The West Texas Intermediate Crude Oil market showed signs of life during the trading session on Thursday, but as the inventory number came out much more bearish than anticipated, the market pulled back slightly. That being said, it isn’t as if there is a massive amount of oversupply, it’s just that we are burning through the supply very quickly. This suggests to me that there is either far too much drilling in the United States, which of course is partially true, or perhaps there is some concern out there due to global demand shrinking, which is also true.

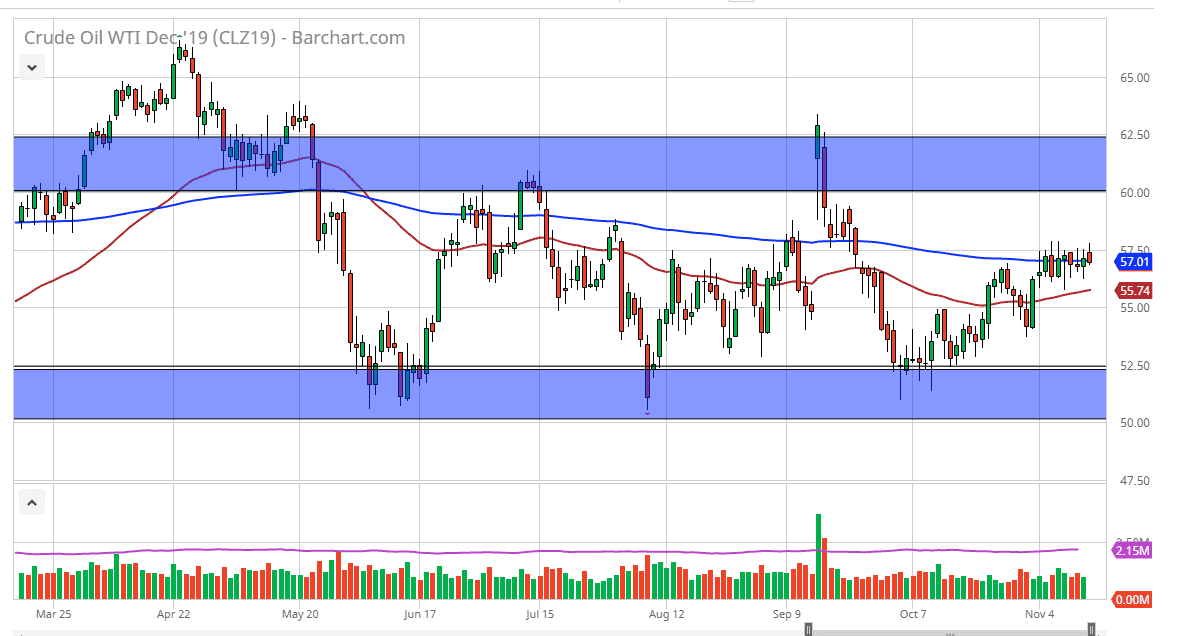

That being said, if we can break above the $58 level, I think that the market will clear the lot of resistance and could go looking towards the $60 level after that. From the other side of the equation, I believe that the 50 day EMA which is at the $55.75 level should offer support, so breaking below there could then send this market down to the $55 handle.

When you look at the longer-term chart you can see that we are going back and forth in a larger consolidation area between the $50 level on the bottom and roughly $62.50 on the top. We are essentially right in the middle of that so that makes this area “fair value.” That is a major reason why the market can’t go anywhere, simply because both buyers and sellers can agree that this is a reasonable price. Beyond that though, there are a whole host of external factors on crude oil that continue to cause issues as well.

The US/China trade war is of course a major problem, but what isn’t thought of initially as the fact that it drives down the need for transportation. This means that there is less crude oil burned in order to move goods from Shenzhen to California. As long as that trade war continues, there is a major concern that the demand will simply drop off a cliff, which is a real fear. On the other side of that equation, there are some members of OPEC calling for production cuts but that seems to have fallen on deaf ears to a couple of the major players in that block of countries, so more than likely won’t be an issue. All things being equal, it seems as if the market is looking for the next major catalyst to start moving. Until then it’s probably a lot of short-term range bound back-and-forth trading.