The US dollar has rallied again during the trading session on Wednesday, in what would have been thin trading due to the Thanksgiving holiday. At this point, the market has been rallying for some time though, so at this point it’s likely that we will continue to go higher. Overall, this is a market that continues to be very noisy but obviously it has been very strong to the upside over the last couple of weeks.

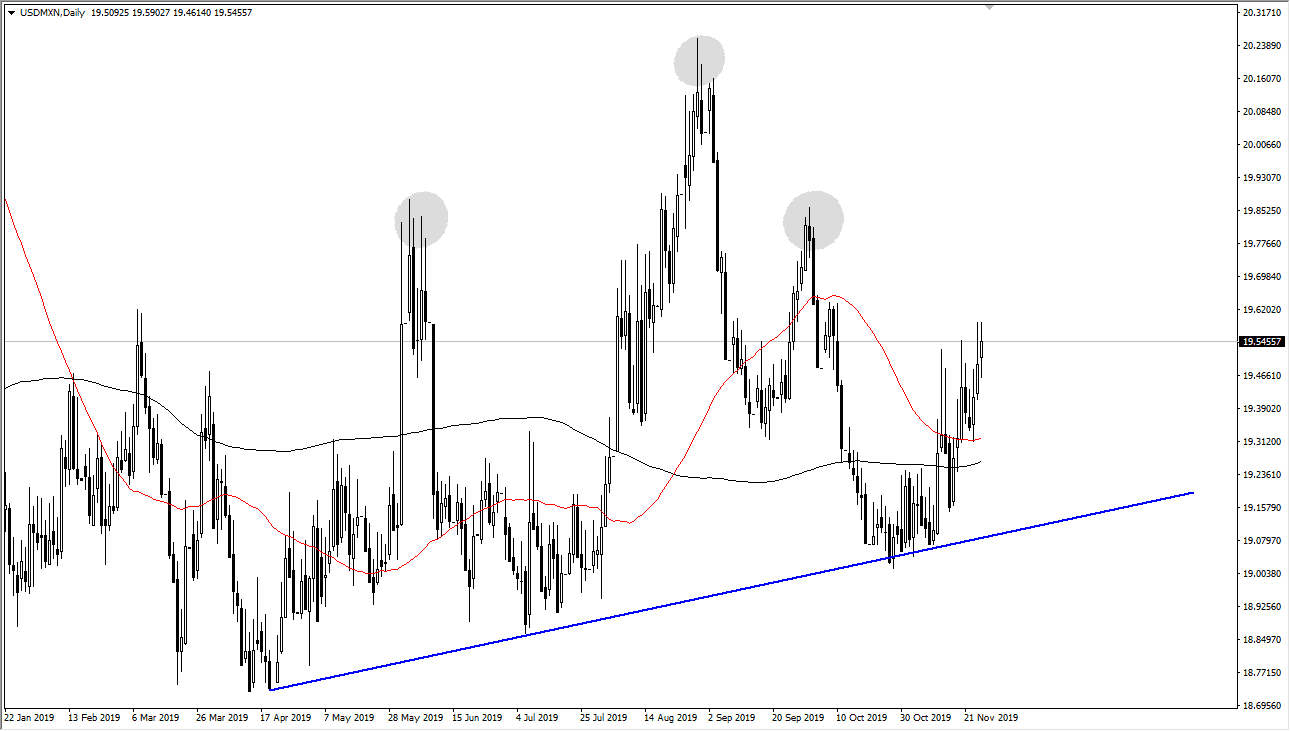

At this point, the market has a lot of support based upon the uptrend line underneath, which has been very reliable in strong for some time. That being the case, the market is likely to continue it’s slow grind higher, because of the momentum shifting that way, and of course the fact that during the trading session on Wednesday, we had gotten quite a few different economic figures coming out the United States, all showing signs of strength. The Core Durable Goods Orders figure was stronger than anticipated, the Unemployment Claims figure was stronger than expected, and that of course the Preliminary GDP figures were stronger than anticipated, all favoring the United States. If that’s going to be the case, then it makes sense of the US dollar would pick up against several exotic currency such as the Mexican peso.

Furthermore, the Mexican peso is somewhat attached to the crude oil market as well, and it makes sense that it will perhaps move back and forth due to it. That being said, the market looks very likely to continue grinding to the upside and perhaps reaching towards the levels that I have marked on the chart. The next area of significant interest will be closer to the 19.85 pesos level, and then the highs. I think short-term pullbacks at this point will continue to show signs of bullish pressure, near the moving averages underneath. The 50 day EMA has offered support recently, and we are well above the 200 day EMA. By doing so, it looks like the market will continue to be supported, so don’t have any interest in trying to short it unless of course suddenly we have a huge explosion to the upside in crude oil or if the US dollar suddenly struggles against many other currencies at the same time. Looking at this chart, there is a lot of noise underneath due to the choppy behavior, and therefore it should continue to support this market going forward. Buying on dips should continue to work.