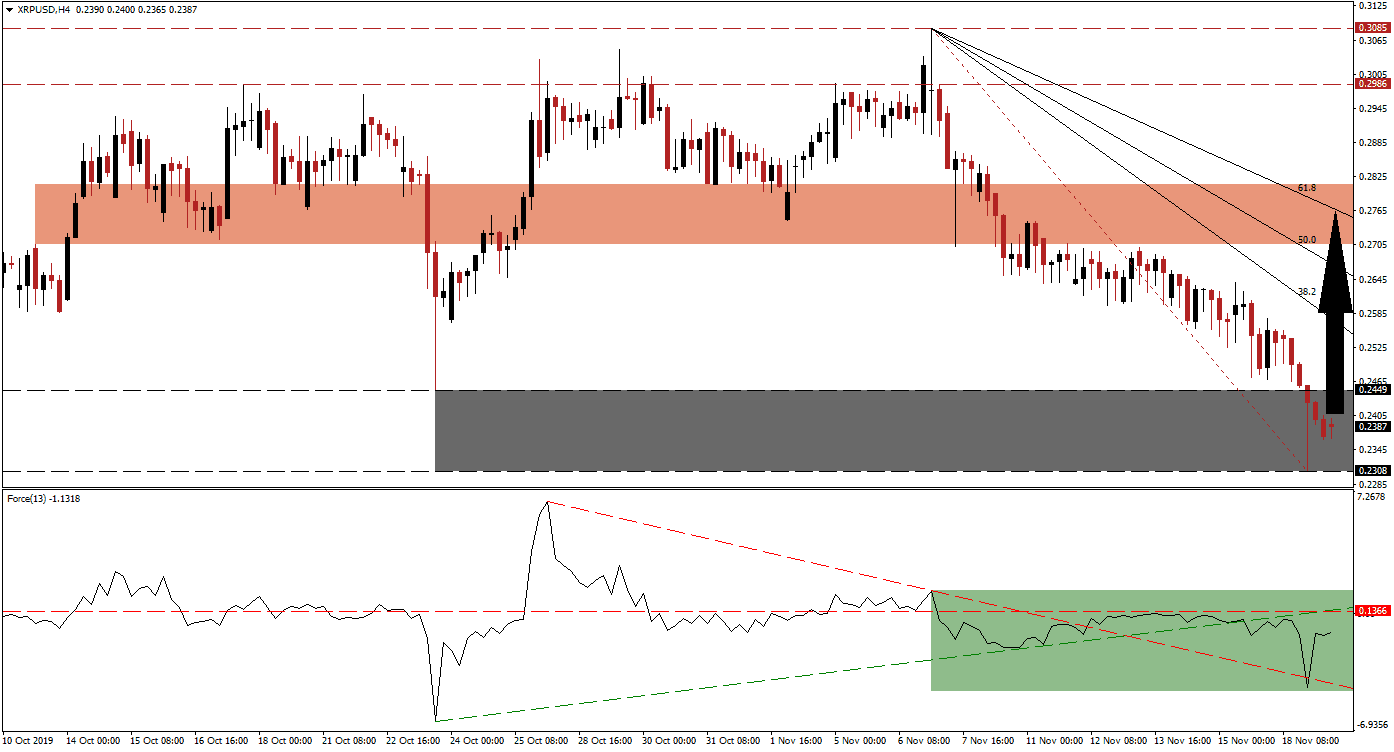

As Bitcoin continues to drag down the cryptocurrency market and is con the verge of a breakdown below the $8,000 level, Ripple has accelerated to the downside from and is now located inside its support zone. The corrective phase has wiped out over 25% of value in XRP/USD, despite solid fundamentals. The Ripple Foundation has often been blamed for causing violent sell-offs due to dumping Ripple from its reserves on the market. The current price of this cryptocurrency pair doesn’t reflect fundamental reality, and a short-covering rally should be expected to emerge.

The Force Index, a next-generation technical indicator, indicates the presence of a positive divergence as the XRP/USD plunged into its support zone. Given the sharp move in price action, the descending resistance level acts as temporary support, while the ascending support level was converted into short-term resistance; this is marked by the green rectangle. The Force Index remains below its horizontal resistance level and in negative territory, placing bears in charge of this cryptocurrency pair. The rise in bullish momentum after price action reached the bottom range of its support zone is expected to lead to a double breakout in this technical indicator. You can learn more about the Force Index here.

From a fundamental perspective, XRP/USD has plenty of upside potential. Mass adoption is becoming a reality for this cryptocurrency pair, which many don’t consider to be a cryptocurrency as it is centralized and controlled by the Ripple Foundation, and the long-term scenario favors price appreciation. The support zone located between 0.2308 and 0.2449, as marked by the grey rectangle, should be considered a great long entry opportunity. A breakout is expected to take price action through its 38.2 as well as 50.0 Fibonacci Retracement Fan Resistance Levels, and convert them back into support.

Any move to the upside will face its first challenge at the short-term resistance zone, located between 0.2705 and 0.2811 as marked by the red rectangle; the descending 61.8 Fibonacci Retracement Fan Resistance Level is nestled inside this zone. Depending on the magnitude of the build-up in bullish momentum as the XRP/USD advances, a breakout above its short-term resistance zone is possible. Fundamental factors favor a bigger advance and the next long-term support zone awaits price action between 0.2986 and 0.3085; from where the current sell-off began. You can learn more about a breakout here.

XRP/USD Technical Trading Set-Up - Breakout Scenario

⦁ Long Entry @ 0.2385

⦁ Take Profit @ 0.2810

⦁ Stop Loss @ 0.2265

⦁ Upside Potential: 425 pips

⦁ Downside Risk: 120 pips

⦁ Risk/Reward Ratio: 3.54

In the event of a breakdown in the Force Index below its descending resistance level which acts as temporary support, the XRP/USD may be encouraged to push for a breakdown below its support zone. A sustained breakdown is highly unexpected due to the fundamental drivers behind this cryptocurrency pair and the next support zone is located between 0.1642 and 0.1784; this should be viewed as an outstanding buying opportunity.

XRP/USD Technical Trading Set-Up - Limited Breakdown Scenario

⦁ Short Entry @ 0.2125

⦁ Take Profit @ 0.1780

⦁ Stop Loss @ 0.2250

⦁ Downside Potential: 345 pips

⦁ Upside Risk: 125 pips

⦁ Risk/Reward Ratio: 2.76