After the recent correction failed to push the USD/JPY pair to break below the 108.00 support, which consolidates the bearish strength, and amid optimism that the trade agreement between the United States and China is close, the pair found the necessary momentum to start up again with gains reaching the 109.20 level, and around that, ahead of the announcement of a package of important and influential economic data, in an intensification of the announcement ahead of a US Thanksgiving holiday. We have noticed the recent improvement in US economic releases. Despite the decline in US consumer confidence for the fourth consecutive month, it is still at record levels and the decline was limited. The US housing market remains strong.

Earlier this week, Federal Reserve Chairman Jerome Powell drew an optimistic view of the US economy, but noted that continued low inflation meant higher interest rates would not be necessary any time soon. He added that even with the country's unemployment rate nearing a 50-year low of 3.6%, there is still "a lot of room" to increase wages and increase the number of US jobs. He noted that annual inflation remains below the Fed's target of 2%.

As for the course of trade talks between the United States and China. The Communist Party newspaper, the Global Times, ran a front-page article citing experts who reject "negative media reports" about the talks. It quoted a researcher at the Chinese Academy of Social Sciences, Gao Lingyun, as saying that he was "close to the trade talks" and said the two sides may reach a "first phase" agreement soon. Chinese Minister of Commerce Zhong Shan, Governor of the People's Bank of China Yi Gang, and Vice-Chairman of the National Development and Reform Commission Ning Jizhi, demonstrated a high-level participation in this stage of discussions.

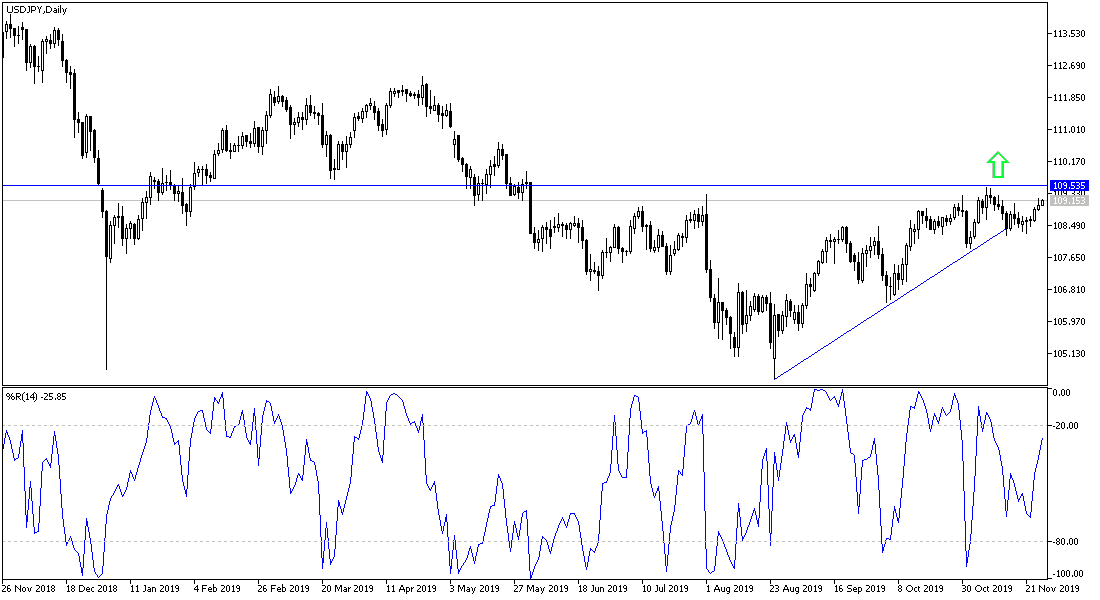

According to the technical analysis: The USD/JPY stabilizing above 109.00 will increase the momentum to break the 110.00 psychological resistance, which confirmed the strength of the current uptrend and supports the move towards higher resistance. As mentioned in recent technical analysis, we now confirm that there will be a strong threat to this trend only by moving below 108.00 support, as only then the trend is broken as per the performance on the daily chart below. The pair is in a cautious position while observing the developments of the world trade war.

As for the economic calendar data: All the attention will be on the US session data, where durable goods orders, GDP growth rate, jobless claims, Chicago PMI, and the Federal Reserve's preferred inflation gauge, the CPI, will be announced. Then the average income and expenditure for the American citizen. Finally, pending home sales and US oil inventories data will be released.