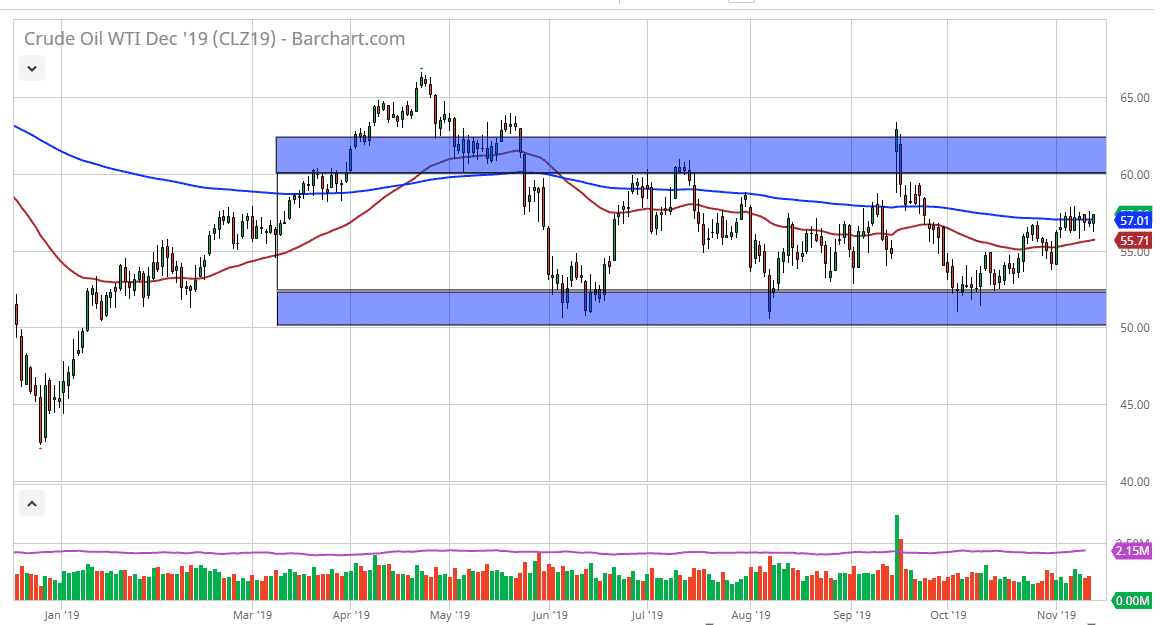

The West Texas Intermediate Crude Oil markets have continued to find buyers on short-term dips, as the market participants look for value. That being said though, the market is essentially stuck at what is considered to be fair value. Ultimately, this is a market that has nowhere to be, so therefore I wouldn’t put too much work or money into it. We dance around the 200 day EMA looking for some type of direction, but don’t have it at this point. The only thing that I can tell you is that short-term buying on the dips has been working. It looks as if the 50 day EMA is starting offer support again, and therefore I believe that will continue to be the move going forward.

As we are between the 200 day and 50 day EMA indicators, it has a lot of conflict build and. This is a market that is looking for some type of direction and I don’t think it’s going to have it. With that being the case it’s likely that we continue to see a lot of confusion and quite frankly difficult trading conditions. I would avoid this market until we get some type of impulsive candlestick, as it seems like traders have simply lost interest.

This is a bit of a microcosm for the trading world right now in general as volumes are dropping off drastically, as quite frankly there is no clarity anywhere it seems. The crude oil markets are a perfect example of this, as they measure the economy and where traders think the world is going. Take a look at the stock markets, they have done nothing over the last week, as they continue to bang up against resistance but are far too overextended to make a serious run at this point. Beyond that, gold has blown up but seems as if it’s trying to recover again, so this could suggest bearish pressure for oil, but there is nothing on this chart that compels me to risk any money at this point, as the trading conditions continue to deteriorate. If you value your trading account, you will stay clear of crude oil until it decides what it wants to do. Perhaps selling at the top of the rectangle closer to the $60 level or buying closer to the $50 level makes sense but playing around in “no man’s land” is a great way to lose money.