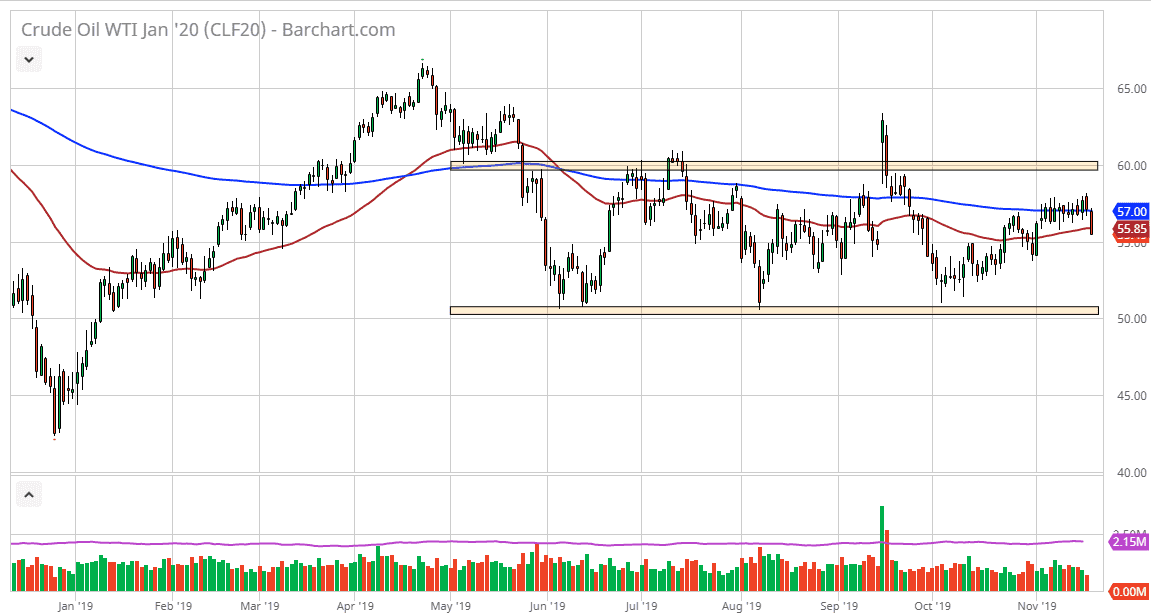

The WTI Crude Oil market fell rather hard during the trading session on Tuesday, reaching below the 50 day EMA as there was a general malaise about risk appetite during trading. That being said though, this is a market that continues to see a lot of back and forth, and therefore I would assume that we are going to see a bit of a “reversion to the mean” going forward. With that, it’s very likely that the market will reach back above the 50 day EMA, and perhaps towards the 200 day EMA which is currently trading at the significant $57 level. This market continues to be very erratic and choppy, so having said that I assume that we continue the same pattern.

Keep in mind that OPEC has a meeting in December that people were paying a lot of attention to, but it appears that some of the bigger players are willing to cut production. That was the latest headline to cause problems for this market. That being said, things could change rather rapidly and of course if we can get some type of positive news coming out of the trade war, the idea is that perhaps demand will pick up for crude oil, and that should send this market much higher. In fact, that probably would break out of the consolidation area, sending this market to much higher levels and well beyond the $60 level. Until that happens though, I suspect that the crude oil markets will simply bounce around in this general vicinity, looking unlikely to go anywhere from a longer move.

To the downside I see massive support at the $50 level, but I would be surprised if we got that far, at least not without some type of headline. In the short term, the $55 level offers a little bit of support, followed by the $52.50 level. At either one of those levels I suspect that a short-term bounce probably offers a buying opportunity for short-term traders. I’m not looking for anything big here, I just think that we are going to continue to play the overall range that we have been in for some time. Because of this, it’s likely that the market continues to be erratic, but we have gotten a little bit to bearish, so I think of bounce is more likely than not.