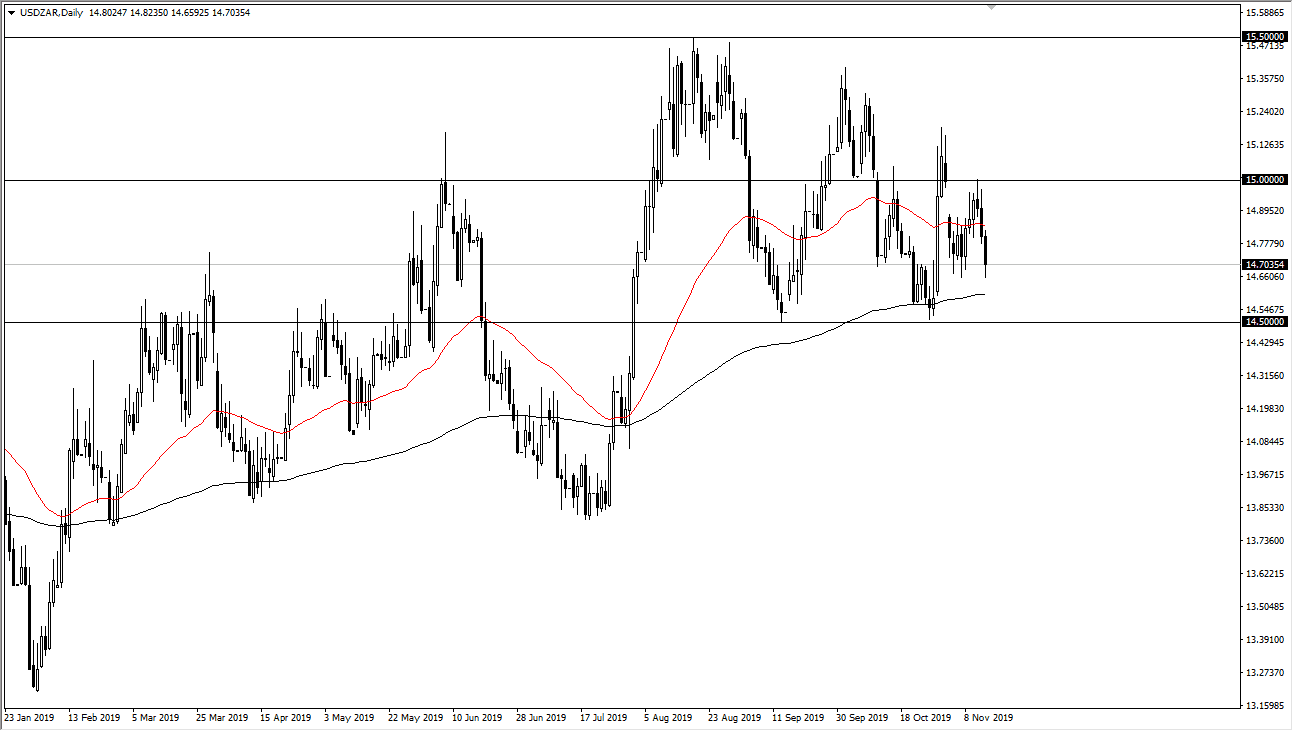

The US dollar fell again during the day on Friday, as we continue to grind lower against the South African Rand. When you look at the market structure, it’s easy to see that the most recent highs continue to get lower, and recently we have revisited the gap from where I had originally started shorting this pair about two weeks ago and have rolled over from there again. At this point, the market looks very likely to continue struggling in general, as we are broken back below the 50 day EMA.

However, the 200 day EMA is just below and that of course will attract a certain amount of attention. Quite frankly this is going to come down to risk appetite, and at this point it looks like the 14.50 Rand level could be significant support. A breakdown below that level opens up the door to much lower pricing, based upon the descending triangle that we are still forming. It’s very likely that the 13.50 Rand level will be targeted if we do break down below there based upon the measurement.

Looking at the chart, it seems as if we are simply running out of momentum, because quite frankly there’s not that many people left to sell the South African Rand. Ultimately, this is a market that breaking down below the 14.50 Rand level will of course kick off some short term bearishness as it would be the breaking of an obvious support level. That being said, keep in mind that the US dollar course is a “safety currency”, so if we get a sudden shock to the system, it’s possible that the US dollar with suddenly spike against South African Rand. Such is the nature of trading exotic currency pairs.

That being said, keep in your position size reasonable and being able to play the big picture gives you the ability to take these trades although patience may be needed as some time to take several weeks to get to where you expected to end up. At this point, until we break above the 15 Rand level, I don’t suspect that the buyers will have any real hope of taking control again although it had originally been a very bullish move. It appears that move is starting to run out of steam, and losing momentum of course is the killer of trends.