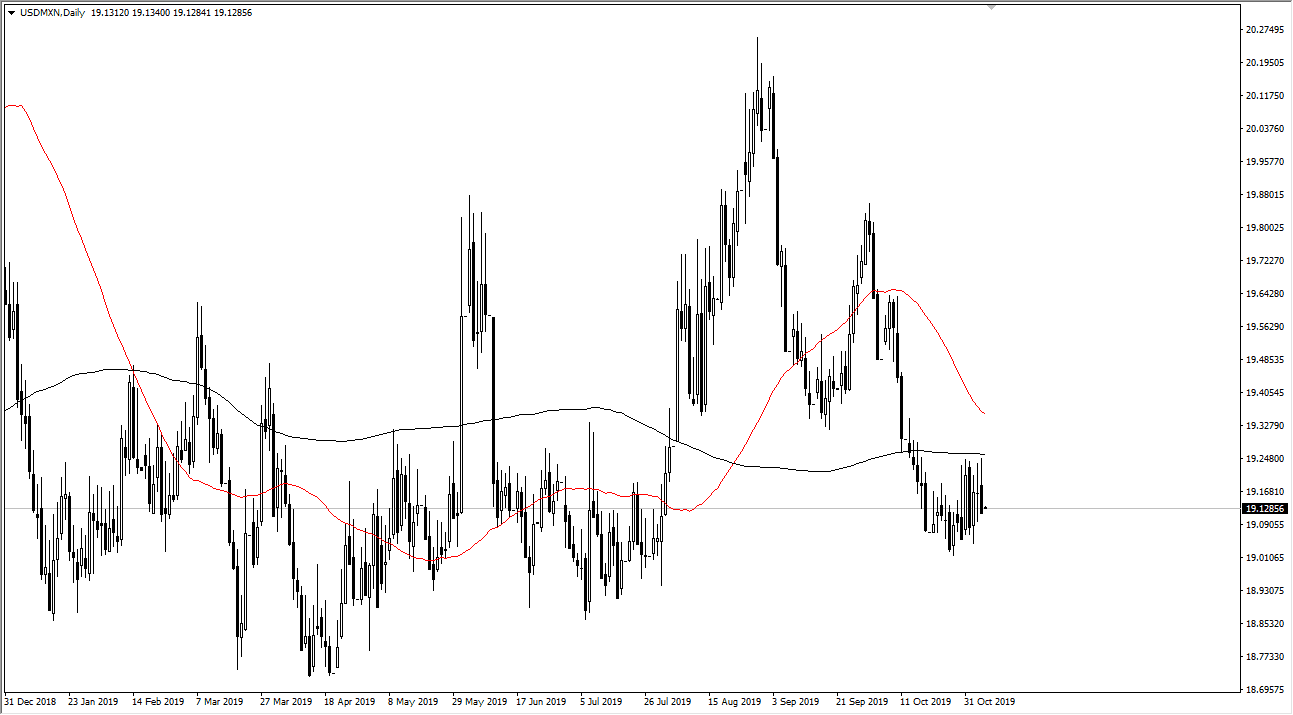

The US dollar has fallen again during the trading session on Wednesday, reaching down below the 200 day EMA yet again. At this point, the market is very likely that the 19 paces level will continue to offer support as it has in the past. That being said, the 50 day EMA is starting to head towards the 200 day EMA, threatening a “death cross” in the charts. That being said, most of the time this longer-term signal tends to be a bit late to the party. That certainly would be the case now.

It comes down to whether or not the “risk on/risk off” attitude is more positive or negative as to where this pair goes next. If we can break above the 200 day EMA, then the market could rally all the way to the 19.65 pesos level initially. That being said though, if we were to break down below the 19 paces level, the 18.80 pesos level would be next, and then possibly even the 18.850 level.

Keep in mind that the Mexican peso is considered a gateway currency for Latin America, so this is a way of trading a huge section of the world, much like the South African Rand correlates to Africa. All things being equal though, you should also keep an eye on oil, because if oil does rally then it tends to help the Mexican peso a bit, but overall you should keep in mind that it’s not as reactive against the US dollar due to crude oil as it once was, because the United States of course produces so much crude now.

All things being equal though, we are testing an area that has been massive support so I’m using the 200 day EMA as a proxy for selling. A daily close above there has me reversing any type a short position to a long position and holding on for a couple of handles. This is a pair that tends to be trader from a longer-term standpoint, and not much along the lines of a short-term market, which unfortunately seems to be what we are trading in overall when it comes to the Forex world lately. Wait for an impulsive candlestick either below the 19 paces level or above the 200 day EMA and simply follow. Until then, expect a lot of noisy trading in this exotic currency pair.