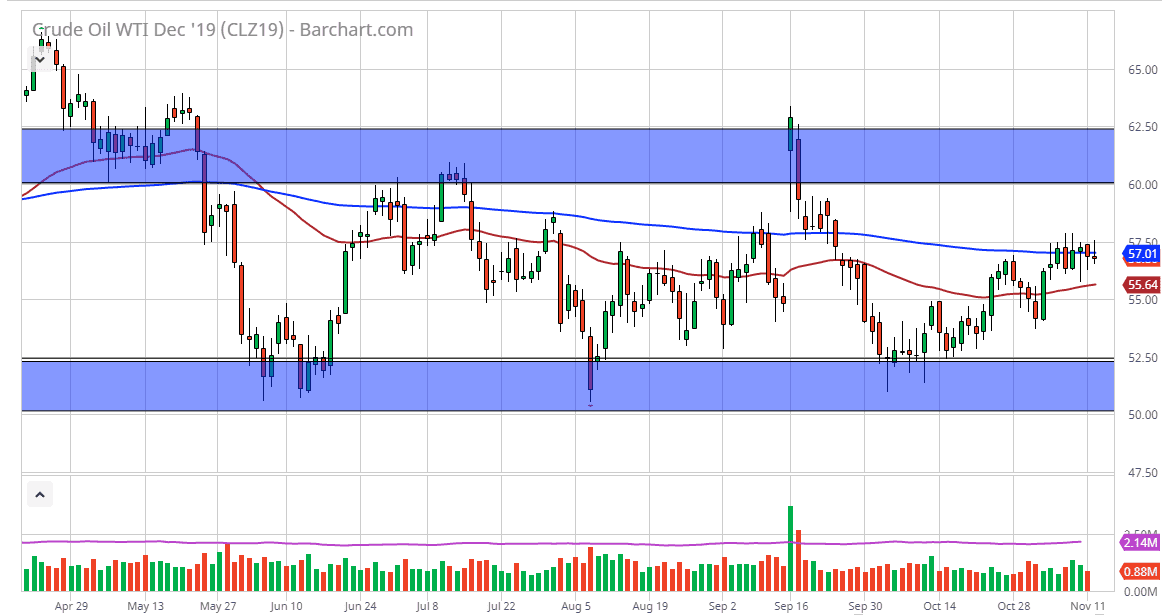

The West Texas Intermediate Crude Oil market continues to be very back and forth, as we are dancing around the 200 day EMA. This is a market that continues to see a lot of noise in general, as there are a lot of different things that could come into play and throw this market back and forth. At this point, the very difficult to imagine a scenario that overwhelms everything, so at this point it’s probably a short-term traders type of marketplace right now.

The $57.50 level offers a significant amount of resistance, but if we were to break above there, the market is likely to go towards the $60 level above, but we are going to need some type of catalyst. The inventory figures come out in the next 24 hours, and that of course will continue to cause a lot of volatility as one would expect. The 50 day EMA underneath should continue to offer a lot of support at the $55.60 level. It is starting to tilt higher, and at this point it’s likely that short-term pullback should continue to find plenty of buyers based upon support, so at this point it’s likely that the market will continue to be very choppy so I would look for short-term trade.

At this point, any type of knee-jerk reaction will probably be faded, and that is likely going to be the case going forward as there is no real catalyst one way or the other to move this market significantly. At this point, we already know that there is a lack of significant global demand, and at this point the oversupply is difficult to drive this market higher, but then again it seems as if the buyers continue to come back every time it drifts lower.

Looking at this chart, it’s obvious that there is significant resistance at the $60 level, and of course below as the $52.50 level. In general, I think we continue to bounce around overall and therefore I’m looking for some type of impulsive move to trade against on the short-term charts, and at this point it’s likely that we continue to work on short-term charts at best. As far as longer-term traders are concerned, this is a difficult market to be dealing with right now. Day trading is probably the best way to approach this market, and that’s exactly how I will.