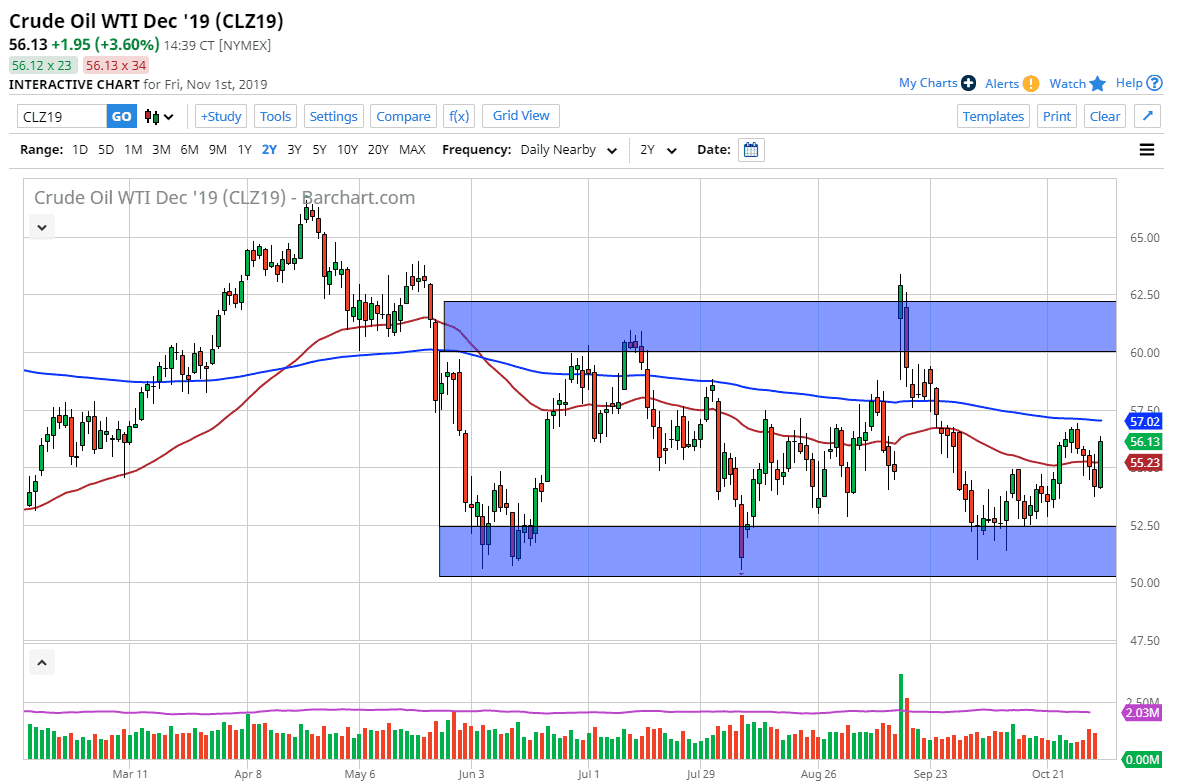

The WTI Crude Oil market rallied significantly during the trading session on Friday, especially later in the day, to break above the 50 day EMA. The candlestick looks very healthy, and it appears that we are going to close towards the very top of the range for the day. Ultimately, this is a very good sign and it looks very likely that we are going to continue to go higher. I recognize that the 200 day EMA above at the $57 level will cause a lot of resistance, so the question now is whether or not we can break above there. The short answer for me is yes.

Looking at this chart, the market seems to have a support zone starting at the $50 level that extends to the $52.50 level. To the outside, I see a resistance zone starting at $60 and extending to the $62.50 level. We are basically in the middle of the range right now of the overall consolidation, but I also recognize that the candlestick is very bullish, and that is something worth paying attention to.

The possibility of OPEC cutting back production during the December meeting will have a bit of an upward pressure put upon the market, but we also have concerns about global growth and therefore global demand of crude oil. I think at this point it makes quite a bit of sense of the market supply goes back and forth overall, but right now it looks is that there is more upward momentum than anything else. Looking at this chart, there is a lot of choppiness between here and there, and at this point it’s likely that we will continue to see erratic behavior. It really comes down to your timeframe, and the ability to hang onto a position. If you are able to hang onto a longer-term position, then the volatility won’t cause much in the way of trouble. However, if you’re an intraday trader then you should probably be looking for short-term pullbacks that you can take advantage of to pick up a bit of “value.” I expect a lot of noise, but at this point it certainly looks as if the buyers are starting to take control, even if it is just for the next couple of days. With this choppy type of market, sometimes it is better to trade smaller positions.