Volatility in the USD/MXN has increased, but a bullish trend started to form. As a result of wild price action swings, this currency pair carved out a series of higher highs and higher lows. Due to the rise in difficulties for the Mexican economy to expand under left-wing President López Obrador, the long-term uptrend could extend farther to the upside but the short-term technical picture favors more downside after this currency pair completed a breakdown below its resistance zone. You can learn more about a breakdown here.

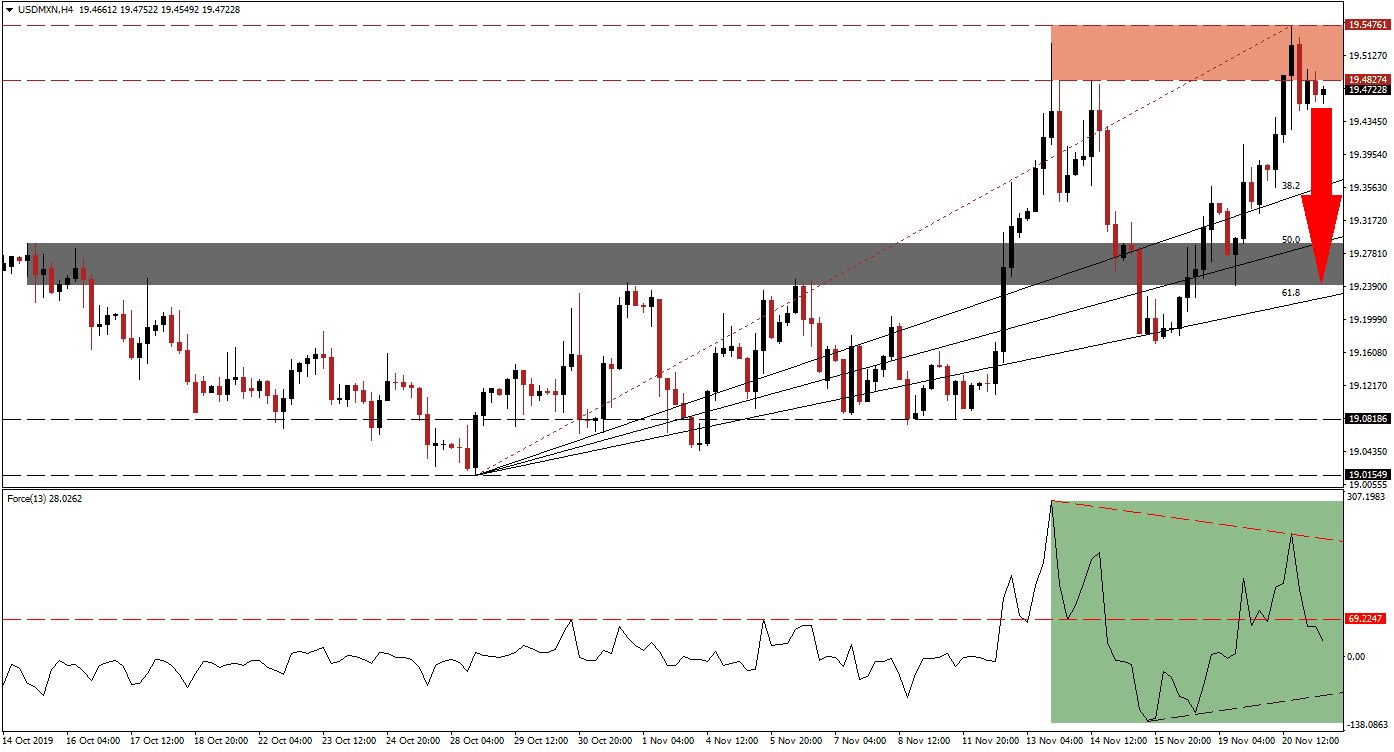

The Force Index, a next-generation technical indicator, indicates the presence of a negative divergence which suggests a price action reversal is imminent. The USD/MXN managed to advance to a higher high, but the Force Index was unable to confirm this move and reversed direction, a descending resistance level formed as a result. This technical indicator plunged below its horizontal support level and turned it into resistance as marked by the green rectangle. The Force Index is now positioned to slide into negative territory, and place bears in charge of price action until it can reach its ascending support level.

Price action already completed a breakdown below its resistance zone which is located between 19.48724 and 19.54761 as marked by the red rectangle. The rise in bearish momentum is now expected to lead to a profit-taking sell-off and forex traders are advised to monitor the intra-day high of 19.42682 which marks the peak of the breakdown in this currency pair below its Fibonacci Retracement Fan trendline; a move below this level is likely to result in the addition of new net short positions in the USD/MXN and accelerate the sell-off. You can learn more about the Fibonacci Retracement Fan here.

Given the return of doubt about the US-China phase one trade truce, which may be delayed until 2020, the US Dollar could come under pressure as the US economy is expected to underperform the global economy next year. Impeachment proceeding in the US area also adding uncertainty ahead of next year’s presidential election. The USD/MXN should extend its breakdown until it will reach its short-term support zone which awaits between 19.24057 and 19.28953 as marked by the grey rectangle. A move into this zone will keep the uptrend intact, while a breakdown into its long-term support zone located between 19.01549 and 19.08186 will clear the path for more downside.

USD/MXN Technical Trading Set-Up - Breakdown Extension Scenario

⦁ Short Entry @ 19.47200

⦁ Take Profit @ 19.24500

⦁ Stop Loss @ 19.53000

⦁ Downside Potential: 2,270 pips

⦁ Upside Risk: 580 pips

⦁ Risk/Reward Ratio: 3.91

A reversal in the Force Index above its horizontal resistance level and a breakout above its descending resistance level may inspire the USD/MXN into a breakout attempt. While the possibility for more upside remains, given the technical scenario an extension of the breakdown presents the dominant cause. The next resistance zone is located between 19.75577 and 19.85847 from where a fresh fundamental catalyst will be necessary to extend a breakout.

USD/MXN Technical Trading Set-Up - Breakout Scenario

⦁ Long Entry @ 19.59250

⦁ Take Profit @ 19.79000

⦁ Stop Loss @ 19.50500

⦁ Upside Potential: 1,975 pips

⦁ Downside Risk: 875 pips

⦁ Risk/Reward Ratio: 2.26