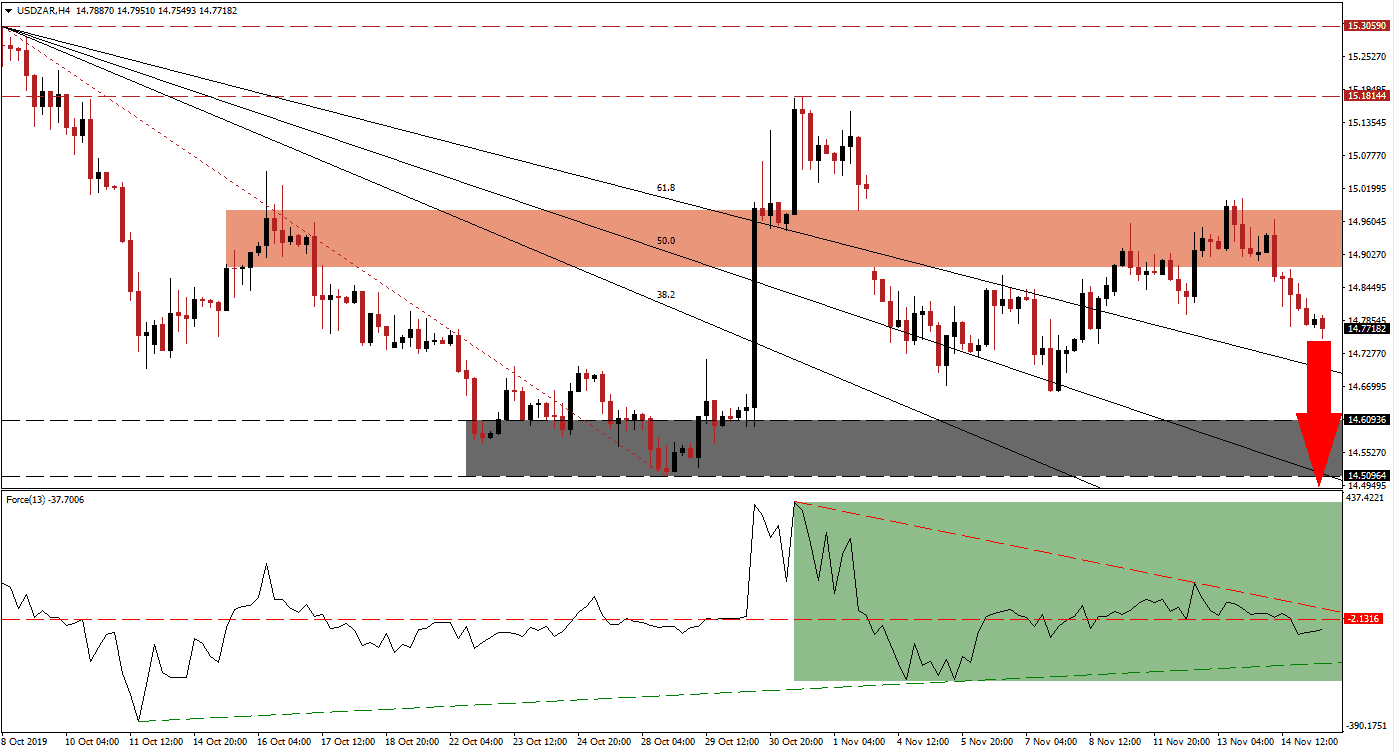

Following the strong rally in this currency pair at the end of October, price action quickly corrected and the sell-off featured a price gap to the downside. South Africa will implement new rules in January that are expected to ease capital outflows of hedge funds and revive the $150 billion alternative asset sector in Africa’s most developed economy. From a long-term perspective, this is great news for an emerging economy which is going through a transition period. The USD/ZAR is now expected to fully reverse its price spike and extend its sell-off, guided lower by its Fibonacci Retracement Fan sequence.

The Force Index, a next-generation technical indicator, advanced with the USD/ZAR as it completed a breakout sequence that converted the Fibonacci Retracement Fan into a descending support level. After price action reached the bottom range of its long-term resistance zone, the Force Index reversed direction and moved below its horizontal support level, turning it into resistance, until it reached its ascending support level. This technical indicator now remains below its horizontal resistance level, while its descending resistance level is adding downside pressures on this currency pair as marked by the green rectangle. A breakdown in the Force Index below its ascending support level is expected to lead price action to the downside. You can learn more about the Force Index here.

Bearish pressures are on the rise after price action descended below its short-term resistance zone, located between 14.88004 and 14.98114 as marked by the red rectangle. This resistance zone covers the price gap which occurred as the USD/ZAR accelerated its sell-off and converted its short-term support zone into resistance. Price action was reversed after reaching its 50.0 Fibonacci Retracement Fan Support Level, but a lower high formed which marked a bearish development. Forex traders should now monitor the descending resistance level in the Force Index as a crossover below its horizontal resistance level is expected to result in more selling pressure.

US economic concerns have additionally boosted the sell-off which is now expected to extend into its support zone, located between 14.50964 and 14.60936 as marked by the grey rectangle. The 38.2 and the 50.0 Fibonacci Retracement Fan Support Levels have already moved below this zone while the 61.8 Fibonacci Retracement Fan Support Level is currently closing in on the top range of this zone. A breakdown below the support zone could emerge given the long-term fundamental scenario, the next support zone awaits the USD/ZAR between 13.81090 and 13.95230. You can learn more about a breakdown here.

USD/ZAR Technical Trading Set-Up - Breakdown Extension Scenario

⦁ Short Entry @ 14.77000

⦁ Take Profit @ 14.50000

⦁ Stop Loss @ 14.82250

⦁ Downside Potential: 2,700 pips

⦁ Upside Risk: 525 pips

⦁ Risk/Reward Ratio: 5.14

A double breakout in the Force Index, above its horizontal resistance level followed by its descending resistance level, may elevate the USD/ZAR above its short-term resistance zone. Upside potential for the unlikely breakout is expected to be limited to the bottom range of its long-term resistance zone at 15.18144; this would mark a solid short-selling opportunity as the long-term outlook favors the sell-off in this currency pair to extend further.

USD/ZAR Technical Trading Set-Up - Limited Breakout Scenario

⦁ Long Entry @ 15.02500

⦁ Take Profit @ 15.18000

⦁ Stop Loss @ 14.96250

⦁ Upside Potential: 1,550 pips

⦁ Downside Risk: 625 pips

⦁ Risk/Reward Ratio: 2.48