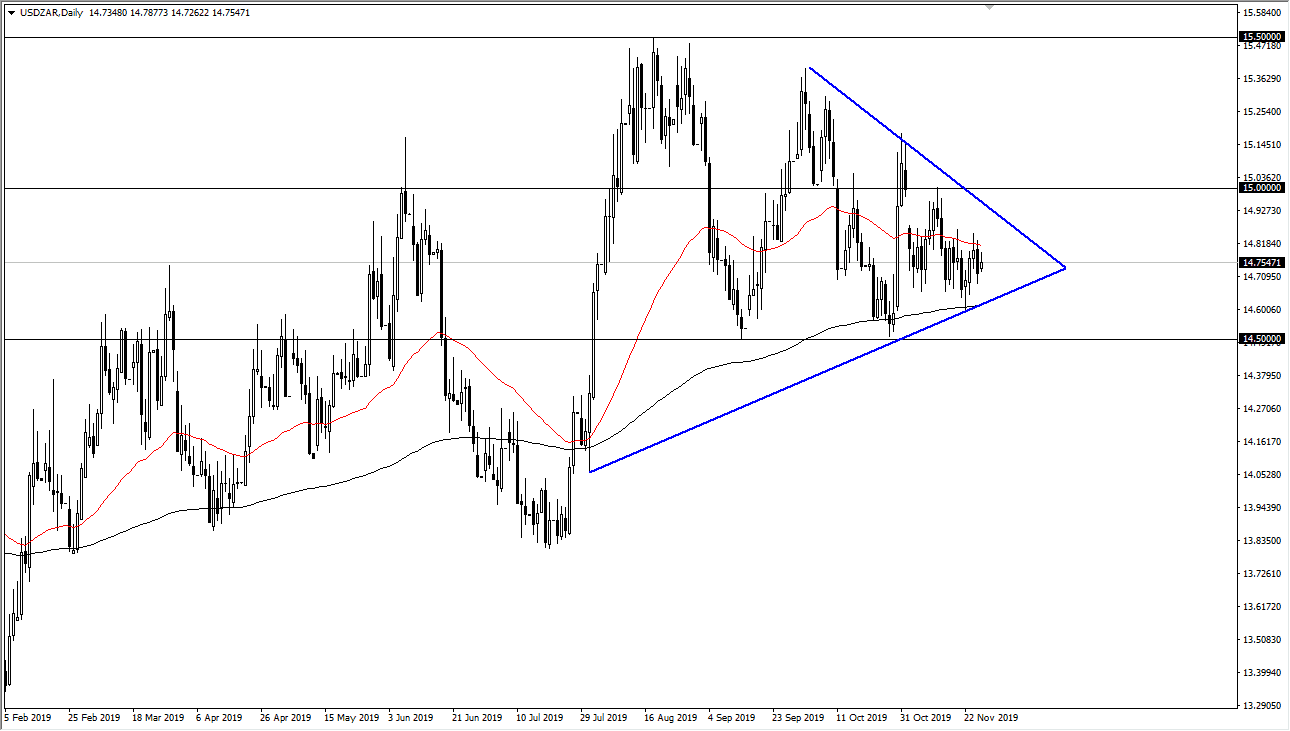

The US dollar has gone back and forth during the trading session on Thursday, in what would have been relatively thin trading due to the Thanksgiving Day holiday. With that in mind, we should look at the longer-term picture when it comes to the South African Rand, which has been forming a bit of a wedge as of late. Recently, we had seen the market gap lower, go back to test that gap, and has since dropped a bit from there. The market is currently trading between the 50 and the 200 day EMA, and therefore it’s likely that we continue to see a lot of back and forth.

That being said, it looks as if this is going to be purely a “risk on/risk off” type of play. Recently, there had been major concerns about ratings agencies downgrading the debt of South Africa, but let’s be honest here: rating agencies more often than not are late to the party and quite often wrong. With that being the case, you can see that the market has given South Africa the benefit of the doubt since then, and in fact South African politicians are starting to address the issue themselves. In other words, there may be a better hope yet.

Keep in mind that this pair is highly levered to risk appetite around the world, as South Africa is without a doubt a major commodity producer. If that’s going to be the case, then it makes a lot of sense that this market will go back and forth due to whatever the risk appetite and flavor of the day is. This explains why we are seeing a lot of back and forth, because headlines coming go that throw markets all around. At this point though, we have a couple of clear trendlines that we can pay attention to.

What I like about the idea of a break lower is that we had a gap that was filled and then fell from there. Beyond that, we have the uptrend line that is currently supported by the 200 day EMA. Both of those give way to selling pressure, it’s likely that it will lead to a bigger breakdown. The 14.50 Rand level would be the initial target, followed by the 14 Rand level. To the upside, if we get more of a “risk off” move, then we need to perhaps watch out for the 15 Rand level.