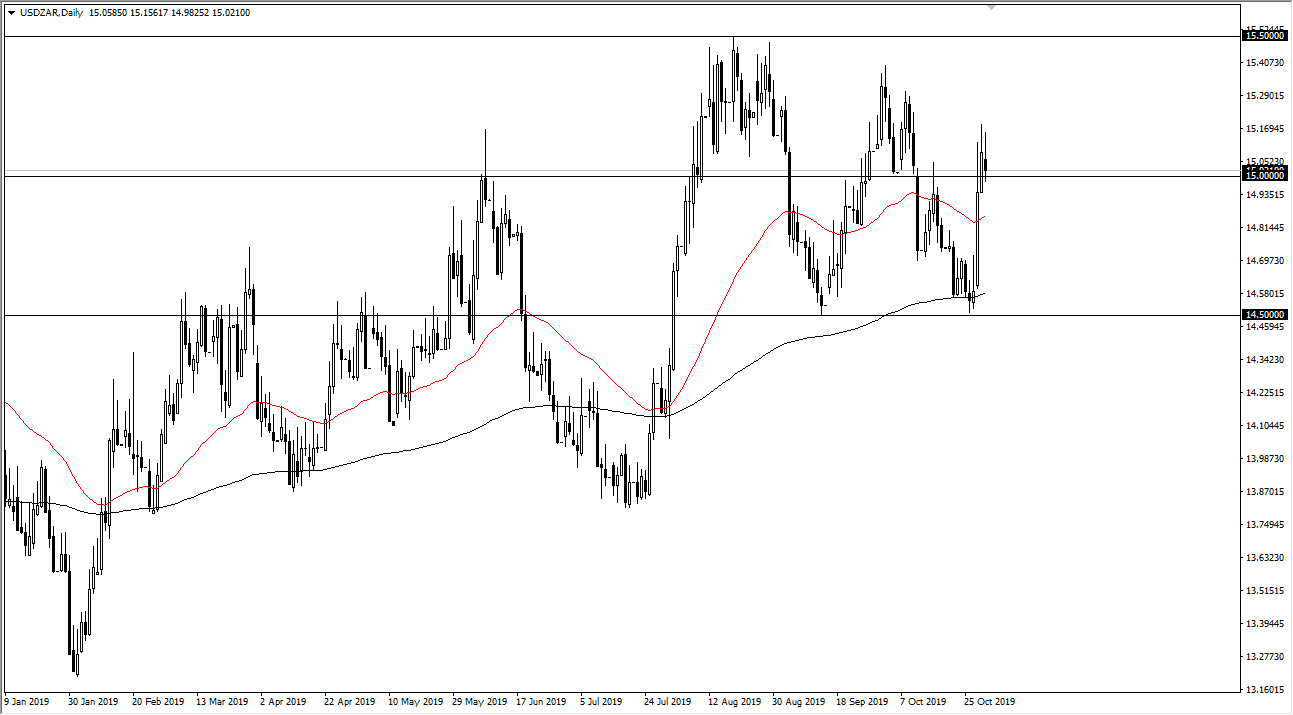

The US dollar has traded back and forth during the session on Friday as we got the Non-Farm Payroll figure. The figure came out better than anticipated, and that relieves some of the upward pressure in the US dollar as people are starting to look for risk around the world. The South African Rand offers a glimpse at emerging market currencies, and what I find interesting about this chart is that the highs are starting to get lower, and that suggest that perhaps a little bit of the bullish pressure in the US dollar may be starting to subside.

Looking at the long term, you can see that the 200 day EMA has offered enough support at the 14.50 Rand area to turn things around over the last several days, so it’ll be interesting to see whether or not it can hold as support if we fall towards the area again. The candlestick from the Friday session has shown signs of exhaustion, so it’s possible we may get a pull back to that area. To the upside, there are several long wicks that show signs of exhaustion above, and it now looks as if the 15 Rand level is going to offer a bit of noise. If we can break above there, that would be a very bullish sign and could go looking towards the 15.40 Rand level.

Looking at the most recent highs, they are lower than the previous one, so it does suggest that perhaps things are starting to turn around in this pair. That being said, the 15.50 Rand level above is massive resistance, and it should continue to be important as the where we go next. If we were to somehow reach above that level it would kick off an entire new leg higher. That being said, this is a great pair to watch as far as risk on or risk off attitude is concerned. Recently, we have had the Federal Reserve cut interest rates and suggest that they were going to be on the sidelines, and although that’s not easy and monetary policy it shows that they are at least willing to put things on pause and kind of sit on the sidelines to digest the economic conditions. That will have a major influence on the US dollar and should have quite a bit here as well as this pair won’t be as liquid as some of the major markets. It looks as if a move below the 15 Rand level will probably open up the possibility of a move down to the 14.60 Rand level, possibly 14.50 ran.