Investors' risk appetite and better results from the US economic data package yesterday provided momentum for the USD/JPY pair, which spiked towards the 109.60 resistance level, a six-month high, before settling around 109.45 at time of writing. With the recent bearish correction moves, we have been advising to buy from these levels because resolving the US trade dispute with China may be positive for the dollar, and will increase investor appetite for risk, and abandon safe havens, such as the Japanese yen, that is one of the most important ones. The negotiation team from the United States and China are working around the clock because time is running out before more US tariffs are due on Dec. 15. Together they confirm that they are in the final stages of the Phase One agreement and that it will be ready for formal signature as soon as possible.

In contrast, the US economy gained momentum in the third quarter, contrary to expectations of a slowdown. Yesterday's third quarter GDP growth was announced at 2.1%, with forecast to slow to 1.9% from 2.0% growth in the previous quarter. US growth did not slow in the third quarter, which is important for the Fed's adherence to stop the pace of US rate cuts until it measures the reaction from the bank's three rate cuts throughout 2019.

US durable goods orders were not far from improving, as they were stronger than expected, and US consumer spending increased, confirming the extent of consumer confidence in the country's economic performance, and that higher wages have boosted consumer spending, which accounts for 70 percent of US economic activity.

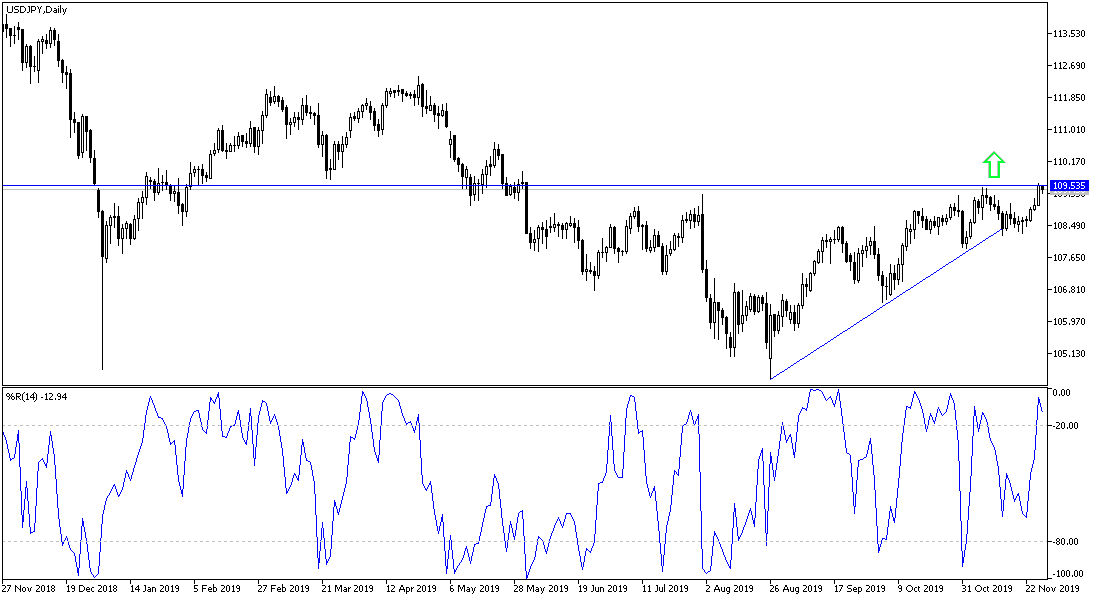

According to the technical analysis of the pair: According to our recent expectations, the USD/JPY is moving above the 109.00 resistance and therefore gets a new momentum, which is currently making it closest to test the 110.00 psychological resistance, which strengthens the uptrend and pushes towards higher resistance levels, with the nearest ones currently at 109.85, 110.25 and 111.00 Respectively. On the downside there will be no break of the current trend and reversal without moving around and below 108.00 support, otherwise the trend will remain bullish. The pair remains cautious while monitoring developments in the global trade war.

As for the economic calendar data: After the announcement of the Japanese retail sales, the calendar has no important and influential releases, especially in light of the US holiday on the occasion of Thanksgiving.