For the second day in a row, USD/JPY is moving in a limited range between the 108.90 support and the 109.25 level awaiting any developments. The lack of US economic data for two days limits its performance. The pair’s recent gains were stalled at the 109.48 resistance after the announcement of the imminent agreement between the United States and China to put an end to the tariff war between them, which greatly hurt the global economic growth, and the US and Chinese economy were not far from the slowdown. The latest remarks by US President Trump have returned investors’ concerns about the passage of the agreement.

Markets are awaiting the next hints of progress in the negotiations between Beijing and Washington later in the day, as US President Trump is scheduled to deliver a speech on trade and economic policy at the New York Economic Club.

For the Asian situation. In comments suggesting tougher legal measures may be planned, Hong Kong leader Kari Lam vowed "to spare no effort" to stop the protests. From China, an industrial group reported late on Monday that car sales in China fell 5.8% from a year earlier in October, as demand for electric vehicles fell, adding to painful pressure on the world's largest industry market. China's auto market is on track to decline for the second year, weighed down by weak demand in the face of slowing economic growth and a tariff war with Washington.

Bank lending in China has also suffered a setback, with new lending in October reaching its lowest level since December 2017, reaching 661.3 billion Yuan ($ 94.4 billion).

US stocks fell after President Donald Trump said at the weekend that reports of US readiness to remove tariffs were "incorrect", just two days after a Chinese official said the two sides had agreed to end such tariffs if talks progressed.

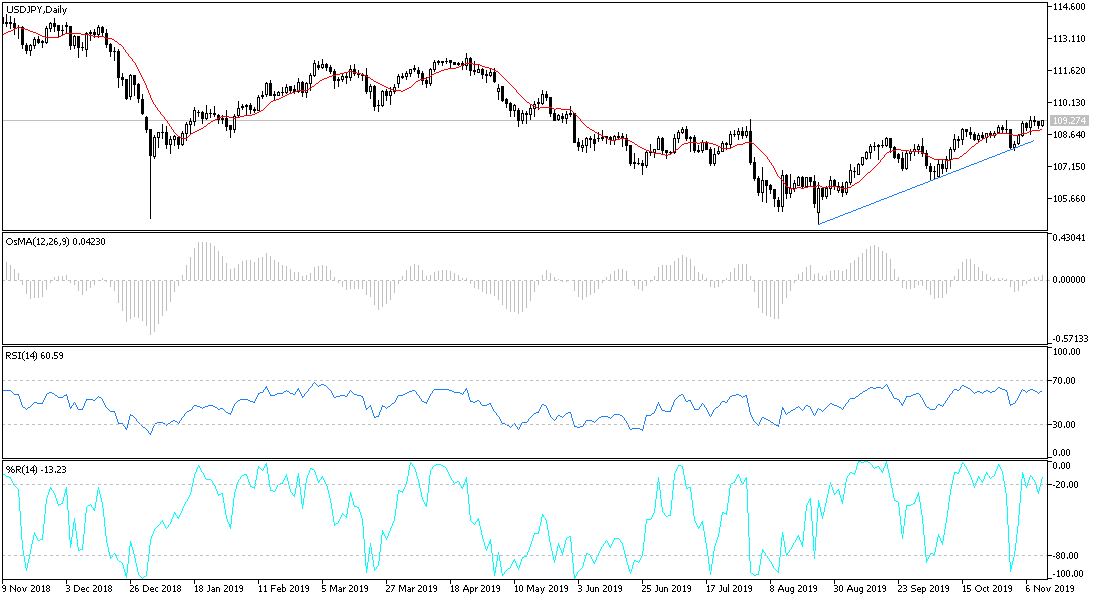

According to the technical analysis of the pair: There is no change to my technical outlook towards the USD/JPY pair; stability above 109.00 resistance will remain a catalyst for the bullish trend and we still need to move towards 110.00 psychological resistance to confirm the strength of this trend. This will depend on investors' appetite and increased optimism about resolving the US-China trade dispute. On the downside, the closest support levels are currently at 108.65 and 107.90 respectively. I still prefer to buy the pair from every bearish level.

There are no important data expected from Japan or the US.