next-generation technical indicator, completed a breakdown below its horizontal support level and turned it into resistance. A brief spike above its descending resistance level preceded the breakdown, but bearish momentum increased following the release of economic data out of Asia. The Force Index is now trapped between its ascending support level and its descending resistance level, as marked by the green rectangle. This technical indicator additionally remains in negative territory, and bears remain in charge of price action in the AUD/JPY.

Volatility in this currency pair remains elevated after the short-term resistance zone, located between 74.616 and 74.836, as marked by the red rectangle, rejected the AUD/JPY. A sharp sell-off was quickly recovered but resulted in a lower high, a bearish development. More downside is favored as the risk-off mood is favored to dominate December. The UK elections on Thursday and potentially new tariffs between the US-China on Sunday will keep traders on edge, providing the fundamental ingredients for an extension in the breakdown sequence. You can learn more about a breakdown here.

Forex traders are advised to monitor the AUD/JPY at the 61.8 Fibonacci Retracement Fan Support Level, as a breakdown in the Force Index below its ascending support level is expected to lead this currency pair into its next support zone. This support zone is located between 73.348 and 73.652 as marked by the grey rectangle. Given the two key developments markets await this week, more downside cannot be ruled out. The next support zone is located between 71.726 and 72.042.

AUD/JPY Technical Trading Set-Up - Breakdown Extension Scenario

Short Entry @ 74.150

Take Profit @ 73.350

Stop Loss @ 74.400

Downside Potential: 80 pips

Upside Risk: 25 pips

Risk/Reward Ratio: 3.20

In case of a breakout in the Force Index above its descending resistance level, the AUD/JPY is expected to retrace into its short-term resistance zone. A move above its intra-day high of 74.633 may result in a breakout and allow price action to move into its next long-term resistance located between 75.400 and 75.663. This should be considered a good short-selling opportunity, as the medium-term outlook for this currency pair remains bearish.

AUD/JPY Technical Trading Set-Up - Limited Breakout Scenario

Long Entry @ 74.950

Take Profit @ 75.450

Stop Loss @ 73.700

Upside Potential: 50 pips

Downside Risk: 25 pips

Risk/Reward Ratio: 2.00