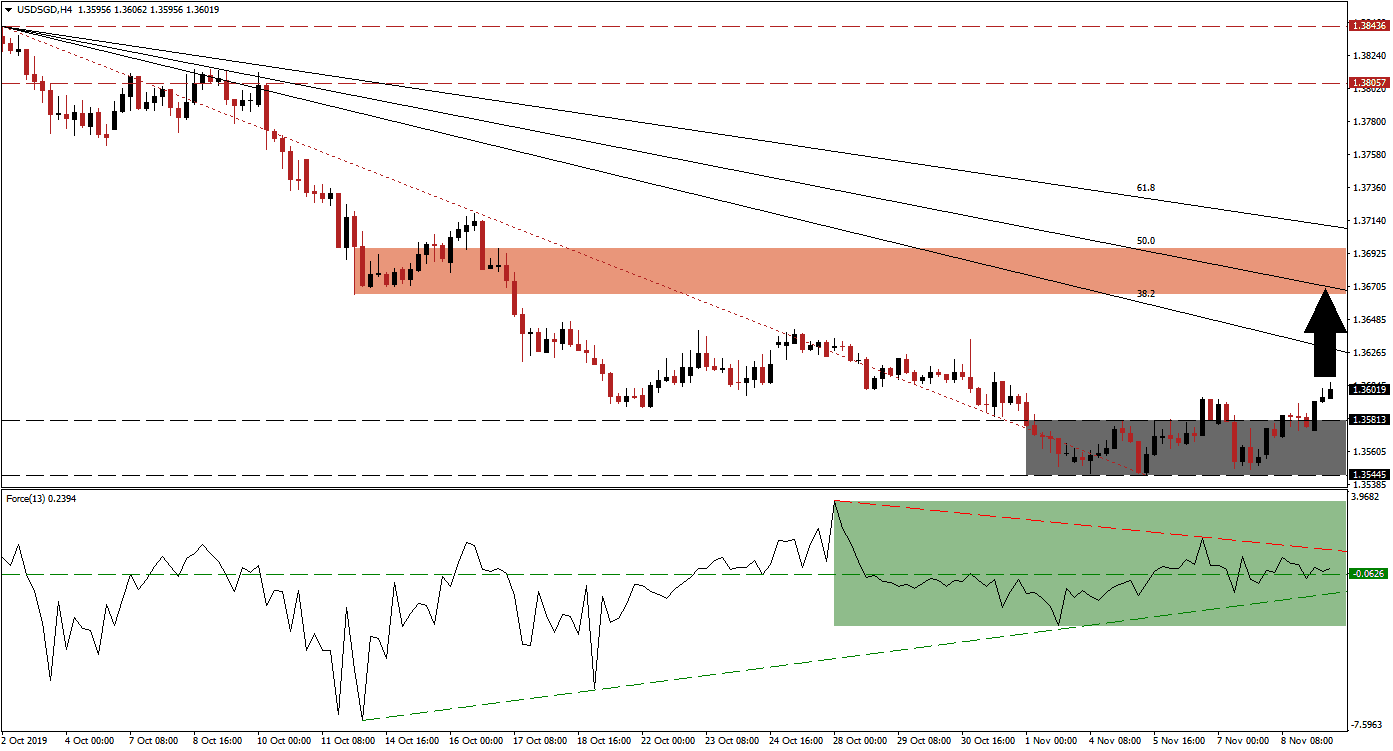

An extended sell-off in the USD/SGD was bound to enter a brief reversal on the back of a short-covering rally. After price action moved above the Fibonacci Retracement Fan trendline, a count-trend advance was shaping up; this will also allow excessive bearishness to recede and an advance into its 50.0 Fibonacci Retracement Fan Resistance Level will ensure the longevity and health of the long-term downtrend. The fundamental scenario which resulted in the bearish trend remains in place and is expected to remain intact, you can learn more about the Fibonacci Retracement Fan here.

The Force Index, a next-generation technical indicator, indicated the likelihood of a reversal after this currency pair completed a breakdown below its short-term support zone which turned it into resistance. A positive divergence formed and bullish momentum started to build-up. The breakout in the USD/SGD above its long-term support zone was confirmed by this technical indicator with a breakout above its horizontal resistance level, which turned it into support. Bullish momentum is kept in check by its descending resistance level as marked by the green rectangle which is expected to limit upside potential in this currency pair.

A minor sideways trend inside the support zone, located between 1.35445 and 1.35813 as marked by the grey rectangle, resulted in a breakout; a failed breakout preceded this move. This currency pair has now eclipsed the intra-day high from its reversed breakout at 1.35963 which is expected to carry it above its descending 38.2 Fibonacci Retracement Fan Resistance Level. Forex traders should now pay attention to the intra-day high of 1.36420 which marks the peak of a previous drift higher before the USD/SGD accelerated into its support zone, a push higher is expected to lift price action into its short-term resistance zone. You can learn more about a resistance zone here.

Capital inflows to Singapore as a result of the ongoing Hong Kong unrest continue to support the economy while the US prints mixed economic reports with a bearish bias. The breakout in the USD/SGD is expected to run out of bullish momentum once it reaches its short-term resistance zone which is located between 1.36651 and 1.36955 as marked by the red rectangle; the 50.0 Fibonacci Retracement Fan Resistance Level is on the verge of a move below this zone with the 61.8 Fibonacci Retracement Fan Resistance Level approaching the top range of it. This will keep the long-term downtrend intact and a breakdown sequence is likely to lead to more downside.

USD/SGD Technical Trading Set-Up - Breakout Extension Scenario

⦁ Long Entry @ 1.36000

⦁ Take Profit @ 1.36700

⦁ Stop Loss @ 1.35800

⦁ Upside Potential: 70 pips

⦁ Downside Risk: 20 pips

⦁ Risk/Reward Ratio: 3.50

A breakdown in the Force Index below its horizontal support level and its ascending support level is likely to lead to a breakdown in the USD/SGD below its support zone. While the short-term technical scenario favors an extension of the breakout, the long-term fundamental picture suggests more downside for this currency pair. The next support zone is located between 1.34463 and 1.34661.

USD/SGD Technical Trading Set-Up - Breakdown Scenario

⦁ Short Entry @ 1.35350

⦁ Take Profit @ 1.34650

⦁ Stop Loss @ 1.35600

⦁ Downside Potential: 70 pips

⦁ Upside Risk: 25 pips

⦁ Risk/Reward Ratio: 2.80