Despite the return of the Japanese yen strength against other major currencies, the price of USD/JPY maintained its bullish momentum and losses did not exceed the 108.65 support, and gains this week reached the 109.24 resistance level the highest level in three months. The pair is stable around 108.75 at the time of writing. The dollar index fell on Wednesday but the weakness is unlikely to last long until sometime next year, thanks to the resilience of US bond yields. They are still attractive to investors even after three Fed rate cuts this year. The dollar could be under pressure due to both the global economic recovery and the 2020 presidential election.

The recent volatility in the performance of the dollar is mostly due to the market's assimilation of a range of trade-related developments that will have implications for the entire global economy. US President Donald Trump is reportedly considering to cancel some tariffs on Chinese imports again this week, a few days after Commerce Secretary Wilbur Ross said in an interview that he might decide to impose punitive tariffs on car imports from Europe. This is a sign that Trump's trade war has shifted to Europe after taking advantage of his war against China.

Trade developments are good news for the US as well as for global economies and may be good for the dollar in the short term. It came as the White House was trying to finalize the "first phase of the deal" agreed in principle with China on October 11, which has already prevented tariff increases and could then prevent a new round of import duties from China on December 15th. The event will reduce the pace of interest rate cut by the US Federal Reserve.

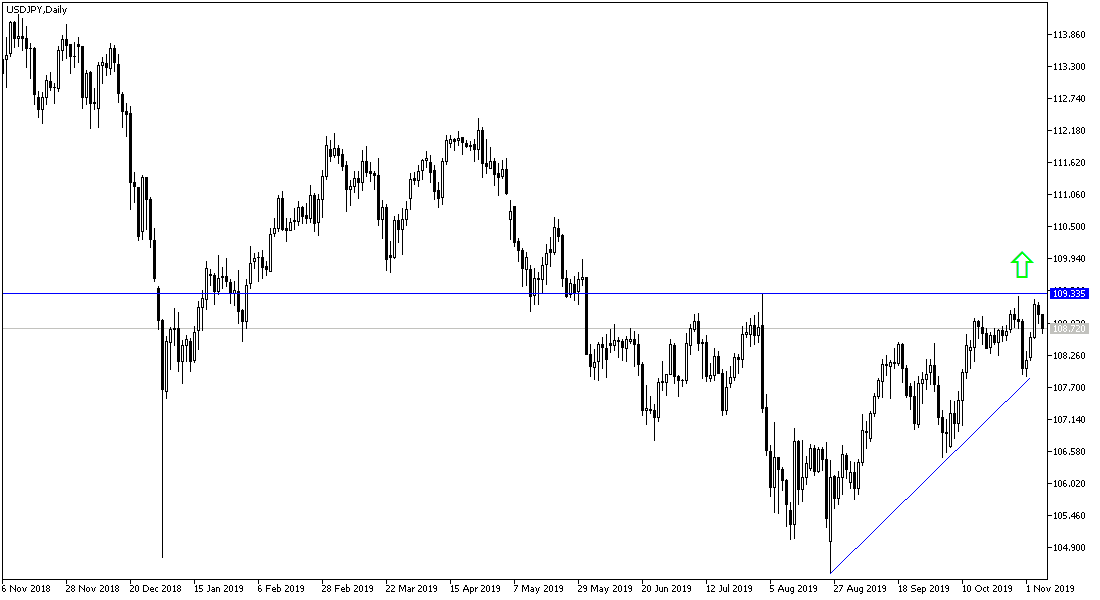

According to the technical analysis of the pair: There are no changes in the technical outlook for the USD/JPY performance. Stability above 109.00 resistance will support the upward correction. Thus, the price may push towards 110.00 psychological resistance, which increases the momentum to test stronger resistance prices. On the downside, the closest support levels are 108.45, 107.90 and 107.00 and the last level confirms the downside strength again.

As for today's economic data: There are no Japanese economic releases today. From the United States we will have jobless claims.