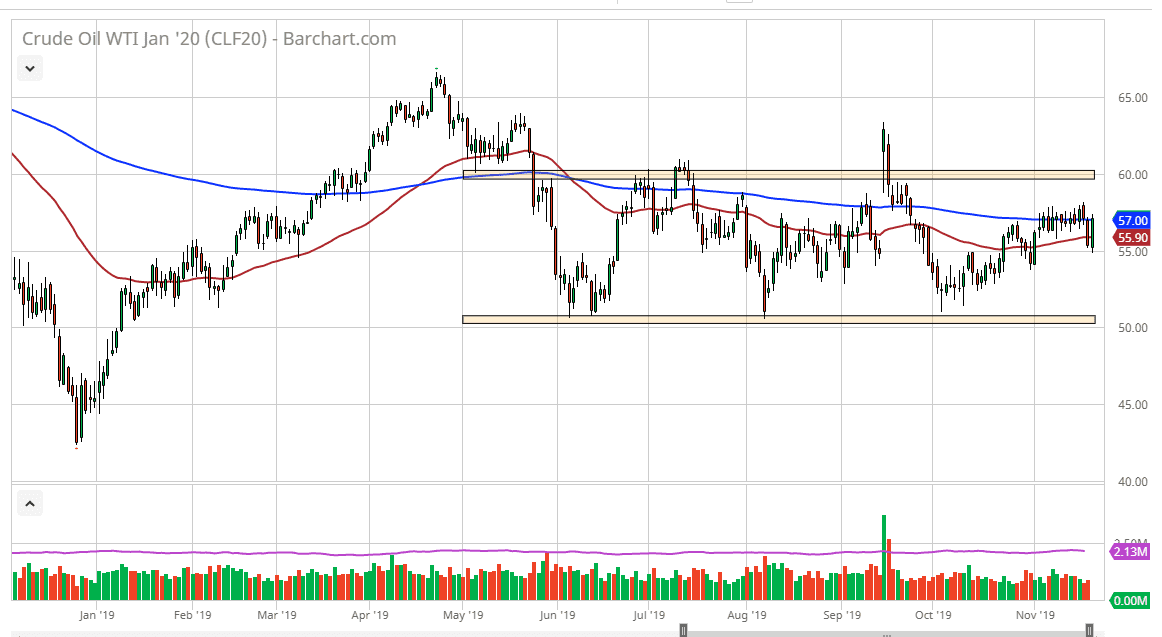

The West Texas Intermediate Crude Oil market rallied rather significantly after initially hitting the $55 level underneath. This completely wiped out the losses sustained during the Tuesday session, and as a result is a very positive sign. However though, there is obvious resistance near the $58 level that will be difficult to break above, but you could make an argument for a bit of an engulfing candlestick, so that is a good sign.

The overall market is consolidating though, and it should be noted that we broke slightly above the 200 day EMA. If we can break above the $58 level though, then we could test the out of range of the overall consolidation area which reaches towards the $60 level above. If that level were to be broken, then the market could really start to take off to the upside. To the downside, the $55 level underneath that has shown itself to be supportive for a couple of days in a row, could open up more selling, but I think this is a market that will find plenty of buyers underneath, extending all the way down to the $50 level. All things being equal, the West Texas Intermediate Crude Oil market tends to trade in very technical increments, most of the time in $10 ranges. As you can see on the chart, it’s obvious that we have been trading in this $10 range for some time.

The inventory number came out as expected, so I suspect part of the rally during the trading session is more or less a “relief rally” and therefore it’s likely to continue to continue the overall pattern before that announcement, which at this point looks like a slow and choppy grind higher. In fact, you can make an argument for an uptrend and channel on shorter time frames, and it looks as if the market is probably going to go looking towards the $60 level above. Overall, ultimately, this is a market that will continue to bang around as we worry about Global supply and of course the lack of demand that could be an issue as the global economy isn’t exactly humming along at top speed. The US/China trade situation of course continues to cause issues when it comes to the idea of how oil will be in demand, so keep that in mind. If we get good news out of there, then it’s likely that the bullish pressure enters this market as well.