Ripple has been dragged down by Bitcoin and the Ripple Foundation, the entity in control of supply, has been continuously accused of dumping XRP on the market. The Ripple Foundation has denied this and pointed out that the prime focus right now is to build-out RippleNet, Dharma, and Forte. RippleNet has already attracted over 200 financial institutions with a growing base. The short-term pain in the XRP/USD is, therefore, not supported by fundamentals and long-term traders and investors alike should consider the current support zone, hugging the key 0.2000 level, as an excellent long-term buying opportunity.

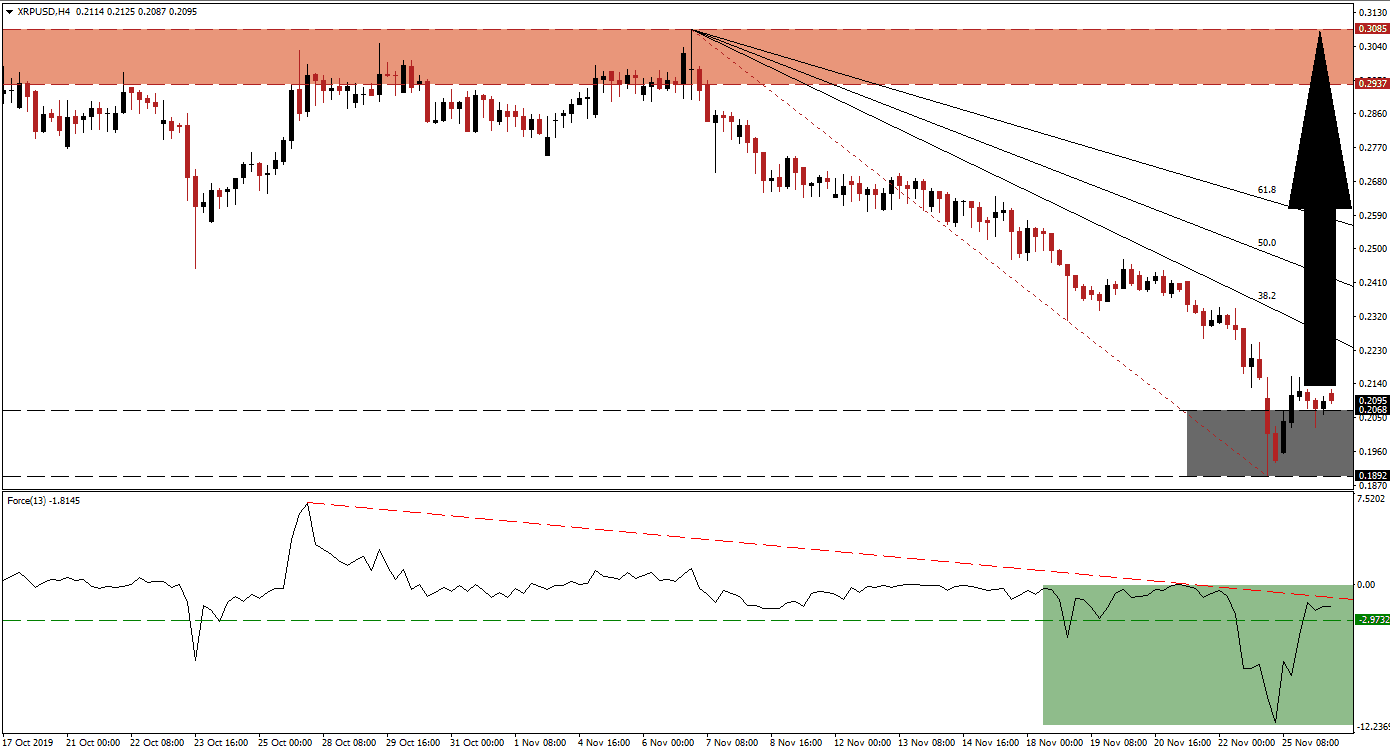

The Force Index, a next-generation technical indicator, points towards the sharp increase in bullish momentum after this cryptocurrency pair reached its support zone. The breakout in the XRP/USD was confirmed by a breakout in the Force Index above its horizontal resistance level that now acts as support. This technical indicator is now faced with its descending resistance level and a move above it is expected to trigger the next wave of buy orders. A breakout by the Force Index above its descending resistance level will additionally place this technical indicator in positive conditions and bulls in charge of price action. You can learn more about the Force Index here.

Following the breakout in the XRP/USD above its support zone, located between 0.1892 and 0.2068 as marked by the grey rectangle, cleared the path for an advance into its descending 38.2 Fibonacci Retracement Fan Resistance Level. Another bullish development emerged as this cryptocurrency pair is trading above its Fibonacci Retracement Fan trendline and forex traders are advised to monitor the intra-day low of 0.2308; this marks the last instance price action paused its sell-off before accelerating into its current support zone. A breakout above this mark may trigger a short-covering rally and lead to more upside.

Given the extreme sell-off in this cryptocurrency pair, not supported by fundamental facts, a short-covering rally may suffice to force price action into a breakout above its 61.8 Fibonacci Retracement Fan Resistance Level. This would allow a rally to extend into its next resistance zone, located between 0.2937 and 0.3085 as marked by the red rectangle. Ripple is leading cryptocurrencies in transparency and while XRP doesn’t follow the same blueprint as traditional cryptocurrencies, it remains a bellwether of this emerging, maturing asset class. It is also noteworthy that the inflation rate of XRP is lower than that of BTC and ETH, XRP is the third biggest cryptocurrency by market capitalization. A breakout in the XRP/USD above its resistance zone would require a new fundamental catalyst and a general change in market sentiment for the entire cryptocurrency sector.

XRP/USD Technical Trading Set-Up - Breakout Extension Scenario

⦁ Long Entry @ 0.2100

⦁ Take Profit @ 0.3085

⦁ Stop Loss @ 0.1875

⦁ Upside Potential: 985 pips

⦁ Downside Risk: 225 pips

⦁ Risk/Reward Ratio: 4.38

Should the Force Index fail to maintain its bullish momentum and convert its horizontal support level back into resistance with a sustained breakdown, the XRP/USD could attempt a breakdown below its current support zone. The downside potential remains extremely limited due to the magnitude of the preceding sell-off and the next support zone awaits price action between 0.1642 and 0.1784. Any move into this zone should be taken advantage of as it represents an outstanding long-term buying opportunity.

XRP/USD Technical Trading Set-Up - Limited Breakdown Scenario

⦁ Short Entry @ 0.18250

⦁ Take Profit @ 0.16450

⦁ Stop Loss @ 0.19100

⦁ Downside Potential: 180 pips

⦁ Upside Risk: 85 pips

⦁ Risk/Reward Ratio: 2.12