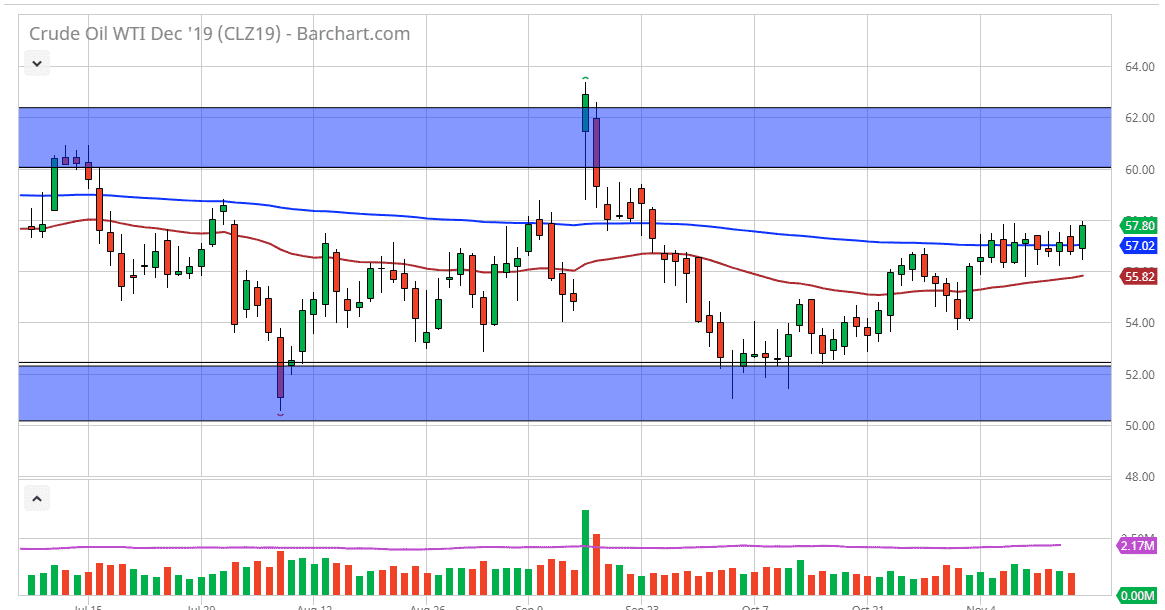

The West Texas Intermediate Crude Oil market initially dipped on Friday but found enough buyers underneath yet again to turn around and rally. By rallying the way, it has it looks as if we will clear the $58 level, possibly as early as Monday. Once we do, that opens up the door for a move to the $59 level, followed very closely by the $60 level.

You can see them the 200 day EMA is slicing right through the most recent candlesticks, and that buyers have come in every time we have trying to break down below that indicator. It shows that there are buyers underneath willing to support this market and it now appears that the 50 day EMA is trying to tilt a little bit higher. (It should be noted that both moving averages are relatively flat from the longer term though, so I do not anticipate an explosive move higher.)

Ultimately, this is a market that is consolidating in a larger range, with the $60 level kicking off the resistance above. I think that resistance extends about $2.50 higher, so even if we were to break above the $60 level, I feel that the rally would only have a certain amount of room to go before the sellers would come in and overwhelm it. Remember, even though the market looks as if it is trying to take off to the upside, the reality is that the global economy is slowing down a bit and demand continues to be an issue. Oversupply is also another issue, as the Americans continue to pump out quite a bit of crude oil.

To the downside I see the 50 day EMA, currently at the $55.82 level, as offering the first significant support level. Below there we would have to pay attention to the $55 level, and then the $52 level. If we do pullback, I suspect there will be plenty of buyers though, as has been the case most of the week. Short-term pullback should offer short-term buying opportunities, but I don’t expect to break out of the larger consolidation area that I have drawn on the chart. I think this is simply the market trying to reach the other side of the consolidation before turning around and drifting back lower. There was once talk about OPEC trying to cut production at the December meeting, but a couple of the larger players have suggested they aren’t interested. If that’s going to be the case, then oil remains range bound.