Despite concerns about the state of the South African economy, the South African Rand caught a bid against the US Dollar. Unease over the upcoming holiday shopping season with a fourth monthly contraction in US consumer confidence, ongoing US impeachment proceedings, and unresolved issues surrounding the phase one trade truce between the US and China are representing major headwinds for the US Dollar. The USD/ZAR started a price action reversal after approaching its short-term resistance zone. You can learn more about a resistance zone here.

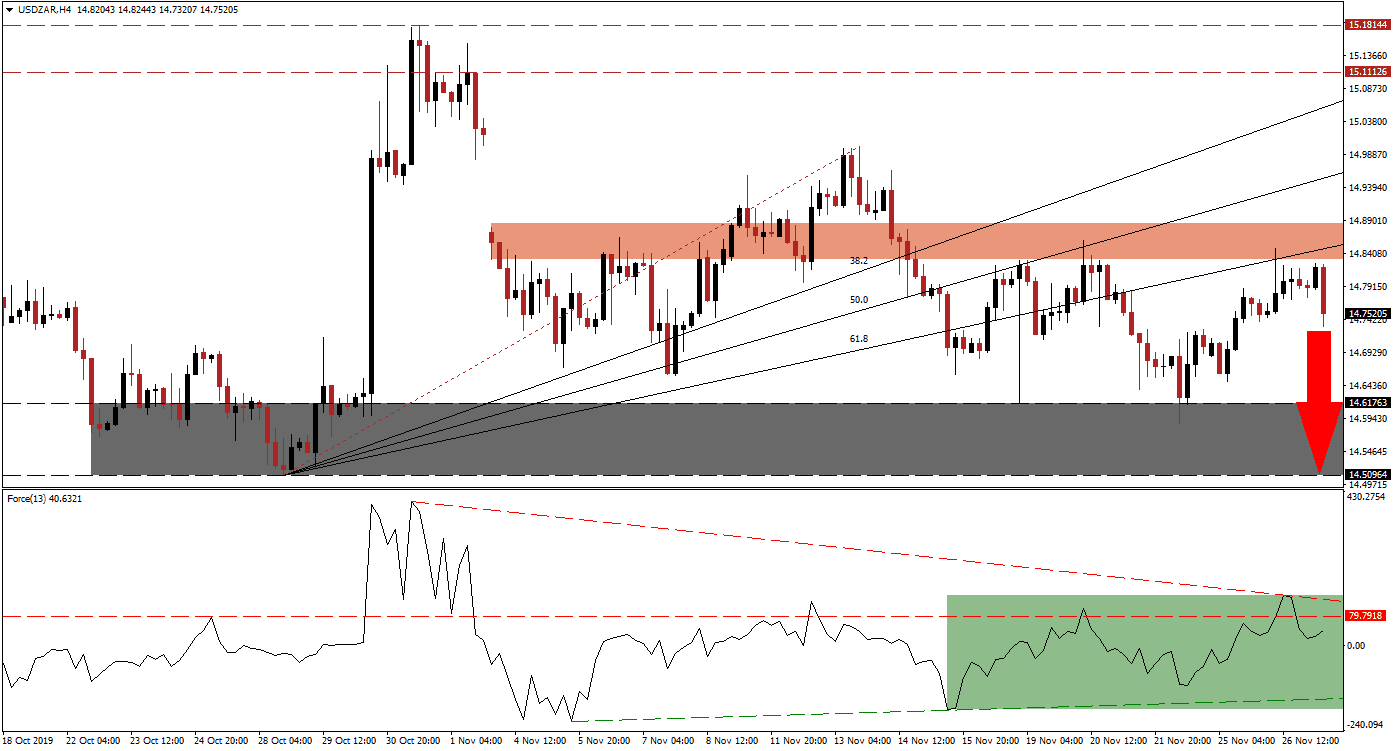

The Force Index, a next-generation technical indicator, completed a breakdown below its horizontal support level and turned it into resistance as the USD/ZAR was rejected by its ascending 61.8 Fibonacci Retracement Fan Resistance Level. While the Force Index remains in positive conditions with bulls in charge, the descending resistance level is closing in on the horizontal resistance level as marked by the green rectangle. A crossover is likely to push this technical indicator into negative territory, narrow the gap to its ascending support level, and accelerate the price action reversal to the downside.

As a result of the failed breakout attempt in this currency pair above its resistance zone, located between 14.83160 and 14.88542 as marked by the red rectangle, the Fibonacci Retracement Fan Sequence is moving further away from price action. This has created more downside potential for the USD/ZAR and forex traders are advised to monitor the Force Index; a move below the 0 centerline is anticipated to result in the addition of fresh sell orders. Volatility is expected to increase with today’s US economic data, but the bearish bias is likely to prevail.

Price action may receive an additional boost to the downside if the USD/ZAR completes a breakdown below its intra-day low of 14.71997. This level marks the low of a previous breakdown below its 61.8 Fibonacci Retracement Fan Resistance Level, after price action reversed from the top range of its support zone, in a volatile move originating from the bottom range of its short-term resistance zone. The price action reversal will face its next support zone between 14.50964 and 14.61763 as marked by the grey rectangle; depending on fundamental developments an additional breakdown cannot be ruled out. You can learn more about a breakdown here.

USD/ZAR Technical Trading Set-Up - Breakdown Extension Scenario

⦁ Short Entry @ 14.75000

⦁ Take Profit @ 14.51000

⦁ Stop Loss @ 14.82000

⦁ Downside Potential: 2,400 pips

⦁ Upside Risk: 700 pips

⦁ Risk/Reward Ratio: 3.43

In the event of a sustained double breakout in the Force Index above its horizontal resistance level and its descending resistance level, the USD/ZAR could attempt a third breakout above its resistance zone in six trading sessions. The long-term fundamental outlook remains bearish and technical developments point towards more downside. Any breakout is likely to be limited to its intra-day high of 15.00113, the endpoint of its re-drawn Fibonacci Retracement sequence; this would close a previous price gap to the downside.

USD/ZAR Technical Trading Set-Up - Breakout Scenario

⦁ Long Entry @ 14.90250

⦁ Take Profit @ 15.00000

⦁ Stop Loss @ 14.86000

⦁ Upside Potential: 975 pips

⦁ Downside Risk: 425 pips

⦁ Risk/Reward Ratio: 2.29