The US dollar has rebounded against the other major currencies for three trading sessions in a row, and the USD/JPY price rises from the 107.88 support to the 108.82 resistance at the time of writing. Investors risk appetite halted the yen's gains. Optimism from the US jobs report released at the end of last week weakened expectations that the Fed will take further rate cuts in the near future.

At the economic level. China's private sector grew slightly faster in October, survey data from IHS Markit showed on Tuesday. The Caixin composite production index rose to 52.0 in October from 51.9 in September. A reading above 50 indicates growth in the sector. The result was the fastest growth in six months. Meanwhile, the services PMI fell to 51.1 from 51.3 in September. This represents the slowest increase in service activity for eight months and was in line with economists' expectations.

Yesterday, US factory orders fell more than expected, confirming that the US manufacturing sector continues to suffer negatively from the prolonged trade dispute between the United States and China. As for monetary policy, US interest rates are no longer the highest in the developed world, but they are unlikely to decline further in the short term, as the Fed's monetary policy makers strongly emphasized last week, and investors were strongly encouraged by Commerce Secretary Wilbur Ross's remarks about the tatification of the “Phase 1”; a US-China trade deal which will be finalized later this month.

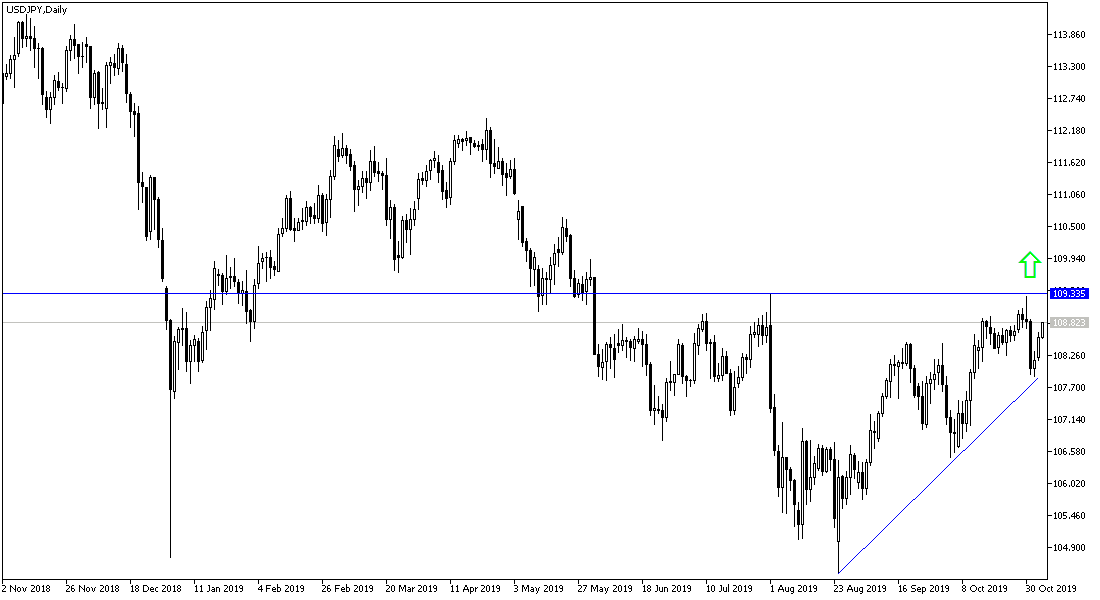

According to the technical analysis of the pair: The USD / JPY successful stability above the 109.00 resistance will support the continuation of the uptrend, because it may push the price towards 110.00 psychological resistance, and as is the case on the daily chart, this level is the key to test stronger resistance levels. Currently, the closest resistance levels for the pair are at 109.20 and 110.00.

Today's economic data will focus on the US trade balance, ISM non-manufacturing PMI and job creation data releases.