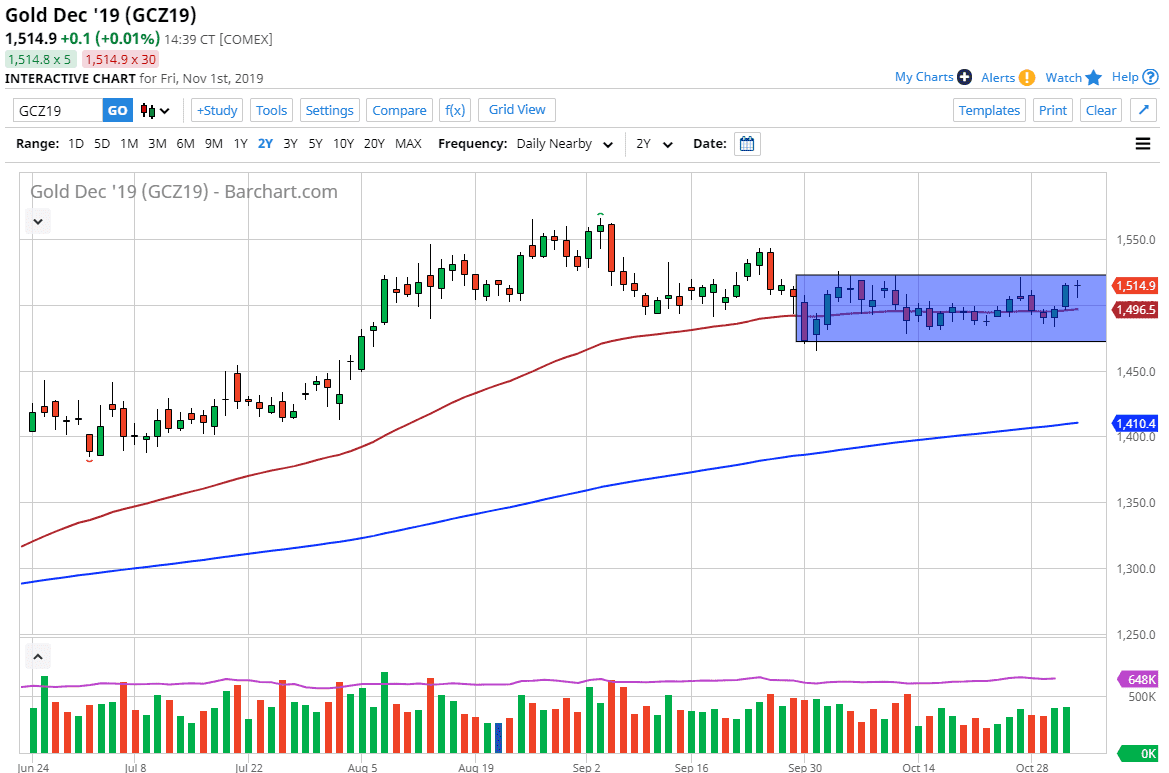

Gold markets initially fell during the trading session on Friday as the jobs never came out stronger than anticipated but given enough time, we have seen the markets come back and end up forming a hammer. The hammer of course is a very bullish sign in the fact that it is pressing resistance suggests that the market is likely to break out soon. The $1520 level should be significant resistance, and if we can break above that level it’s very likely that the market is ready to go much higher. The initial target will be the $1540 level, and then possibly the $1560 level.

Underneath, the 50 day EMA which is painted in red on the chart, offers support which is right in the middle of the blue box that I have marked as the most recent consolidation area. It certainly looks as if we are trying to break out to the outside, and I think dips at this point will continue to offer support. In fact, I believe that a lot of information was gleaned from the Friday session as although everything went “risk on” after the jobs number, we started to see the market by gold on that dip again. This tells me that there is a lot of demand for gold, and that it’s only a matter of time before we break through this little bit of resistance and continue to go much higher.

Based upon the consolidation rectangle it looks as if this move should be good for roughly $50, which would put us right back at the top again. If you stretch out the chart, you can make an argument for a bullish flag and that even potentially looks like we could be going towards the $1800 level. Don’t be wrong, it’s going to take a long time to get there but that is very possible. Given the fact that central banks around the world are cutting interest rates and being involved in quantitative easing, it makes sense that gold should continue to strengthen. There are plenty of geopolitical issues out there that will continue to drive this market higher as well, not to mention the fact that we have recently seen a move higher due to the recent huge spike higher and all of that momentum will have a lot of traders wishing to get into the marketplace as they will have missed the original move.