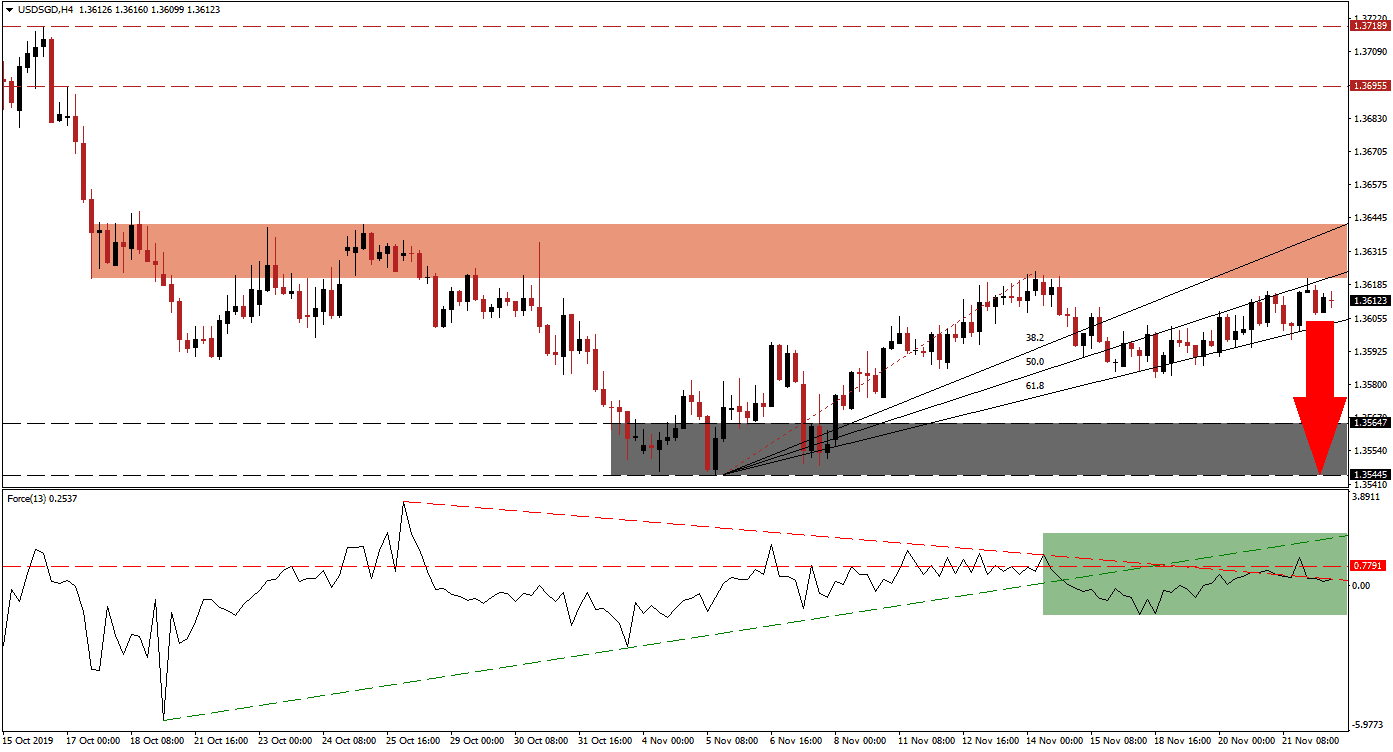

Singapore continues to benefit from capital outflows out of Hong Kong as a result of intensifying unrest, but the positive effects are likely to diminish moving forward as the bulk of capital reallocation may be complete by the end of this year. Singapore is ideally positioned to navigate through the global economic slowdown and in combination with a US economy expected to underperform the global economy in 2020, the USD/SGD is expected to correct to the downside. Price action has now again approached the short-term resistance zone which rejected an advance on the previous five attempts, a sixth rejection is likely to follow.

The Force Index, a next-generation technical indicator, points towards the loss in bullish momentum as price action has drifted higher. Following the corrective phase which took the USD/SGD into its support zone, the Force Index failed to recover and remains confined to a narrow range. This resulted in a breakdown below its ascending support level which now acts as temporary resistance. Anther bearish development materialized when the descending resistance level crossed below the horizontal resistance level as marked by the green rectangle. This technical indicator is now anticipated to hand control over to bears with a descending into negative conditions. You can learn more about the Force Index here.

Price action halted its move to the downside after reaching its ascending 61.8 Fibonacci Retracement Fan Support Level. The rejection which led to the descend was initiated after the USD/SGD failed at its fifth breakout attempt above its short-term resistance zone located between 1.36208 and 1.36420 as marked by the red rectangle. This currency pair drifted back into this zone inside a widening cone created by the 61.8 Fibonacci Retracement Fan Support Level and the 50.0 Fibonacci Retracement Fan Resistance Level; the latter has now entered the short-term resistance zone. You can learn more about the Fibonacci Retracement Fan here.

As US economic data remains mixed with a bearish bias, the US Dollar is anticipated to reflect fundamentals moving forward. The risk of more issues regarding US-China trade negotiations remains elevated and the US Fed has started to pump capital into its domestic inter-bank market which has not been priced into currency markets yet. Bearish pressures are on the rise, both from a fundamental as well as technical perspective, and the USD/SGD is expected to enter a breakdown sequence into its support zone which awaits this currency pair between 1.35445 and 1.35647 as marked by the grey rectangle. A move below the intra-day low of 1.35973 may additionally inspire a profit-taking sell-off.

USD/SGD Technical Trading Set-Up - Breakdown Scenario

⦁ Short Entry @ 1.36150

⦁ Take Profit @ 1.35450

⦁ Stop Loss @ 1.36350

⦁ Downside Potential: 70 pips

⦁ Upside Risk: 20 pips

⦁ Risk/Reward Ratio: 3.50

A breakout in the Force Index above its descending resistance level could be followed by a seventh breakout attempt in the USD/SGD. Due to the long-term fundamental outlook, the upside potential for a breakout remains limited to the next long-term resistance zone which is located between 1.36955 and 1.37189. Any advance into this zone represents should be viewed as a great opportunity to enter fresh sell orders.

USD/SGD Technical Trading Set-Up - Limited Breakout Scenario

⦁ Long Entry @ 1.36500

⦁ Take Profit @ 1.37000

⦁ Stop Loss @ 1.36300

⦁ Upside Potential: 50 pips

⦁ Downside Risk: 20 pips

⦁ Risk/Reward Ratio: 2.50