USD/JPY is trying to keep moving around and above 109.00 resistance to ensure the continuation of the bullish correction. Ahead of the announcement of important US inflation figures, that often affect the US dollar and the direction of the Fed's policy, today we will have Governor Jerome Powell testifying before a special congressional committee to clarify the country's economic performance and the bank's plans to revive the economic sectors, especially in light of the global trade war. In morning trading, the pair fell to 108.86 before settling around 109.07 at the time of writing. The market did not react to Trump's remarks late Tuesday, echoing earlier statements that the United States and China are close to signing the first phase deal to end the tariff war that is contributing to the global economic slowdown. Trump did not specify the details of the deal, nor when and where the official signing will be, and therefore there was little change in the performance of the currency market.

Japan's MUFG, the world's fifth largest bank, and an important currency trader, says the Yen has a strong negative correlation with US stocks, and that stocks may remain strong as investors celebrate the emerging improvement in global economic outlook. Investors have become less optimistic about the future since October 11, when US President Donald Trump announced the "first phase" to stop the US-China trade war.

The US/JPY is one of the most sensitive dollar pairs when it comes to interest rates and global growth prospects, because Japan is the major provider of capital to the rest of the world. The country runs surpluses on both trade and current accounts, rather than the deficit in the United States and Britain. Trump renewed his criticism of the Fed's policy and demanded negative interest rates, similar to those of other central banks, to support the currency and economy.

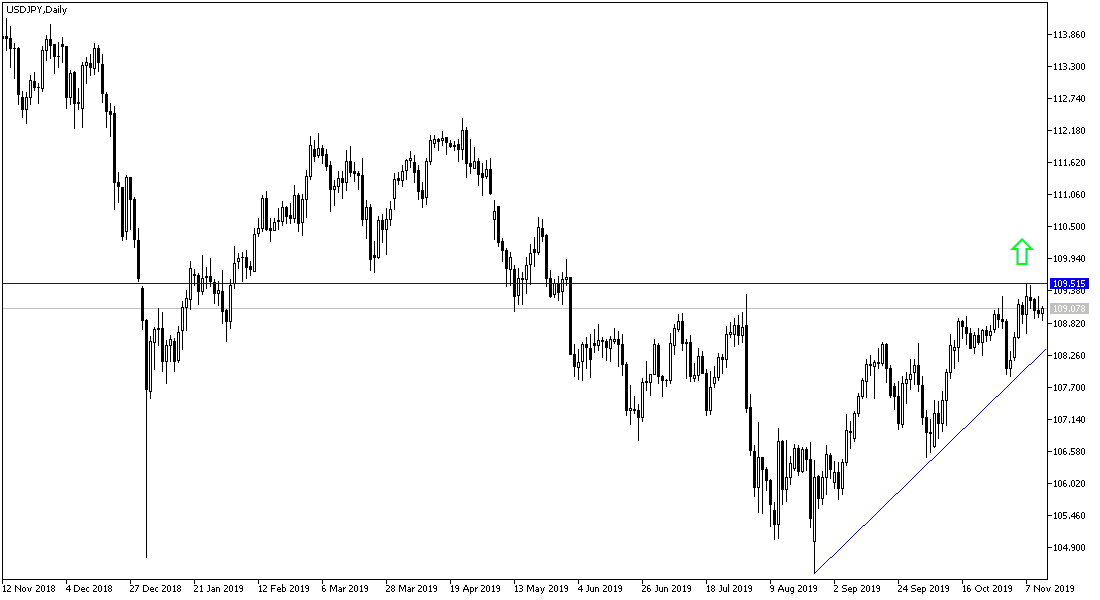

According to the technical analysis of the pair: USD/JPY still has a chance for an upward correction as long as it holds above 109.00 resistance and its gains will depend on investors' risk appetite. US inflation figures and Jerome Powell's remarks will be a strong influence on the pair's performance from today to the end of the week. The uptrend will not strengthen without testing the 110.00 psychological resistance and achieving stability above it. On the downside, the closest support levels are currently at 108.65, 107.90 and 107.00 respectively.

According to the economic calendar data: All the focus will be on the release of the consumer price index and the reaction to the testimony of the Federal Reserve Governor Jerome Powell before the Congressional Committee.