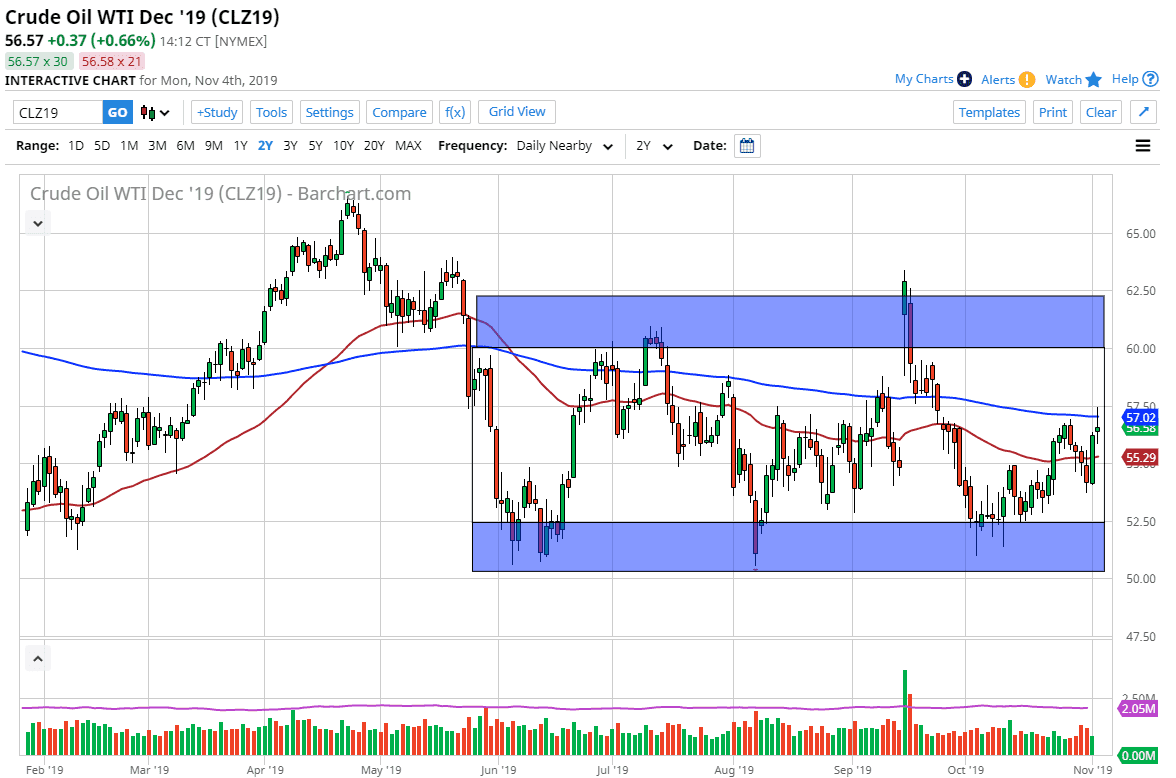

The West Texas Intermediate Crude Oil market has gone back and forth during the trading session on Monday to kick off the week, but at this point it doesn’t look very likely that the market is going to be able to figure out where it was to go in the short term. The market is very likely to continue to pay attention to the 200 day EMA to offer resistance, with the 50 day EMA underneath offer support.

It should be noted that the daily candlestick looks a lot like a shooting star, and it is right in the middle of the overall consolidation range that I have marked on the chart. With this, I think the market will continue to chop back and forth, which is a great microcosm for the rest of the markets in general, with perhaps the exception of the S&P 500. OPEC is likely to cut production at the December meeting, and that of course is negative. However, it’s difficult to imagine been able to simply buy or sell and hold with any type of ease, because the markets are all over the place. Volumes have been light in most markets as well, so this continues to make the entire situation difficult.

Over the next couple of days, it would not surprise me at all to see the market try to wipe out the Friday candlestick, only to turn around of bounce again. However, if the market were to break above the $57.50 level, then I think it could go looking towards the $60 level above. Ultimately, this is a market that will continue to be very noisy to say the least. Longer term though, I think we are simply bouncing between the $50 level on the bottom and the $62.50 level on the top. You can see that I have a couple of blue rectangles at the top and bottom, suggesting where the “zone” of support or resistance is found. This is a market that continues to see a lot of back and forth noise, and I don’t see that changing anytime soon because we have the bullish pressure of the potential of OPEC cut, but at the same time there are a lot of concerns about whether or not there is going to be enough global demand and of course the Americans continue to pump out massive amounts of crude oil.