Following yesterday’s Swiss National Bank interest rate decision, were interest rates remained unchanged at -0.75%, the Swiss Franc weakened against the Australian Dollar. This was magnified, after reports surrounding a phase-one trade deal between the US and China emerged; the legal text is not yet finalized and may present a stumbling block, but fresh tariffs scheduled for Sunday appear delayed. The AUD/CHF converted its short-term resistance zone into support, and more upside is favored as a result of the breakout in this currency pair.

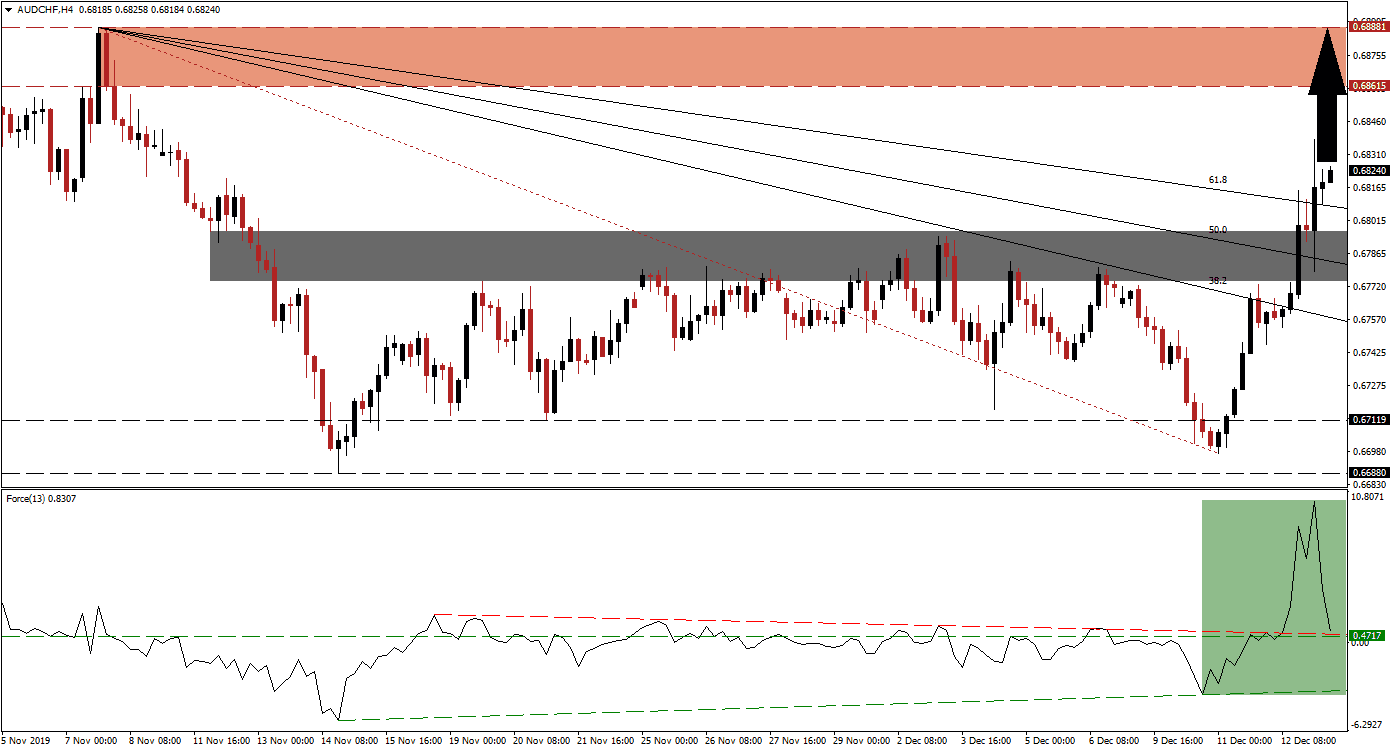

The Force Index, a next-generation technical indicator, surged to a fresh high and confirmed the significant bullish advance. After the AUD/CHF moved into its support zone, bullish momentum increased, and the Force Index recorded a higher low. An ascending support level formed, and this technical indicator accelerated to the upside. It completed a breakout above its horizontal resistance level and pushed through its descending resistance level. While bullish momentum eased from its peak, it remains in positive conditions, and an extension of the advance is favored. You can learn more about the Force Index here.

Price action commenced a recovery after briefly dipping into its long-term support zone between 0.66880 and 0.67119. Bullish momentum sufficed to convert its short-term resistance zone into support; this zone is set between 0.67741 and 0.67967, as marked by the grey rectangle. The breakout sequence in the AUD/CHF additionally elevated it above its entire Fibonacci Retracement Fan sequence and converted it from resistance into support. While a retracement into its descending 61.8 Fibonacci Retracement Fan Support Level remains possible, the technical picture suggests more upside.

Until the legal text of a watered-down phase-one trade deal is finalized, the risk to the downside should not be ignored. The existing bullish momentum is anticipated to carry price action into its resistance zone located between 0.68615 and 0.68881, as marked by the red rectangle. A further breakout would require a confirmation from the US and China that the phase-one trade has been indeed finalized. The Force Index should be closely monitored, as long as it remains in positive conditions, the uptrend in the AUD/CHF remains intact. You can learn more about a resistance zone here.

AUD/CHF Technical Trading Set-Up - Breakout Extension Scenario

- Long Entry @ 0.68250

- Take Profit @ 0.68850

- Stop Loss @ 0.68050

- Upside Potential: 60 pips

- Downside Risk: 20 pips

- Risk/Reward Ratio: 3.00

A breakdown in the Force Index below its descending resistance level, which will additionally convert its horizontal support level back into resistance, may result in a breakdown attempt in the AUD/CHF. The Fibonacci Retracement Fan sequence could then guide price action down into its long-term support zone. Uncertainty will remain, until more clarity on the legal text regarding the phase-one trade deal emerges.

AUD/CHF Technical Trading Set-Up - Breakdown Scenario

- Short Entry @ 0.67650

- Take Profit @ 0.67100

- Stop Loss @ 0.67900

- Downside Potential: 55 pips

- Upside Risk: 25 pips

- Risk/Reward Ratio: 2.20