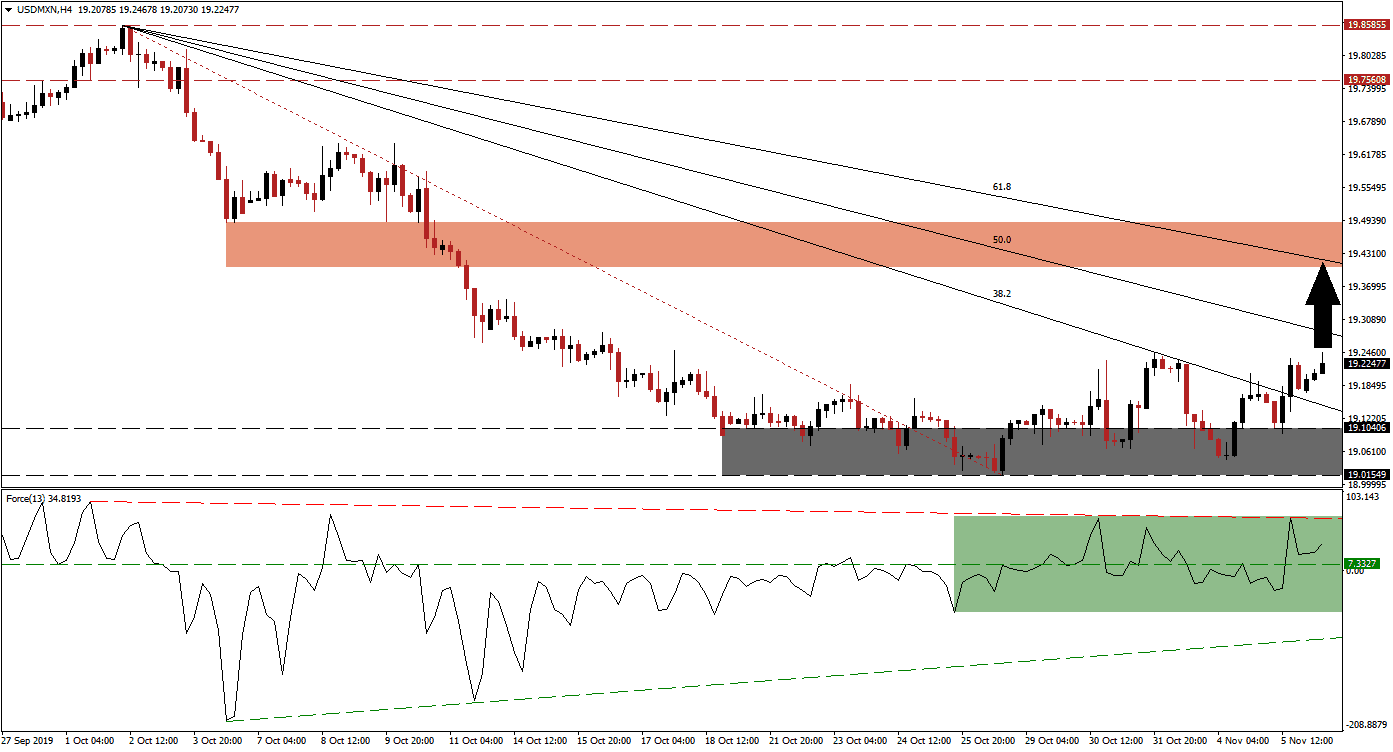

Despite economic challenges out of the US, the USD/MXN is under the influence of an increase in bullish momentum which initiated a breakout sequence. This followed a strong sell-off and a short-covering rally can partially be credited for the advance in this currency pair. As the Fibonacci Retracement Fan approached the top range of its support zone, pressures for either a breakdown or a breakout increased; the second breakout above its support zone sufficed to elevate price action above its descending 38.2 Fibonacci Retracement Fan Resistance Level, turning it into support.

The Force Index, a next generation technical indicator, shows the rise in bullish momentum and confirmed the double breakout in price action with a push above its horizontal resistance level which turned it into support; this is marked by the green rectangle. A shallow descending resistance level has emerged in the Force Index, but a breakout above it may follow and extend the sequence in the USD/MXN. As long as this technical indicator will remain above its converted horizontal support level, the uptrend remains intact. You can learn more about the Force Index here.

Bullish momentum started to build-up in the USD/MXN inside its support zone which is located between 19.01549 and 19.10406 as marked by the grey rectangle. The first breakout above it was reversed by its 38.2 Fibonacci Retracement Fan Resistance Level, but it resulted in a higher low which represents a bullish development. This currency pair followed through with a sustained double breakout and forex traders are now advised to monitor the intra-day high of 19.28953 which marks a minor resistance level from a previous pause in the corrective phase. A move above it will also place price action above its 50.0 Fibonacci Retracement Fan Resistance Level and turn it into support.

A successful breakout above its 50.0 Fibonacci Retracement Fan Resistance Level will clear the path for this currency pair to advance into its next short-term resistance zone; this zone is located between 19.40484 and 19.49039 as marked by the red rectangle. The 61.8 Fibonacci Retracement Fan Resistance Level is approaching the bottom range of this zone and could end the short-term counter-trend move unless a change in the fundamental scenario provides a new catalyst for a breakout. The next long-term resistance zone awaits the USD/MXN between 19.75608 and 19.85855; you can learn more about a resistance zone here.

USD/MXN Technical Trading Set-Up - Breakout Extension Scenario

⦁ Long Entry @ 19.22700

⦁ Take Profit @ 19.40500

⦁ Stop Loss @ 19.17100

⦁ Upside Potential: 1,780 pips

⦁ Downside Risk: 560 pips

⦁ Risk/Reward Ratio: 3.18

In the event of a breakdown in the Force Index below its horizontal support level, the USD/MXN is likely to follow suit and push back into support zone; if the Force Index completes a breakdown below its ascending support level, more downside in this currency pair is possible. The next support zone is located between 18.74506 and 18.80460 from where farther downside would require a fresh fundamental catalyst.

USD/MXN Technical Trading Set-Up - Breakdown Scenario

⦁ Short Entry @ 18.98000

⦁ Take Profit @ 18.80500

⦁ Stop Loss @ 19.06000

⦁ Downside Potential: 1,750 pips

⦁ Upside Risk: 800 pips

⦁ Risk/Reward Ratio: 2.19