As expected, the Reserve Bank of Australia kept its benchmark interest rate unchanged at 0.75%. This lifted the AUD/CHF off of its ascending 38.2 Fibonacci Retracement Fan Support Level. Yesterday’s Chinese Manufacturing PMI added to the bullishness in this currency pair which is now faced with its short-term resistance zone. With only twelve days before fresh tariffs are set to apply in the US-China trade war, uncertainty about the progress of trade negotiations remains elevated. This currency pair requires a fundamental catalyst to attempt a sustained breakout above its short-term resistance zone.

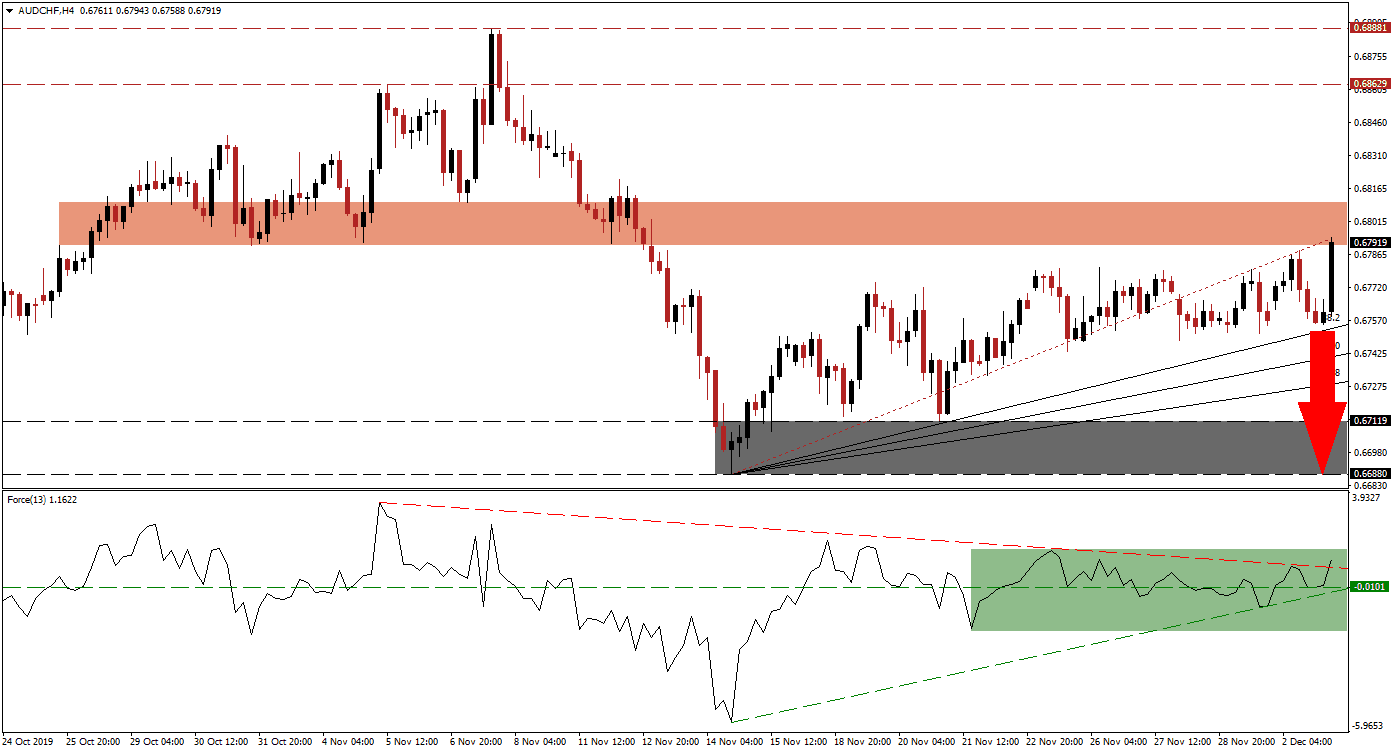

The Force Index, a next-generation technical indicator, recovered together with price action after grazing its ascending support level. The Force Index moved above its horizontal resistance level and converted it into support as marked by the green rectangle. This technical indicator additionally moved into positive territory, suggesting bulls are in charge of the AUD/CHF, but is faced with its descending resistance level. You can learn more about the Force Index here.

Price action is now moving into its resistance zone located between 0.67905 and 0.68099 as marked by the red rectangle. A loss in bullish momentum is expected to materialize and while a breakout attempt is possible, given the current fundamental picture it is unlikely to be sustained. Another bearish development to consider is the Fibonacci Retracement Fan trendline, the AUD/CHF is located below it and will remain there unless a significant advance can follow a sustained breakout.

With the global manufacturing sector in a recession, economic risks remain and they stretch beyond the US-China trade war. The Swiss Franc initially came under pressure last week after commentary from the SNB in regards to a potential interest rate cute deeper into negative conditions, but GDP data came in better than expected and the SNB is expected to remain on the sidelines. The AUD/CHF is expected to retrace its advance and descend back into its support zone, located between 0.66880 and 0.67119 as marked by the grey rectangle. Such a move would take it below its entire Fibonacci Retracement Fan sequence. You can learn more about the Fibonacci Retracement Fan here.

AUD/CHF Technical Trading Set-Up - Price Action Reversal Scenario

Short Entry @ 0.67900

Take Profit @ 0.66900

Stop Loss @ 0.68200

Downside Potential: 100 pips

Upside Risk: 30 pips

Risk/Reward Ratio: 3.33

Should the Force Index maintain a breakout above its descending resistance level, the AUD/CHF may attempt a breakout above its short-term resistance zone. Due to the elevated risks and uncertainties, the upside potential is anticipated to remain limited to its next long-term resistance zone, located between 0.68629 and 0.68881. This should be considered a good short-selling opportunity.

AUD/CHF Technical Trading Set-Up - Limited Breakout Scenario

Long Entry @ 0.68450

Take Profit @ 0.68850

Stop Loss @ 0.68250

Upside Potential: 40 pips

Downside Risk: 20 pips

- Risk/Reward Ratio: 2.0