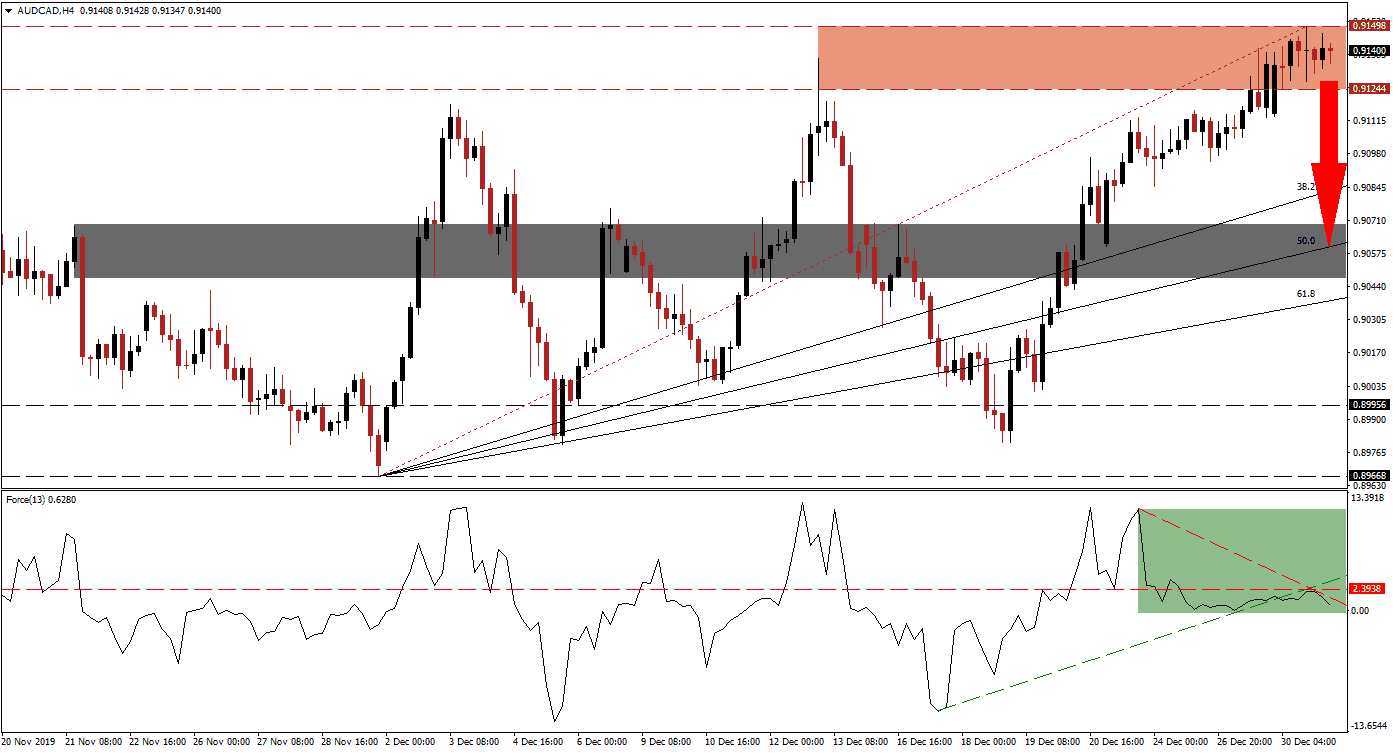

Bullish momentum is fading after price action reached its resistance zone, but it managed to record a marginally higher high. Chinese PMI data for December showed a slowdown in the expansion of the services sector while the manufacturing sector barely escaped a contraction. The Australian Dollar is the top Chinese Yuan proxy currency, and this morning’s Chinese data ensured that the AUD/CAD won’t be able to extend its advance. The exhausted upside is anticipated to result in a corrective phase. You can learn more about a resistance zone here.

The Force Index, a next-generation technical indicator, started to descend before this currency pair reached its resistance zone and a negative divergence formed. Downside momentum sufficed to pressure the Force Index below its horizontal support level, turning it into resistance. It additionally moved below its ascending support level, as marked by the green rectangle. The descending resistance level is now expected to push this technical indicator into negative territory and place bears in control of the AUD/CAD.

Adding to the bearish developments in this currency pair is the move in price action below its Fibonacci Retracement Fan trendline. This materialized inside its resistance zone located between 0.91244 and 0.91498, as marked by the red rectangle. A breakdown is favored to initiate a profit-taking sell-off, which will close the gap between the AUD/CAD and its ascending 38.2 Fibonacci Retracement Fan Support Level. Forex traders are advised to monitor the intra-day low of 0.91129, the low of a previous drop below its resistance zone. A move below it is likely to result in an accelerated move to the downside.

A corrective phase should take the AUD/CAD into its next short-term support zone located between 0.90473 and 0.90694, as marked by the grey rectangle. The 50.0 Fibonacci Retracement Fan Support Level is passing through this zone. A breakdown would require a fresh fundamental catalyst, but given the existing conditions remains unlikely. The technical picture suggests a short-term sell-off in this currency pair, but the long-term outlook remains bullish. You can read more about a breakdown here.

AUD/CAD Technical Trading Set-Up - Breakdown Scenario

Short Entry @ 0.91400

Take Profit @ 0.90600

Stop Loss @ 0.91600

Downside Potential: 80 pips

Upside Risk: 20 pips

Risk/Reward Ratio: 4.00

In case of a breakout in the Force Index above its ascending support level, which acts as temporary resistance, the AUD/CAD is anticipated to attempt a breakout. This would extend the dominant long-term trend in this currency pair, but a short-term corrective phase would ensure the longevity of it. The next resistance zone awaits price action between 0.92266 and 0.92466, more upside will depend on economic developments.

AUD/CAD Technical Trading Set-Up - Breakout Scenario

Long Entry @ 0.91850

Take Profit @ 0.92350

Stop Loss @ 0.91600

Upside Potential: 50 pips

Downside Risk: 25 pips

Risk/Reward Ratio: 2.00