The West Texas Intermediate Crude Oil market has rallied rather significantly during trading on Thursday as reports are coming out that OPEC may in fact look to extend the production cuts that are currently in effect going forward. There has even been talk about perhaps expanding the production cuts, but there is a difficult balancing act that the members of OPEC must do, as most of them require oil sales to fund their economies, but at the same time there is an oversupply of crude oil the world. If they cut down production, they can get more per barrel, but sell less of them.

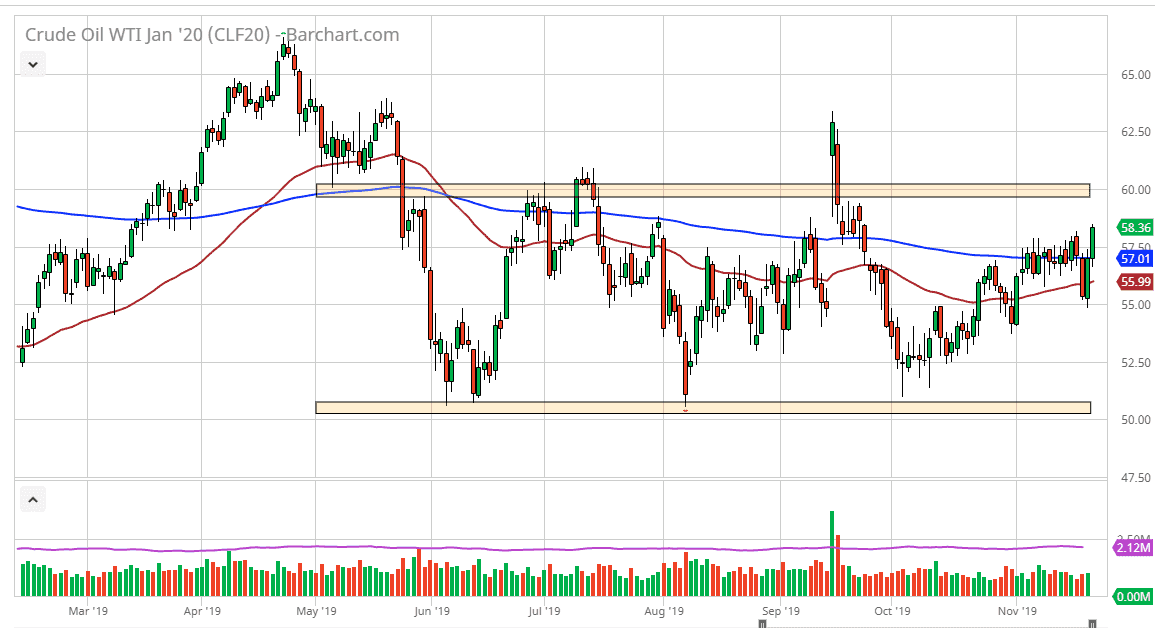

At this point, it should be noted that as the market is closing, we are at the very top of the range, so it does suggest that the market is probably going to continue to go higher. Reaching towards the top of the consolidation area seems to be likely, reaching towards that $60 level which has been so important. I think at this point there is a significant barrier that extends to the $62.50 level above, as it is a big barrier. That being said, I don’t expect to see this market break through the top anytime soon and I think that the bullish pressure probably has another day or two before the sellers come back and start pushing.

The alternate possibility is that we break down from here, reaching towards the 200 day EMA at the $57 level, and then eventually the 50 day EMA at the $56 level. I do think that it’s only a matter of time before crude oil find buyers on these dips as it is slowly creeping higher. If you squint, you can see that there is an up trending channel that the market has been in, so therefore I think there will be continued pressure to the upside as traders continue to try and pick up value every time it pulls back. If we were to break down below the $55 level could open the door to the $52.50 well but that doesn’t seem to be very likely right now. I think we are simply trying to go to the top of the consolidation range that the market has clearly carved out of the last several months. Ultimately, I think the real fight is closer to the $60 level and I will be watching very closely in that region to see if there is a selling opportunity.