Trump claimed that the US economy and equity markets would be stronger if the central bank took his advice and cut interest rates further. He admitted his mistake in nominating Jerome Powell as chairman of the Federal Reserve. But Powell, in testimony to the Congress, did not heed US President Trump's criticism and insisted that the bank's policy was based on the country's economic performance, and the political administration had nothing to do with what the bank saw fit. He stressed that the pace of US rate cuts should be stopped until the economic reaction to the US rate cuts made in 2019 is seen. Amid uncertainty about the future of the US-China trade deal, investors have been relocating to safe havens again, supporting USD/JPY losses to 108.65 before settling around 108.77 at the time of writing, and ahead of the release of an important Chinese economic data package.

The Federal Reserve is scheduled to hold its next monetary policy meeting from Dec. 10 to 11, with expectations now of a 96.3 percent chance that the central bank will leave interest rates unchanged.

Rising gasoline prices in the United States pushed US consumer prices up last month at the fastest pace since March. The Labor Department reported that the CPI rose 0.4% in October after a steady reading in September. Gasoline prices, after falling in August and September, jumped 3.7% last month. Excluding volatile energy and food prices, core consumer inflation rose only 0.2% in October.

Overall consumer prices rose 1.8% over the past year, just below the Fed's 2% target. Core prices rose 2.3%. Relatively small inflation has allowed the Fed to cut US short-term interest rates three times this year to support the US economy, which has been slowed down by trade disputes with China.

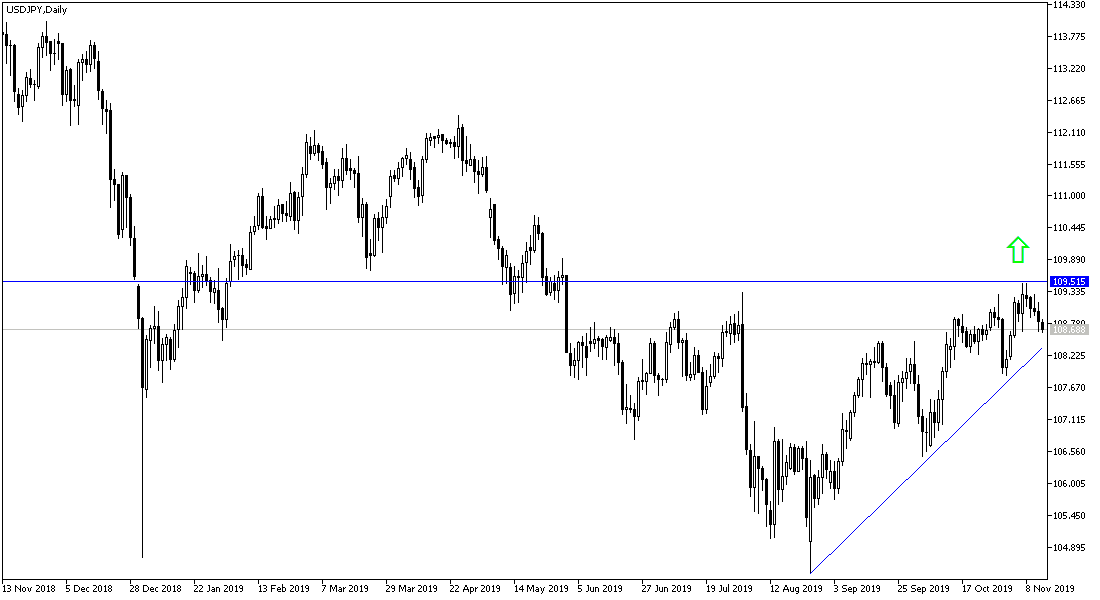

According to the technical analysis of the pair: On the USD/JPY daily chart, there will be no break of the bullish trend without moving towards the 108.00 support, and the bullish correction remains valid as long as it moves around and above the 109.00 resistance, which supports the move towards the next bulls’ target at the 110.00 psychological resistance. Renewed global trade and geopolitical tensions will favor further gains for the Japanese yen as one of the most important safe havens.

As for the economic calendar data today: The pair will be affected by the release of China data, led by industrial production and fixed assets investment index. Then during the US session will have the producer prices, jobless claims data and what the content of Federal Reserve Governor Jerome Powell second testimony.