The West Texas Intermediate Crude Oil market has gone back and forth during the day on Friday, as we have a lot of noise out there and the market is likely to see a lot of noise due to the US/China trade headlines, and of course the overall concern about growth globally.

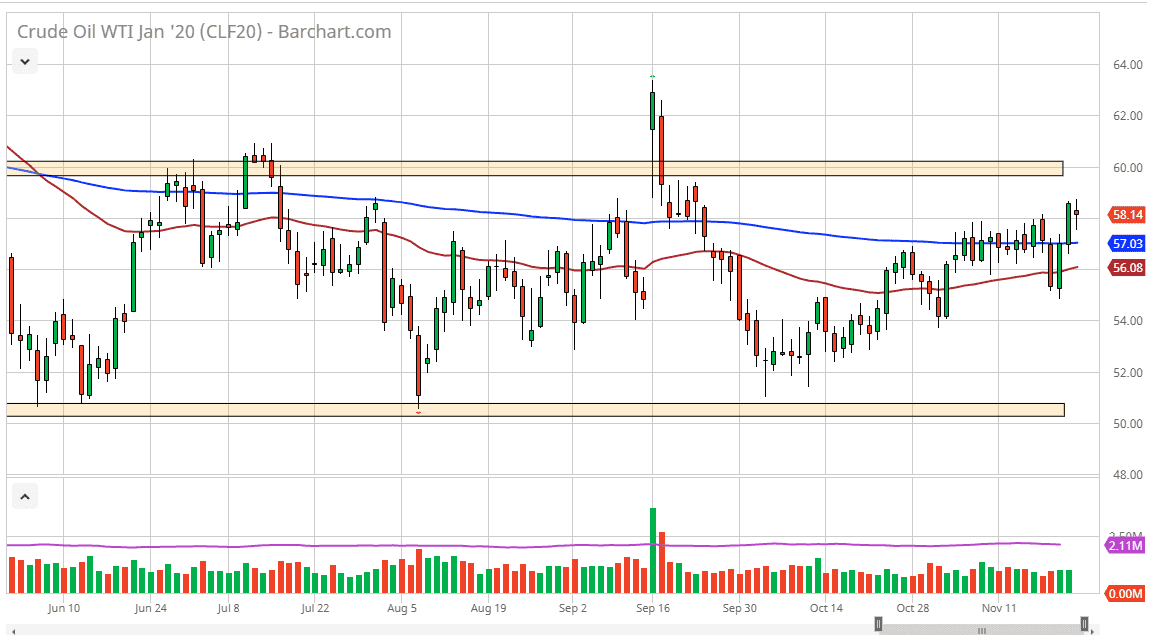

Ultimately though, we do have the OPEC members talking about possibly extending the production cuts past the December meeting, that of course could cause quite a bit of upward pressure. The $60 level above would be an area where there should be resistance, and I think it extends to the $62.50 level. That is an area that we have seen a lot of pressure at, and it is currently the top overall trading. If we can break above that area, then obviously crude oil markets can take out to the upside, but I don’t expect to see that anytime soon. In fact, when you look at the overall attitude of the market, we have essentially formed a nice uptrend and channel. That channel is simply looking towards the top of the overall consolidation, and I anticipate that we will probably pull back a bit from there.

To the downside, I think the 200 day EMA at the $57 level could offer support, just as the 50 day EMA underneath will near the $56 level. Both of these EMA indicators could cause a bit of bullish pressure in support, but if we were to break through both of them it’s likely that we will simply find buyers underneath.

The bottom of the overall consolidation area is at the $50 level, so it’s likely that the market will continue to find plenty of buying pressure underneath in that area. If we were to break down below there it would be a complete trend change but I don’t expect to see that happen anytime soon. Overall, I do think that we simply grind back and forth but in the short term it looks like we need to continue drifting higher. This is a market that that will be paying close attention to geopolitical issues and the Middle East, and of course the US/China trade deal. If we can get some good movement in the US/China trade deal, then it suggests that the market could expect more demand coming, therefore driving prices higher.