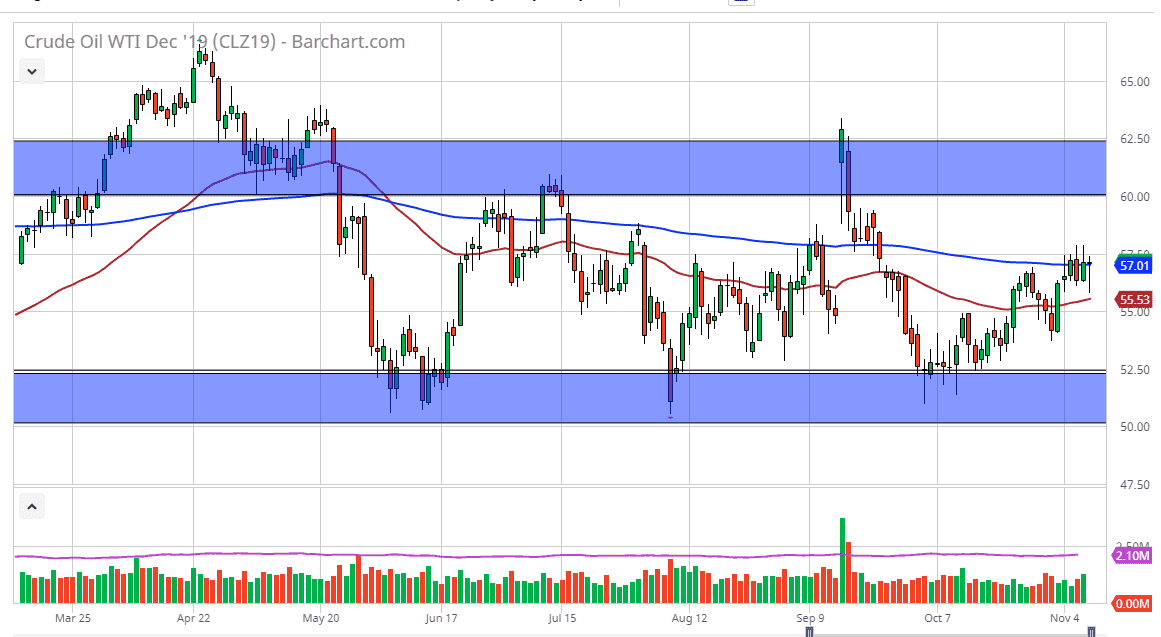

The West Texas Intermediate Crude Oil market initially fell during the trading session on Friday, reaching down towards the 50 day EMA at the $55.53 level. We turned around at that point though to form a bit of a bounce and now the market is simply hanging about the 200 day EMA. This is a longer-term a signal for trend followers, so it will obviously attract a bit of attention. That being said, we could not break out to the upside so essentially nothing has been settled other than the market is consolidating and is very choppy.

On one end of the spectrum, you have the possibility of OPEC cutting production during their December meeting in Vienna, but there are already members suggesting that it isn’t going to happen. That being the case, it does put a little bit of a kink into the idea of a bullish market in that sense. However, on the other side of the equation we have the concerns about global demand, as economies around the world have been slowing a bit. Furthermore, the US/China trade relations seem to be getting slightly better, but there is a lot of confusion at the end of the week as to whether or not the Americans are going to lift tariffs in the short term, as the Chinese want to see.

In other words, there are a lot of conflicting pressures on the crude oil market right now, and that leads me to believe that we will simply consolidate going forward, and therefore I think that the market breaking out to the upside could possibly send this market looking towards the $60 level above, but at that point I would expect to see a lot of selling. To the downside, if we were to break down below the 50 day EMA, then we could see a reach towards the $52.50 level. The market has been stuck between these couple different areas, and as a result expect more back-and-forth trading than anything else. Short-term traders will continue to like the oil market, as the back-and-forth type of action will continue to be favored. Short-term trading in a back-and-forth manner is probably as good as it gets right now. Longer-term traders will have to respect these boundaries, as markets can’t seem to decide on a longer-term direction. With this, look for opportunities on intraday charts more than anything else.